Crypto Tax Calculator

When you sell Bitcoin for dollars, trade Ethereum for Solana, or even get paid in crypto, the IRS sees that as a taxable event. It’s not like cashing a paycheck. It’s like selling a stock or flipping a house. And if you’re not tracking every trade, you’re risking an audit. In 2025, the rules have changed - and they’re getting stricter.

Crypto Is Property, Not Currency

The IRS has treated cryptocurrency as property since 2014. That means every time you buy, sell, trade, or spend crypto, you might owe taxes. It doesn’t matter if you traded 0.001 BTC for a coffee or swapped 10 ETH for 500 SOL. If you disposed of it, you triggered a taxable event.

Here’s how it works: You calculate your capital gain or loss by subtracting your cost basis from your proceeds. Cost basis is what you paid for the crypto - including fees. Proceeds are what you got in return - in dollars, not crypto. For example, if you bought 1 BTC for $30,000 and sold it for $50,000, your gain is $20,000. That’s taxable.

Staking rewards, mining income, and crypto payments? Those count as ordinary income. You report them at the fair market value on the day you received them. If you got 0.5 ETH worth $1,200 as a staking reward, that $1,200 gets added to your taxable income for the year.

Short-Term vs. Long-Term Gains

How long you hold your crypto changes your tax rate. If you sell within a year, it’s a short-term gain - taxed at your regular income tax rate. For 2025, that’s between 10% and 37%, depending on your income. If you hold longer than a year, it’s a long-term gain. Those rates are lower: 0%, 15%, or 20%.

For single filers in 2025:

- 0% long-term capital gains if income is $47,025 or less

- 15% if income is between $47,026 and $518,900

- 20% if income exceeds $518,900

And if you earn over $200,000 (single) or $250,000 (married), you also pay the 3.8% Net Investment Income Tax (NIIT). That means the top effective rate on crypto gains can hit 40.8% - higher than most stocks.

The New 1099-DA Reporting Rules

Starting January 1, 2025, all U.S. crypto brokers - Coinbase, Kraken, Binance.US - must report your gross proceeds on a new form: 1099-DA. This replaces the old 1099-B for crypto. You’ll get one if you had more than $20,000 in transactions or 200+ trades in a year.

But here’s the catch: In 2025, they only report the total amount you sold. They don’t report your cost basis yet. That changes in 2026. Starting January 1, 2026, brokers must report exactly what you paid for each coin. That’s a big deal. It means the IRS will have a clear record of your gains - and you’ll have to match it.

If you didn’t track your own cost basis, you’re stuck. The IRS will assume your first purchase was your first sale (FIFO). That could mean paying way more tax than you should. You need to tell your broker which coins you sold - called “lot selection.” You have to do this by December 31, 2025, to get accurate reporting in 2026.

Accounting Methods Matter

The IRS lets you choose how to calculate cost basis:

- Specific Identification (Spec ID) - pick which exact coins you sold

- FIFO - first coins bought, first sold

- LIFO - last bought, first sold

- HIFO - highest price bought, first sold

- Average Cost - total cost divided by total coins

Starting in 2025, you must use the same method for all your trades. No switching between FIFO and HIFO on different wallets. Pick one and stick with it. If you used different methods in past years, you’ll need to adjust your records - and possibly file amended returns.

Spec ID is the most powerful. It lets you pick the coins with the lowest gain (or highest loss) to minimize taxes. But you have to track every purchase - date, amount, price, fee. That’s hard without software.

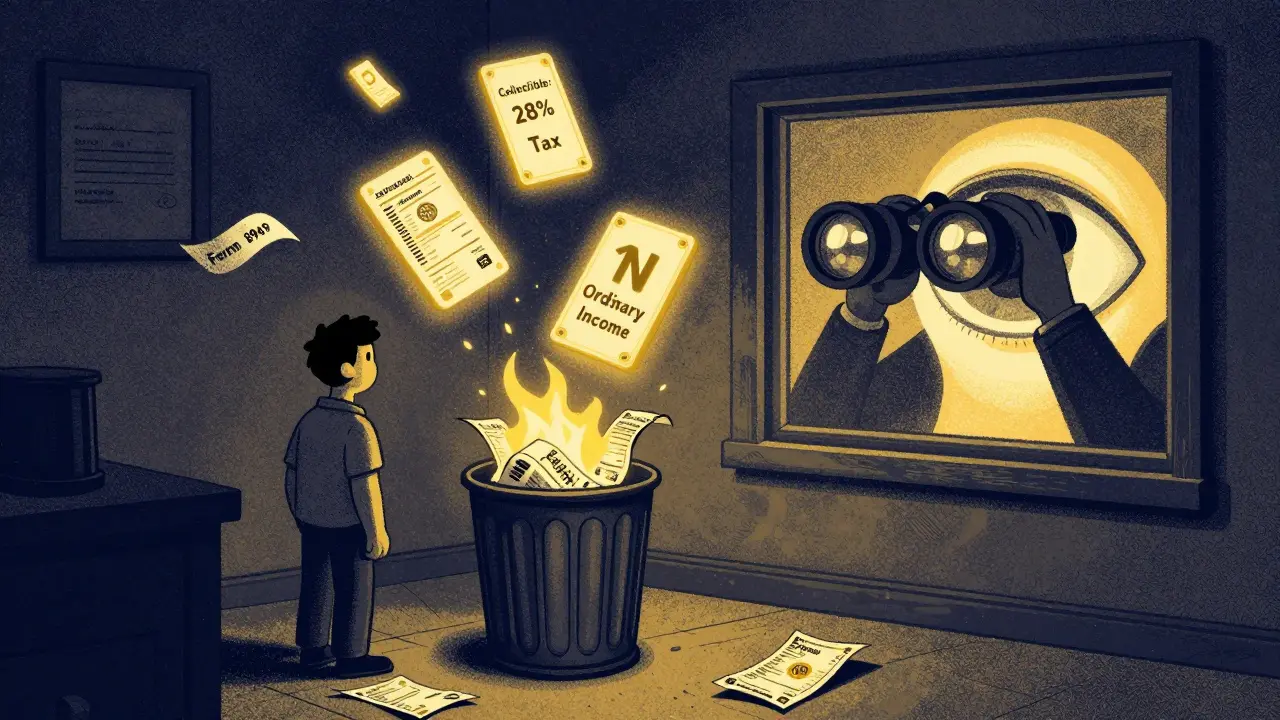

NFTs and Collectibles Are Different

NFTs might be taxed differently. If the IRS decides your NFT is a “collectible” - like art or rare coins - then long-term gains are taxed at 28%, no matter your income. That’s higher than the standard 20% cap.

Right now, the IRS hasn’t given clear rules. But many tax pros assume NFTs will be treated as collectibles, especially if they’re digital art, profile pictures, or gaming items. If you sold an NFT for $50,000 that you bought for $5,000, you could owe $12,600 in taxes instead of $7,500. That’s a $5,100 difference.

What’s Not Taxed

Not every crypto action triggers a tax bill.

- Buying crypto with dollars - no tax

- Transferring crypto between your own wallets - no tax

- Gifting crypto under $19,000 (2025 limit) - no tax for giver or receiver

- Donating crypto to a qualified charity - no tax on the gain, and you can deduct fair market value

But here’s the trap: Swapping one crypto for another? That’s a sale. Trading BTC for ETH is two taxable events: selling BTC and buying ETH. The IRS doesn’t care that you didn’t touch cash. It sees two property exchanges.

DeFi, Airdrops, and Hard Forks

DeFi transactions are a gray zone. Depositing crypto into a liquidity pool? The IRS hasn’t said if that’s a sale. But most tax professionals treat it as a disposal - meaning you owe tax on any gain since you bought it.

Airdrops and hard forks? If you receive new coins, you owe income tax on their value the day you get them. For example, if you got 100 new tokens worth $5 each from a hard fork, that’s $500 in taxable income.

Staking rewards? Taxed as income. Even if you don’t sell them. If you earned $3,000 in ETH staking rewards in 2025, that’s $3,000 added to your income - even if ETH dropped to $2,000 by year-end.

How to Track Everything

You need a record of every single transaction:

- Date acquired

- Amount and type of crypto

- Cost basis (price + fees)

- Date sold or traded

- Proceeds (in USD)

- Transaction ID

Most exchanges don’t give you full data. Coinbase might show your sales, but not your original purchase price from 2018. That’s why 57% of crypto traders hire a pro, according to TaxBit’s 2025 survey.

Software like CoinTracker, Koinly, or TokenTax can auto-import your transactions from exchanges and wallets. But they’re not perfect. DeFi swaps, NFT sales, and cross-chain bridges often break the sync. You’ll still need to review every import.

What Happens If You Don’t Report

The IRS sent over 412,000 crypto warning letters in 2024 alone. That’s up 37% from 2023. If you ignore them, you risk an audit - and penalties. The penalty for underreporting can be 20% of the tax owed. If the IRS thinks you’re being reckless, it jumps to 40%.

Worst case? Criminal charges. In 2023, a California man was sentenced to 2 years in prison for hiding $2.4 million in crypto gains. He didn’t file returns for five years. He wasn’t rich - just careless.

International Differences

The U.S. is one of the strictest. Portugal taxes crypto gains as zero for individuals. Germany lets you hold crypto tax-free after one year. Singapore doesn’t tax capital gains at all. But India? Flat 30% tax on gains, plus 1% withheld at source.

If you moved from another country, your past trades might still be taxable. The IRS taxes worldwide income. If you bought crypto in Germany in 2020 and sold it in 2025 in the U.S., you owe U.S. tax on the gain - even if you paid nothing abroad.

What’s Coming Next

The IRS is working on new rules for staking and DeFi, expected in late 2025. The House is also debating the CREATechnology Act, which could create a new crypto tax category - separate from property, securities, or commodities.

But for now, the system is messy. Brokers are scrambling to comply. Tax software is still catching up. And millions of people are still using old records from 2017 or earlier - when exchanges didn’t track cost basis properly.

Bottom line: If you trade crypto, you’re in the tax system. No shortcuts. No hiding. The IRS knows. And they’re watching.

Do I owe taxes if I just hold crypto and never sell?

No. Holding crypto without selling, trading, or spending it doesn’t trigger a taxable event. Taxes only apply when you dispose of it - whether you sell it for dollars, trade it for another coin, or use it to buy something. Just sitting on Bitcoin or Ethereum won’t create a tax bill.

What if I lost money trading crypto? Can I deduct it?

Yes. Crypto losses offset capital gains. If you lost $5,000 on Ethereum and made $8,000 on Bitcoin, you only pay tax on the $3,000 net gain. You can also deduct up to $3,000 in net losses against your ordinary income each year. Any extra losses roll forward to future years. Unlike stocks, crypto isn’t subject to the wash sale rule, so you can buy back the same coin the next day and still claim the loss.

Do I pay tax on crypto received as a gift?

You don’t pay tax when you receive crypto as a gift under $19,000 (2025 limit). But when you later sell it, your cost basis is the same as the original owner’s - not the value when you got it. If they bought it for $1,000 and gifted it when it was worth $5,000, and you sell it for $6,000, your gain is $5,000 ($6,000 - $1,000). You owe tax on the full increase since the original purchase.

Can I use tax software to file my crypto taxes?

Yes - and most people should. Tools like CoinTracker, Koinly, and TokenTax auto-import transactions from exchanges and calculate gains/losses. They generate Form 8949 and Schedule D for your tax return. But they’re not foolproof. DeFi, NFTs, and cross-chain swaps often need manual fixes. Always review the final report before filing. If your portfolio is complex, hire a crypto-savvy CPA.

What if I traded crypto on a foreign exchange like Binance?

You still owe U.S. taxes. The IRS requires you to report all worldwide income. Foreign exchanges like Binance (non-U.S.) don’t report to the IRS - so you’re on your own to track everything. You must manually log every trade, withdrawal, and deposit. Use blockchain explorers like Etherscan or Blockchair to verify transactions. Don’t assume foreign platforms will protect you - the IRS doesn’t care where the trade happened.

How do I report crypto on my tax return?

You report crypto gains and losses on Form 8949 and summarize them on Schedule D of your Form 1040. You also answer a yes/no question on page 1 of Form 1040: “At any time during 2025, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” Answer “yes” if you did any of those things. Even if you had no gain, you still answer “yes.” Failing to answer correctly is a red flag for the IRS.

Can I avoid crypto taxes by using a crypto IRA?

Yes - but only if you use a self-directed IRA with a custodian that allows crypto. You can buy and trade crypto inside the IRA without triggering taxes. Gains grow tax-deferred (traditional IRA) or tax-free (Roth IRA). But you can’t touch the crypto until retirement age without penalties. And you can’t use it to buy things - it must stay in the account. This is a long-term strategy, not a loophole for short-term trading.

What if I forgot to report crypto from a previous year?

File an amended return using Form 1040-X. You have three years from the original filing date to correct it. The IRS is more lenient with voluntary corrections than with audits. If you owe taxes, pay them with the amended return to avoid penalties. If you’re due a refund, you can still claim it. Don’t wait - the IRS is actively matching data from 1099-DA forms with past returns.

Nicole Parker

December 4, 2025 AT 07:45Just want to say how much I appreciate this breakdown. I’ve been holding crypto since 2017 and never realized how many little things counted as taxable events-like swapping ETH for SOL or even staking rewards. I used to think if I didn’t cash out to USD, I was fine. Turns out, I was living in a fantasy. I’ve started using Koinly now and it’s been a game-changer, even if it still messes up my DeFi swaps sometimes. Just took me three hours to manually fix 12 transactions from a liquidity pool I forgot about. Worth it though-better than an IRS letter.

Also, the part about NFTs being collectibles at 28%? That scared me. I sold a few Bored Apes last year and thought I was getting away with 15%. Now I’m sweating.

Thanks for not making this sound like a tax lecture. You made it feel human.

Tom Van bergen

December 5, 2025 AT 12:13Sandra Lee Beagan

December 6, 2025 AT 12:47As a Canadian who’s watched the U.S. crypto tax landscape evolve, I’m both impressed and horrified. You guys are so meticulous it’s almost beautiful-tracking cost basis, lot selection, 1099-DA forms. But also… why is this so complicated? In Canada, we just report capital gains on disposition and call it a day. No FIFO vs HIFO drama. No 40.8% effective rates. I get the need for transparency but this feels like over-engineering a toaster.

That said, your point about foreign exchanges is spot on. I have friends who traded on Binance and thought they were invisible. Nope. CRA and IRS share data now. You’re not hiding. You’re just delaying the reckoning.

Also-crypto IRAs? Brilliant. I wish we had that here. Maybe one day. 🤞

Ben VanDyk

December 7, 2025 AT 06:12It’s funny how everyone treats crypto like it’s some newfangled beast when it’s just digital property. The IRS didn’t change the rules, they just applied the same ones that’ve existed since 1917. You buy something, sell it for more, you owe tax. That’s not crypto policy, that’s basic accounting.

And if you didn’t track your basis, that’s your fault, not the government’s. No one forced you to trade on a platform that didn’t give you data. You used a tool without reading the manual. That’s not a loophole, that’s negligence.

Also, the wash sale rule doesn’t apply? Cool. But that’s because crypto isn’t a security. It’s property. So stop pretending it’s stocks with a different face.

Stanley Wong

December 8, 2025 AT 15:50I’ve been in this game since 2014 and I still get overwhelmed by the tax stuff. I used to just lump all my trades together and guess my gains. That was dumb. Now I use CoinTracker and I swear by it but even then I have to double check every DeFi transaction because the sync always breaks on Curve or Aave.

And the part about the 1099-DA only reporting gross proceeds in 2025? That’s a trap. People are going to think they’re safe because the form says ‘$50,000 sold’ and they’ll forget they bought half of it for $5,000 and the other half for $45,000. The IRS will assume FIFO and you’ll get nailed for $20k in gains you never actually made.

I think the real problem isn’t the tax rate, it’s the lack of unified tracking tools. Every exchange does it differently. Wallets don’t talk to each other. And the IRS expects you to be your own accountant. That’s just unfair. We need a standard. Like, a single API for crypto tax data. Come on, people.

Also, if you’re still using Excel sheets from 2018… please stop. You’re not a hero. You’re a liability.

Richard T

December 10, 2025 AT 01:17One thing I wish more people talked about is the emotional toll of crypto taxes. It’s not just numbers-it’s anxiety. Every time I log into my wallet, I’m not thinking about the price. I’m thinking: Did I track that swap? What was the USD value on that date? Did I use Spec ID or FIFO? Am I going to get flagged?

I used to love crypto because it felt free. Now it feels like another job. And I’m not even rich. Just a guy who bought a few ETH in 2020 and got lucky.

But I’m glad someone finally explained the 1099-DA thing clearly. I’ve been confused about that for months. And the NFT collectible thing? That’s wild. I didn’t even know that was a possibility. Thanks for the clarity.

jonathan dunlow

December 11, 2025 AT 01:01Listen, if you’re trading crypto and not paying attention to taxes, you’re not being clever-you’re being lazy. The IRS isn’t coming for you because they hate you. They’re coming because you didn’t do your homework. This isn’t a conspiracy. It’s basic responsibility.

And yes, it’s a pain to track every single trade. But guess what? So is getting audited. So is paying 40% in penalties. So is explaining to your spouse why you owe $12k in back taxes because you thought ‘it’s just crypto’.

I’ve helped 17 people fix their crypto taxes this year. Every single one of them said ‘I didn’t think it mattered’. They all thought they’d get away with it. They didn’t.

Use software. Track your basis. Pick a method and stick with it. Don’t wait until April 14th to figure it out. You’re not saving time-you’re just gambling with your future. And I don’t mean your portfolio. I mean your peace of mind.

rita linda

December 11, 2025 AT 11:27