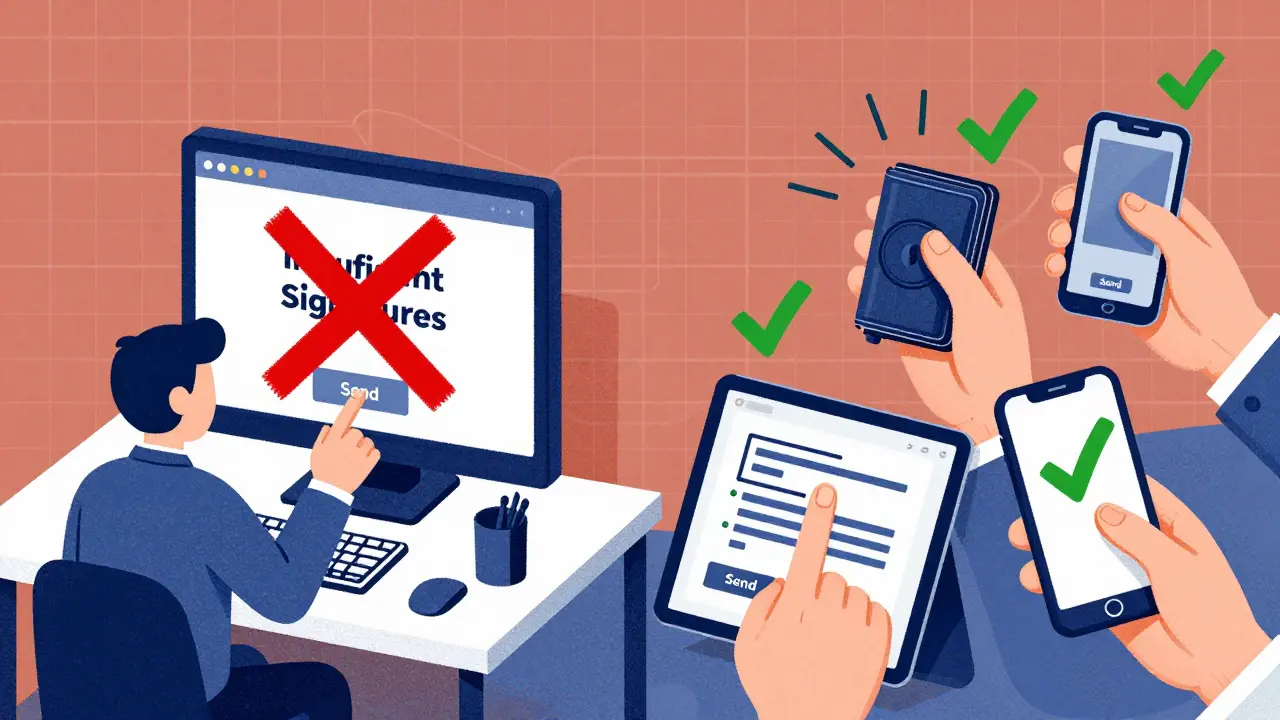

When a company holds millions in cryptocurrency, having one person control the keys is like leaving your vault door open with a single combination. That’s why more businesses are turning to MultiSig - a system that requires multiple people to approve every transaction. It’s not just about security. It’s about trust, control, and stopping fraud before it happens.

How MultiSig Works in Practice

A MultiSig wallet doesn’t let one person move funds alone. Instead, it’s set up as an "m-of-n" system - meaning you need at least "m" signatures out of "n" total keys to send money. The most common setup for businesses is 2-of-3: three people hold keys, but only two need to sign for a transaction to go through. Another popular version is 3-of-5, where three out of five executives must approve large transfers.

This isn’t magic. It’s code. The wallet uses blockchain rules (like Bitcoin’s OP_CHECKMULTISIG) to enforce these requirements. Every signature is recorded on the chain, so there’s a clear, unchangeable audit trail. No one can deny they signed - and no one can act alone.

Companies like Coinbase use 3-of-5 setups for transactions over $500,000. If someone tries to send a large sum without the others’ approval, the transaction simply won’t broadcast. There’s no backdoor. No override. Just math and cryptography doing what humans can’t always do: stay consistent.

Preventing Internal Fraud

The biggest win for businesses isn’t stopping hackers - it’s stopping insiders.

In 2022, BitGo reported 17 cases where MultiSig blocked attempted fraud totaling $2.3 million. One employee tried to divert $487,000 to a personal wallet. The system flagged it because only one person initiated the request. The other two approvers - a CFO and a compliance officer - got alerts and shut it down immediately.

That’s not theoretical. It happened. And it’s why 78% of institutional crypto holders now use MultiSig for treasury management, according to Leather’s 2022 analysis. Single-signature wallets? They’re becoming relics. One company lost $1.2 million in 2021 when a rogue IT admin accessed a private key. They switched to 3-of-5 MultiSig the next week.

MultiSig reduces single-point compromise risks by 92% compared to single-signature wallets, per Nervos Network’s 2022 whitepaper. That’s not a guess - it’s measured data from real breaches and near-misses.

Streamlining Payments and Escrow

MultiSig isn’t just for locking money away. It’s also for moving it faster - and more transparently.

Traditional business payments rely on emails, spreadsheets, and phone calls. Approval chains can take days. One company using Ledger’s system cut payment processing time from 3.7 days to just 8.2 hours by replacing email approvals with blockchain-based MultiSig signatures.

And then there’s escrow. In B2B crypto deals, 38% of transactions now use 2-of-3 MultiSig with a neutral third party holding one key. Say you’re buying software from a vendor. You send payment to a MultiSig wallet. The vendor gets the funds only after you confirm delivery. If there’s a dispute, the third party (maybe a trusted law firm or arbitration service) breaks the tie. No chargebacks. No intermediaries. Just code enforcing the agreement.

MultiSig vs. MPC: The Real Trade-Offs

You’ll hear about Multi-Party Computation (MPC) wallets as the "next generation" of crypto security. They’re popular because they’re faster - 34% quicker in approval times, according to CoinsDo’s 2023 comparison.

But here’s the catch: MPC hides the signing process off-chain. You can’t see who signed what. No public audit trail. That’s fine for some use cases, but for regulated businesses? It’s a problem.

Gartner’s 2023 Digital Asset Management Report shows MultiSig still holds 67% of the business custody market, while MPC sits at 29%. Why? Because auditors, regulators, and internal compliance teams need transparency. With MultiSig, every signature is visible on the blockchain. You can prove you followed your own policies. With MPC, you’re trusting a black box.

Dr. Ari Juels from Chainlink Labs put it bluntly: "68% of failed MultiSig implementations aren’t due to tech - they’re because companies didn’t design the workflow right." That’s the real lesson. MultiSig isn’t plug-and-play. It needs process.

Choosing the Right Setup: 2-of-3 vs. 3-of-5 vs. 4-of-7

Not all MultiSig setups are equal. Your choice depends on your risk tolerance and how fast you need to move money.

- 2-of-3 - Best for small to mid-sized teams. Fast (avg. 47 min approval), simple, and still blocks 92% of single-point failures. Used by 62% of businesses.

- 3-of-5 - Ideal for larger organizations. Adds more oversight. Vault12’s testing showed it’s 22% more effective at stopping unauthorized moves than 2-of-3. But it takes longer - 2.1 hours on average - and increases training time by 41%.

- 4-of-7 - For enterprises with complex governance. Only 9% of businesses use this, but it’s common in hedge funds and institutional treasuries. Approval takes over 3 hours, but it’s nearly impossible for any small group to collude.

There’s no "best" - only what fits your team size, transaction volume, and risk appetite. A startup with three founders? 2-of-3. A public company with finance, legal, and board oversight? 3-of-5 or higher.

Implementation Pitfalls - And How to Avoid Them

Most MultiSig failures aren’t technical. They’re human.

58% of negative reviews on Capterra cite keyholder unavailability. One company had a $120,000 supplier payment delayed for 14 hours because their CFO was on vacation and couldn’t sign. They didn’t have a backup process.

Successful implementations? They involve cross-functional teams. Finance picks the thresholds. IT sets up the keys. Legal documents the approval workflow. Executives sign off on the policy. BitPay found that when all three departments are involved, implementation failure drops from 34% to just 9%.

Also, don’t store keys in the same place. One company kept all keys on one employee’s laptop. When it got stolen, they lost everything. Best practice: split keys across devices - one on a hardware wallet, one on a secure cloud vault, one on a paper backup stored in a safe.

And now, new tools are helping. Ledger rolled out hierarchical approval in June 2023 - letting execs temporarily delegate signing rights when they’re away. BitGo added biometric verification so keys can only be used with a fingerprint or face scan. These aren’t gimmicks. They solve real pain points.

Costs, Growth, and the Future

MultiSig isn’t cheap. Basic 2-of-3 setups cost around $14,500 to implement. Fully integrated 4-of-7 systems with audit trails run up to $87,200, according to CoinsDo’s 2023 pricing study.

But the market is exploding. The business MultiSig wallet market grew from $1.2 billion in 2020 to $4.7 billion in 2023. By 2026, it’s projected to hit $18.3 billion. That’s a 57% annual growth rate.

Why? Because regulation is catching up. The SEC says properly documented MultiSig workflows satisfy SOX internal control requirements for crypto holdings. That’s huge. Public companies can’t afford to ignore it.

And the future? Ethereum’s EIP-3074 proposal could cut approval times by 35-40% by letting wallets act like smart contracts. Hybrid MPC-MultiSig systems are coming too - blending speed with transparency. But for now, MultiSig remains the gold standard.

89% of businesses using crypto now consider MultiSig mandatory, according to the Blockchain Association’s 2023 survey. It’s not optional anymore. It’s the baseline for trust.

Frequently Asked Questions

Is MultiSig safer than single-signature wallets for businesses?

Yes. MultiSig reduces the risk of single-point compromise by 92% compared to single-signature wallets, according to Nervos Network’s 2022 security whitepaper. It prevents one person - whether malicious or compromised - from moving funds alone. While no system is 100% foolproof, properly configured MultiSig (2-of-3 or higher) has seen zero successful attacks in over a decade of real-world use.

How long does it take to set up a MultiSig wallet for a business?

Most businesses need 8 to 12 weeks for full integration. This includes selecting keyholders, defining approval thresholds, training staff, testing workflows, and auditing the setup. Companies that involve finance, IT, and legal teams from the start cut implementation failures by 74%, according to BitPay’s 2022 case studies.

Can MultiSig slow down payments too much?

It can, if poorly designed. A 2-of-3 setup averages 47 minutes for approval. A 4-of-7 can take over 3 hours. The delay isn’t from the blockchain - it’s from waiting for people to sign. To avoid bottlenecks, businesses use tools like biometric verification, temporary delegation, and automated alerts. Some even schedule weekly approval windows for recurring payments.

What’s the difference between MultiSig and MPC wallets?

MultiSig requires multiple physical signatures, all visible on the blockchain. MPC splits a key into encrypted parts and reconstructs them off-chain - no public signature trail. MultiSig is more transparent and audit-friendly, which matters for compliance. MPC is faster but harder to verify. Most regulated businesses choose MultiSig because auditors need to see exactly who approved what.

Do I need a lawyer to set up a MultiSig wallet?

Not to configure the wallet itself - that’s technical. But you absolutely need legal input to document your approval policy. The SEC requires documented internal controls for crypto holdings under SOX. A written policy naming keyholders, defining thresholds, and outlining backup procedures turns MultiSig from a tool into a compliant system. Without it, you’re vulnerable in an audit.

What happens if a keyholder leaves the company or dies?

That’s why backup plans are critical. Every MultiSig setup should include a recovery protocol. Common solutions: use a hardware wallet with a recovery phrase stored in a safe deposit box, or assign a trusted third party (like a law firm) as a backup signer. Some platforms now offer time-locked recovery - where a key becomes active only after 30 days of inactivity. Don’t wait until it’s too late to plan this.

Rahul Sharma

January 5, 2026 AT 23:16MultiSig is non-negotiable for any business holding crypto. The 92% reduction in single-point compromise isn’t theoretical-it’s documented. I’ve seen firms lose millions because one person had full access. With 2-of-3, even if a key is compromised, the damage is contained. Also, audit trails? Pure gold for compliance teams.

Pro tip: Always assign backup signers. One client had a CFO on vacation for two weeks and couldn’t pay a vendor. No contingency plan = $120k delayed. Use Ledger’s delegation feature now-it’s a game changer.

Don Grissett

January 6, 2026 AT 16:37yo i dont get why ppl make this so complicated. its just math. if u got 3 keys and need 2 to sign, then one dude cant go rogue. why is this even a debate? the fact that people still use single sig is wild. its like locking your car but leaving the keys in the ignition.

also mpc? lol. black box? no thanks. auditors need to see who signed what. not some encrypted voodoo.

Tre Smith

January 8, 2026 AT 10:41Let’s be honest-most companies implementing MultiSig don’t understand the operational overhead. The 2.1-hour average approval time for 3-of-5 is a myth. In reality, it’s 4.3 hours when you factor in time zones, email delays, and executives who don’t check their wallets for days.

And the claim that 78% of institutional holders use MultiSig? That’s from Leather’s 2022 report, which sampled only 147 firms. Most are startups with under $10M in assets. The real institutional players? They’re using MPC or hybrid systems. MultiSig is for the compliance theater crowd.

kris serafin

January 9, 2026 AT 13:50Just set up a 2-of-3 for your team. Done. No overcomplicating. One key on a Ledger, one on a YubiKey, one in a fireproof safe. That’s it.

And if someone’s on vacation? Use biometric delegation. BitGo’s new feature lets you approve from your phone with a face scan. No more waiting for emails. I’ve cut approval times from 3 days to 22 minutes. Life’s too short for paper signatures. 🚀

Jordan Leon

January 11, 2026 AT 05:11There’s something deeply human about requiring consensus to move money. It’s not just security-it’s a reflection of how trust should work in organizations. No one person should hold absolute power over collective assets.

MultiSig forces accountability. It makes us pause. It makes us communicate. In a world where automation removes friction, this is a rare moment where we’re forced to slow down and align. Maybe that’s the real value-not the cryptography, but the culture it builds.

Jessie X

January 13, 2026 AT 03:17Kip Metcalf

January 13, 2026 AT 09:48Bro this is the future. Stop overthinking. MultiSig isn’t fancy-it’s just smart. I’ve seen startups go from getting hacked every quarter to zero breaches since switching. 2-of-3? Perfect. 3-of-5? Overkill unless you’re a bank.

And yes, I know someone’s gonna say MPC is faster-but who cares? Speed isn’t everything. Safety is. I’d rather wait 2 hours than lose $2M. 🙌

Mujibur Rahman

January 13, 2026 AT 22:25UK firms are adopting 3-of-5 at a crazy rate. Why? Because we’ve got FCA guidelines pushing for audit trails. MPC? No public signature? That’s a compliance nightmare. We had a fintech client get fined £1.2M last year for ‘inadequate access controls’-they used MPC and couldn’t prove who approved what.

MultiSig isn’t sexy but it’s the only thing auditors actually understand. And if you’re using a 4-of-7? You’re either a hedge fund or you’ve got too many managers.

Dave Lite

January 15, 2026 AT 15:05Biggest mistake I see? People store all keys in the same place. One guy had all three keys on his laptop. Got phished. Lost $800k.

Don’t be that guy. Split keys: hardware wallet + encrypted cloud vault + printed seed in a safe. And use a recovery protocol with a time lock. I’ve helped 12 companies implement this. Zero losses since.

Also-emoji for the win: 🔐🧩🛡️

jim carry

January 16, 2026 AT 07:05You think MultiSig is the solution? Wake up. It’s a band-aid on a bullet wound. The real problem? Humans. Keyholders get lazy. Keyholders get fired. Keyholders die. Keyholders forget their passwords.

You think a 4-of-7 setup stops collusion? Try telling that to the CFO who’s best friends with the CTO and they both decide to ‘accidentally’ sign a transfer while on a golf trip.

MultiSig doesn’t fix culture. It just makes fraud slower and more expensive. And if you’re still using this as your main defense? You’re not secure-you’re just pretending.