Bitcoin Difficulty Adjustment Calculator

How It Works

Bitcoin adjusts difficulty every 2,016 blocks (≈ every 2 weeks) to maintain a 10-minute block time. Your calculation uses the formula: new difficulty = old difficulty × (actual time ÷ ideal time) Ideal time = 1,209,600 seconds (14 days)

Maximum adjustment limit: Difficulty can't change by more than 4x in either direction per adjustment period.

Ideal Time: 1,209,600 seconds (14 days)

Results will appear here after calculation

Real-World Example: China Mining Ban (2021)

Actual Time:

1,123,200 seconds

Difficulty Change:

+8.0%

Actual Time:

604,800 seconds

Difficulty Change:

-27.94%

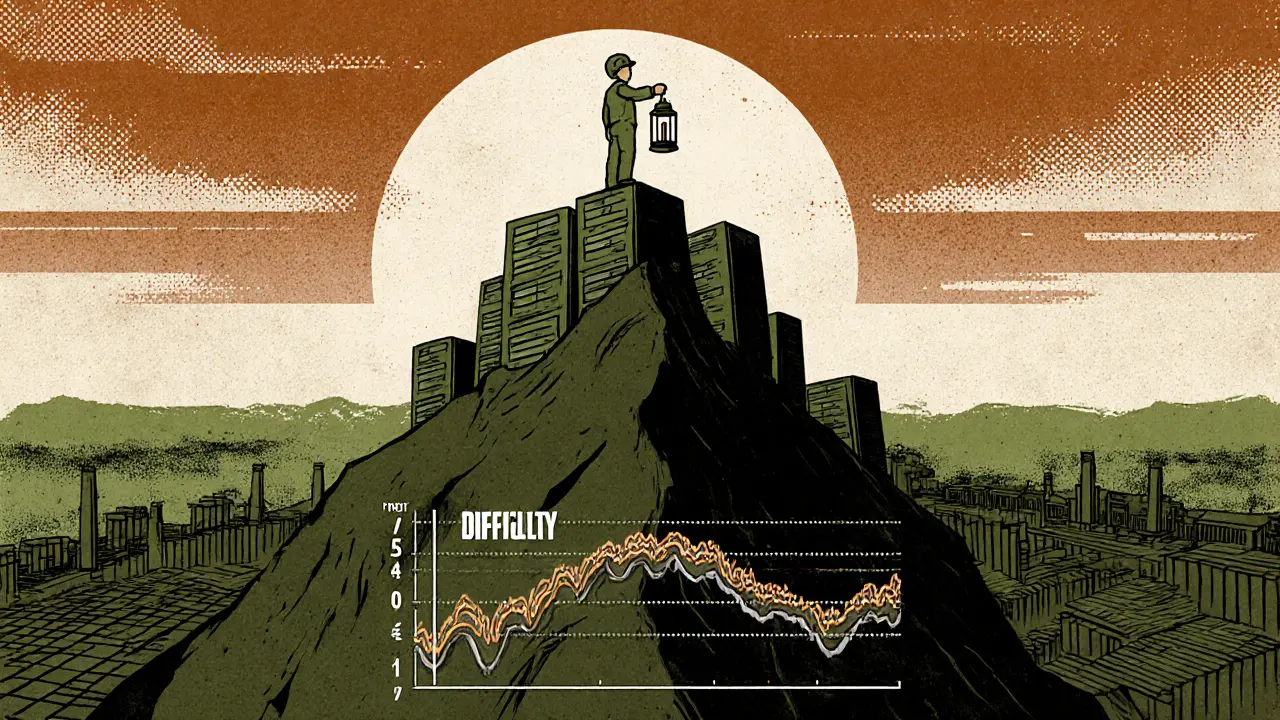

Bitcoin doesn’t care how many miners join the network. It doesn’t matter if a single farm in Texas adds 100 new machines, or if a country shuts down half its mining operations overnight. The clock still ticks every 10 minutes. That’s not magic. It’s math. And that math is built into Bitcoin’s core: the mining difficulty adjustment.

Why Does Difficulty Even Exist?

When Bitcoin launched in 2009, the first block was mined in seconds. There were maybe a dozen people mining with their CPUs. The network was tiny. But Bitcoin’s rules said: one block every 10 minutes. Always. No exceptions. That’s the heartbeat of Bitcoin. It’s what makes the currency predictable. It’s what lets people trust that new coins will come out at a steady pace-until the last one is mined in 2140. But if more people start mining, blocks would come faster. If miners leave, blocks would slow down. That breaks the system. So Satoshi built a self-correcting mechanism. Every 2,016 blocks-roughly every two weeks-Bitcoin checks how long it took to mine those blocks. If it was too fast, difficulty goes up. Too slow? Difficulty drops. Simple. But powerful.How the Adjustment Actually Works

Here’s the real formula, stripped down:- Bitcoin looks at the last 2,016 blocks.

- It adds up how many seconds it took to mine them all.

- The ideal time? 1,209,600 seconds (14 days × 24 hours × 60 minutes × 60 seconds).

- If it took 1,100,000 seconds? That’s faster than expected. Difficulty goes up.

- If it took 1,500,000 seconds? Slower. Difficulty drops.

- If the last 2,016 blocks took 13 days (1,123,200 seconds), difficulty increases by about 8%.

- If it took only 7 days? Difficulty doubles.

- If it took 21 days? Difficulty drops by a third.

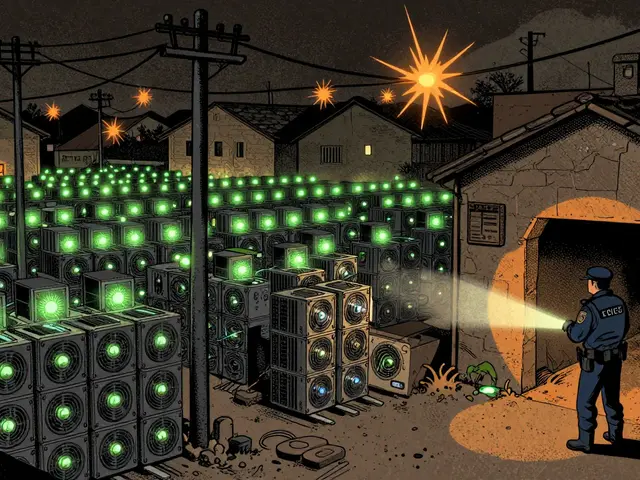

A Real-World Shock: China’s Mining Ban in 2021

In June 2021, China banned Bitcoin mining. Overnight, about half the world’s hash rate vanished. Miners scrambled. Machines were unplugged. Power grids went quiet. The result? The next difficulty adjustment-on July 3, 2021-dropped by 27.94%. That’s the biggest single drop in Bitcoin’s history. And the network didn’t skip a beat. Blocks kept coming every 10 minutes. Miners who stayed in the game suddenly had more room to breathe. Their machines weren’t competing against as much hash power anymore. That’s the adjustment working perfectly. It didn’t panic. It didn’t break. It just recalibrated.

What Happens to Miners When Difficulty Changes?

For miners, difficulty isn’t just a number-it’s profit or loss. A 10% difficulty increase means your mining rig has to work 10% harder to earn the same reward. If your electricity costs $0.05 per kWh and your machine is inefficient, you might start losing money. That’s why miners track difficulty like stock prices. In 2022, after the Terra crash, Bitcoin’s difficulty dropped 16%. That opened a window. People bought old Antminer S9s-machines that were dead just months before-for pennies on the dollar. Some made back their investment in a week. On the flip side, when difficulty spiked 12% in April 2025, miners in Texas had to renegotiate their power contracts within 72 hours. One operator cut their rate from $0.038 to $0.032 per kWh just to stay alive. The most profitable miners now use algorithms to predict the next adjustment. They watch hash rate trends, pool activity, and even weather patterns (because droughts can raise electricity prices). The best ones can forecast difficulty within 2% accuracy.Why It’s Still Working After 16 Years

Bitcoin’s hash rate has grown 320 million percent since 2009. From 7 megahashes per second to over 720 exahashes per second. That’s like going from a bicycle to a fleet of supersonic jets-all while keeping the same speed limit. And yet, the average block time since day one? 9.97 minutes. Not 10. Not 11. 9.97. That’s the adjustment doing its job. It smooths out chaos. It turns wild swings into steady rhythm. Critics say the 2,016-block window is too slow. They argue that with today’s volatility, adjustments should happen every block. But that’s risky. Too frequent changes could make it easier for big miners to manipulate the network. The Bitcoin Core team has tested this. They’ve seen no need to change it. As Dr. Adam Back, inventor of Hashcash and CEO of Blockstream, put it: “The difficulty adjustment is Satoshi’s unsung masterpiece-it’s the invisible hand that maintains monetary policy integrity against any conceivable technological advancement.”What’s Next? Could It Change?

There’s a proposal called Dynamic Difficulty Adjustment (DDA), introduced in May 2025. It would adjust difficulty after every block. Sounds precise, right? But miners are split. Smaller operators worry it would favor big players with real-time data feeds and fast hardware. If difficulty shifts every 10 minutes, you’d need to constantly upgrade or downgrade your rigs. That’s not practical for most. So far, the community has resisted. The current system is simple, predictable, and battle-tested. It doesn’t need fixing. It just needs time.

The Bigger Picture: Security and Trust

The difficulty adjustment isn’t just about keeping block times steady. It’s about security. The higher the difficulty, the more computing power it takes to control the network. Today, the cost of a 51% attack-where someone tries to rewrite history-is estimated at $18.7 billion. That’s more than the market cap of most public companies. That number isn’t random. It’s directly tied to difficulty. As difficulty rises, so does security. And as security rises, so does trust. That’s why institutions now hold 38.7% of all Bitcoin. They know the system can’t be gamed.What You Should Know as a Miner or Investor

If you’re mining:- Track the next adjustment date. It’s always 2,016 blocks out.

- Know your hardware’s efficiency. Anything over 8 J/TH is struggling in 2025.

- Lock in electricity rates before big increases. Many profitable miners have contracts that adjust with difficulty.

- Don’t panic after a drop. It’s not a free lunch. Difficulty usually climbs back within two cycles.

- Understand that difficulty growth = stronger network = higher security.

- Each adjustment is a vote of confidence. Miners are betting real money that Bitcoin will keep going.

- When difficulty rises sharply, it often means the price is expected to rise too. Miners don’t invest unless they see value.

Althea Gwen

November 30, 2025 AT 00:33Durgesh Mehta

November 30, 2025 AT 15:15Sarah Roberge

December 1, 2025 AT 19:19Steve Savage

December 3, 2025 AT 03:25Joe B.

December 4, 2025 AT 20:06Rod Filoteo

December 6, 2025 AT 06:32