On December 30, 2024, everything changed for crypto businesses operating in the European Union. No more exceptions. No more small transfers slipping through the cracks. The EU’s Travel Rule went live with a zero threshold-meaning every single crypto transaction, no matter how small, must carry full sender and receiver details. Even a €0.50 transfer from one exchange to another now requires the same level of data as a €50,000 wire. This isn’t a suggestion. It’s the law.

What the EU Travel Rule Actually Requires

The EU’s Travel Rule isn’t just an update-it’s a complete overhaul of how crypto transactions are tracked. Under Regulation (EU) 2023/1113 and the Markets in Crypto-Assets (MiCA) framework, any transfer between two crypto asset service providers (CASPs) registered in the EU must include:- Full name of the sender

- Account or wallet number

- Physical address or national identity number

- Full name of the recipient

- Account or wallet number of the recipient

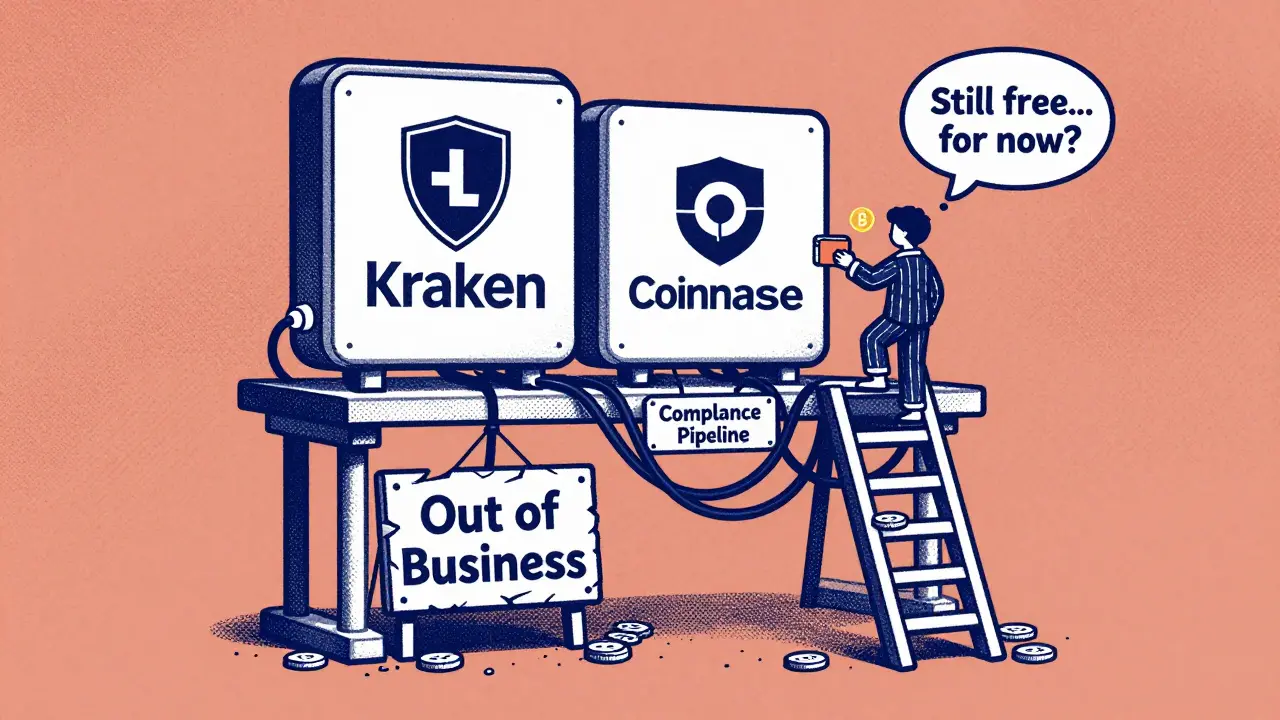

Why the EU Chose Zero Threshold

The official reasoning is simple: prevent money laundering and terrorist financing. The EU argues that crypto’s pseudonymity makes it a risk, even at low values. But the real story is more about control than crime. Crypto transactions under €100 are rarely used for illicit purposes-most are small payments, tips, or micro-transactions. Traditional finance sees far more money laundering at the retail level. So why zero threshold? The answer lies in regulatory ambition. The EU wants to be the global standard-bearer for crypto oversight. By going further than anyone else, it forces global players to adapt to its rules. If you want to serve EU customers, you comply with EU law-even if your home country doesn’t. It’s a power move. And it’s working. Major exchanges like Kraken, Coinbase, and Bitstamp have already built EU-specific compliance pipelines to meet this standard.What Happens When Data Is Missing?

This is where things get messy. If a transaction arrives without full details, the receiving CASP doesn’t just reject it. They have options:- Accept the transfer (if risk is low)

- Reject it outright

- Return the funds

- Suspend the transaction and investigate

How Businesses Are Adapting

Compliance isn’t optional. It’s operational. Companies are investing in specialized platforms to handle the flood of data. Solutions like KYCAID, Elliptic, and Chainalysis now offer tools that:- Automatically validate wallet addresses against known CASPs

- Encrypt and transmit required data using secure protocols

- Integrate with existing exchange systems without slowing down trades

- Monitor for sanctions lists and darknet-linked wallets in real time

The Sunrise Problem

The biggest operational challenge isn’t technology-it’s global inconsistency. The EU calls this the "Sunrise Issue." It happens when a transaction flows between jurisdictions with different rules. For example:- Sender: A German exchange (compliant)

- Receiver: A U.S.-based exchange (no Travel Rule yet)

What Happens If You Don’t Comply?

Non-compliance isn’t a slap on the wrist. The penalties are severe:- Fines up to 5% of annual turnover

- Suspension of operating licenses

- Forced exit from the EU market

- Reputational damage that scares away institutional investors

What This Means for You

If you’re a regular crypto user in the EU, you might not notice much. Your transfers still go through. But behind the scenes, your wallet address is now tied to your identity in the eyes of the exchange. If you’re using a non-EU exchange, you might see delays or rejections when sending crypto to EU-based wallets. Some platforms now require you to verify your identity even for small transfers. If you’re a business, this is the new baseline. You need:- A system that captures and transmits full data on every transaction

- Staff trained to handle missing data cases

- Legal counsel familiar with MiCA and TFR

- Partners who also comply

What’s Next?

The EU is already looking ahead. Discussions are underway to extend the Travel Rule to peer-to-peer (P2P) transactions through decentralized exchanges. That would mean even wallet-to-wallet transfers might need identity checks. It’s not law yet-but it’s being debated in Brussels. Other regions are watching. The UK is considering lowering its threshold. Australia is reviewing its rules. The U.S. Congress is under pressure to act. The EU didn’t just set a standard-it set a new global floor. And the world is being forced to match it.Does the EU Travel Rule apply to personal wallets?

No. The Travel Rule only applies to transactions between regulated crypto asset service providers (CASPs)-like exchanges, custodians, and trading platforms. If you’re sending crypto from your personal wallet to another personal wallet, even if both are in the EU, the rule doesn’t apply. But if you send it to an exchange, the exchange must collect your data before processing the deposit.

Can I still use non-EU crypto exchanges?

Yes, but with limits. If you’re sending crypto from an EU-based exchange to a non-EU exchange that doesn’t comply with the Travel Rule, the EU exchange may block the transfer. Some non-EU exchanges have created EU-compliant branches or partnered with EU-based custodians to keep transactions flowing. Always check whether your exchange has an EU-compliant on-ramp before sending funds.

What if I accidentally send a transaction without required data?

If you’re a user, you won’t be penalized. The responsibility falls on the CASP that sent or received the transaction. If data is missing, the receiving exchange will likely freeze the funds and contact the sender’s exchange for clarification. You may need to provide additional verification to get your funds released. Always double-check that your exchange handles Travel Rule compliance before sending.

Are NFTs covered by the Travel Rule?

Yes, but only if they’re traded through a regulated CASP. If you’re buying or selling NFTs on a platform that’s registered as a crypto asset service provider under MiCA, then the Travel Rule applies. That means your identity and wallet info must be shared with the counterparty’s exchange. If you’re trading NFTs on a decentralized marketplace like OpenSea without a regulated intermediary, the rule doesn’t apply-yet.

How does this affect DeFi users?

Right now, DeFi protocols that are fully decentralized (no central operator) are exempt. But if you use a DeFi platform that’s operated by a company registered in the EU-like a regulated yield aggregator or lending protocol-you’re subject to the rule. The EU is actively working on how to regulate DeFi, and future updates could require identity checks even for smart contract interactions. Don’t assume DeFi is a loophole.

Is there a way to avoid the Travel Rule entirely?

Not if you’re using regulated services. If you want to avoid the rule, you’d need to use non-regulated, decentralized tools and never interact with EU-based exchanges. That means no buying crypto with euros on Kraken or Coinbase EU, no depositing to EU wallets, and no using EU-based custodians. But that also means losing access to legal protections, insurance, and fiat on-ramps. For most users, compliance is the price of entry.

Bryan Muñoz

January 14, 2026 AT 10:12Rod Petrik

January 14, 2026 AT 20:02Sarah Baker

January 15, 2026 AT 05:13Pramod Sharma

January 16, 2026 AT 00:02Liza Tait-Bailey

January 16, 2026 AT 23:30nathan yeung

January 17, 2026 AT 02:07Bharat Kunduri

January 17, 2026 AT 07:32Chris O'Carroll

January 18, 2026 AT 07:41myrna stovel

January 19, 2026 AT 16:49Hannah Campbell

January 20, 2026 AT 01:49