El Salvador didn’t just experiment with Bitcoin - it made it legal tender. On September 7, 2021, the country became the first in the world to give Bitcoin the same status as the U.S. dollar. No other nation had done this before. The goal was simple: fix a broken economy. Nearly 70% of Salvadorans were unbanked. Remittances from abroad - money sent home by family members working overseas - made up over 20% of the country’s GDP. Every dollar saved on transfer fees was a dollar that stayed in local pockets. Bitcoin, the government said, would cut costs, reach the unbanked, and attract global investors.

Why Bitcoin? The Economic Problem El Salvador Was Trying to Solve

Before Bitcoin, El Salvador’s economy was stuck. The U.S. dollar had been its official currency since 2001, but that didn’t fix the deeper issues. Most people didn’t have bank accounts. Sending money from the U.S. to family in rural towns cost 10-20% in fees. That’s $500 million a year just in transfer charges. The government claimed Bitcoin could slash those fees to near zero. It also promised to bring financial services to 700,000 people who had never used a bank. The plan was built around one app: Chivo. The government gave every citizen $30 in free Bitcoin just for downloading it. Gas stations, street vendors, and even public buses were supposed to accept Bitcoin. The idea was that if enough people used it, it would become normal - like paying with cash.The Chivo App: A Promising Start, But a Failing Engine

At launch, over half of El Salvador’s population downloaded Chivo. That’s more than 1.5 million people. But downloads aren’t usage. By early 2022, the momentum collapsed. More than 60% of those who got the free Bitcoin never made a single transaction after the bonus ran out. One in five still hadn’t spent their $30. The app crashed often. Many users couldn’t figure out how to convert Bitcoin to dollars. Older adults, women, and people in rural areas - the exact groups the policy was meant to help - were left behind. The government set up digital kiosks in towns to teach people how to use it. But tech support couldn’t keep up. A farmer in Ahuachapán might have a phone, but not the knowledge to handle a digital wallet. Bitcoin’s volatility made it risky. If you got paid in Bitcoin on Monday and the price dropped 15% by Wednesday, you lost money. No one wanted to hold it.Remittances Didn’t Change - And That Was the Whole Point

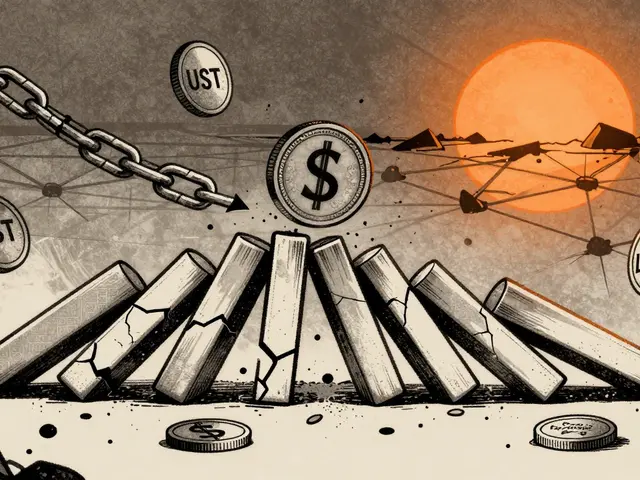

The biggest promise was remittances. El Salvador gets $7 billion a year from people working abroad. Most of that comes through Western Union and MoneyGram. With Bitcoin, the government promised to cut those fees from 15% to 1%. But in reality, very few senders switched. Why? Because the people sending money - often in California or Texas - didn’t use Bitcoin. They didn’t want to learn a new system. Their relatives in El Salvador didn’t want to hold Bitcoin. So they cashed out immediately. The money still flowed through the same old channels. A 2023 study by the National Bureau of Economic Research found that Bitcoin adoption had flatlined. People who used it were young, male, educated, and already had bank accounts. The unbanked? They stayed unbanked. The policy didn’t include them - it skipped over them.

The IMF Step In: When the World Said ‘Stop’

By 2024, things were falling apart. El Salvador’s public debt was rising. The country needed a $1.4 billion loan from the International Monetary Fund. The IMF said yes - but only if El Salvador backed off Bitcoin. The agreement didn’t ban Bitcoin. But it forced major changes. The government had to stop buying Bitcoin with public funds. It had to stop using Bitcoin for tax payments. It had to stop offering free Bitcoin bonuses. The state’s $150 million Bitcoin reserve was now off-limits for new purchases. The IMF didn’t say Bitcoin was evil. They said it was too risky. Too unpredictable. Too dangerous for a country with no safety net. That was the turning point. The dream of Bitcoin as national currency had been scaled back to a footnote.Bitcoin’s Price Swings Made the Problem Worse

El Salvador didn’t just adopt Bitcoin - it bought it. When the price hit $40,000, the government bought $100 million worth. When it dropped to $20,000, the country lost $50 million. That’s not a loss on paper - it’s real money taken from public funds. The government had to explain why it was gambling on Bitcoin while schools and hospitals were underfunded. The volatility made businesses nervous. A shop owner who accepted Bitcoin for a $100 sale might wake up to find it was worth only $85. No one wants that uncertainty. So most shops kept prices in dollars. Bitcoin was just a middle step - convert it, then spend dollars. It never became money. It became a payment tool that people used once and forgot.

What Actually Changed? Not Much

The government claimed Bitcoin would attract foreign investment. Tech startups did come. A few crypto firms opened offices. But no major investor poured in billions. Why? Because investors don’t trust a country that’s betting its budget on a coin that swings 20% in a week. The only real change? A new app on phones. A few more people have wallets. A few more ATMs that swap Bitcoin for cash. But the economy? It still runs on dollars. Remittances still cost too much. Banks still don’t serve most people. The Bitcoin experiment didn’t fix the system - it added a layer of confusion on top of it.Is Bitcoin Still Legal Tender? Yes. Is It Used? Barely.

Legally, Bitcoin is still equal to the dollar. You can pay taxes with it. You can buy a car with it. You can settle a loan with it. But in practice? Less than 1 in 10 Salvadorans use it regularly. The Chivo app still exists. The government still holds Bitcoin. But the bold vision? It’s gone. The country didn’t fail because Bitcoin didn’t work. It failed because the plan ignored how real people live. It assumed technology would fix poverty. But poverty isn’t solved by an app. It’s solved by jobs, banks, education, and trust.The Bigger Lesson: Technology Can’t Replace Institutions

El Salvador’s Bitcoin move was bold. It was historic. But it was also naive. You can’t replace a financial system with a cryptocurrency. You can’t replace trust in banks with trust in blockchain. You can’t replace economic stability with speculation. Other countries watched. Some, like Panama and Ukraine, looked into it. None followed. Why? Because they saw the cost: $150 million spent, $50 million lost, no real gains. Bitcoin didn’t fail because it was bad technology. It failed because it was the wrong solution to the problem. El Salvador needed better banking, not a new currency. It needed lower fees, not more volatility. It needed real inclusion - not a digital gimmick. Today, the country walks a tightrope. It keeps Bitcoin as legal tender - mostly because it’s too expensive to reverse. But the real economy? It’s still in dollars. Still in cash. Still in the hands of people who never downloaded an app. The experiment didn’t transform El Salvador. It exposed how hard it is to change a system - even when you have the power to try.Is Bitcoin still legal tender in El Salvador?

Yes, Bitcoin is still legal tender in El Salvador as of 2025. The 2021 Bitcoin Law hasn’t been repealed. But while it’s technically valid for payments, taxes, and debts, the government no longer promotes its use actively. Most businesses and citizens still rely on the U.S. dollar.

Did Bitcoin reduce remittance fees in El Salvador?

No. Remittance fees remain high because the people sending money - mostly in the U.S. - don’t use Bitcoin. They still send through Western Union, MoneyGram, or bank transfers. The recipients cash out immediately into dollars. The promised 90% fee reduction never materialized because the system didn’t change at the sender’s end.

Why did the IMF demand El Salvador scale back Bitcoin?

The IMF was worried about macroeconomic risk. El Salvador’s Bitcoin reserves lost over $50 million due to price drops. The government was spending public money on a volatile asset. The IMF required El Salvador to stop buying Bitcoin with state funds, stop offering Bitcoin bonuses, and stop using it for tax payments to protect the country’s financial stability.

How many Salvadorans actually use Bitcoin daily?

Fewer than 10% of Salvadorans use Bitcoin regularly. A 2024 survey found that over 60% of people who downloaded the Chivo app never made a transaction after their free Bitcoin ran out. Usage is mostly limited to young, urban, tech-savvy men - not the unbanked population the policy targeted.

Did Bitcoin attract foreign investment to El Salvador?

Not significantly. While a few crypto startups opened offices, no major global investors committed capital. Investors saw the volatility, political risks, and lack of regulatory clarity. The country’s credit rating didn’t improve. The promised economic boom never came.

What happened to the $150 million the government spent on Bitcoin?

The government bought Bitcoin with $150 million in public funds between 2021 and 2023. As of 2025, the value of those holdings has dropped by about $50 million due to price declines. The Bitcoin is still held in government wallets, but the IMF now prohibits further purchases. The loss is a direct drain on public resources.

Is El Salvador planning to ditch Bitcoin entirely?

No official plan to abolish Bitcoin exists. But the government has quietly stopped promoting it. The focus has shifted to stabilizing the dollar-based economy and meeting IMF conditions. Bitcoin remains on the books, but it’s no longer a policy priority.

Could other countries follow El Salvador’s lead?

No major country has followed. Even those considering Bitcoin adoption - like Panama or Ukraine - have paused or rejected it after seeing El Salvador’s results. The risks outweigh the rewards. Most governments prefer stable, regulated digital currencies (CBDCs), not volatile private cryptocurrencies.

Raja Oleholeh

December 31, 2025 AT 04:12prashant choudhari

January 2, 2026 AT 02:56Jackson Storm

January 2, 2026 AT 06:13Elisabeth Rigo Andrews

January 2, 2026 AT 17:03alvin mislang

January 3, 2026 AT 04:14Jack and Christine Smith

January 4, 2026 AT 21:20Kenneth Mclaren

January 5, 2026 AT 05:52Joydeep Malati Das

January 5, 2026 AT 11:55Shawn Roberts

January 6, 2026 AT 00:58Johnny Delirious

January 7, 2026 AT 21:06