Bitcoin Mining Pool: How Shared Mining Works and Where It Matters

When you hear about Bitcoin mining pool, a group of miners who combine their computing power to increase their chances of earning Bitcoin rewards. Also known as mining collective, it’s the reason most people get paid in Bitcoin today—not because they’re lucky, but because they’re part of a team. Alone, a single miner might wait years to find a block. But in a pool, hundreds or thousands of miners share the work—and split the reward—every 10 minutes.

That’s why over 90% of Bitcoin’s hash rate, the total computing power securing the Bitcoin network comes from pools, not individuals. The U.S. now leads this race, making up 44% of global hash power, thanks to cheap renewable energy and supportive states like Texas and Georgia. But it’s not just about location—it’s about efficiency. Pools like Foundry USA, F2Pool, and AntPool use smart software to assign work, track contributions, and pay out daily. Without them, mining would be too unpredictable for most people to join.

The system works because of mining difficulty, the invisible adjustment Bitcoin makes every two weeks to keep block times steady at 10 minutes. As more miners join—or leave—the network automatically gets harder or easier. Pools handle this complexity so you don’t have to. They also reduce risk: instead of waiting months for a big win, you get small, regular payouts. That’s why even small rigs with old GPUs still make sense in a pool, but not alone.

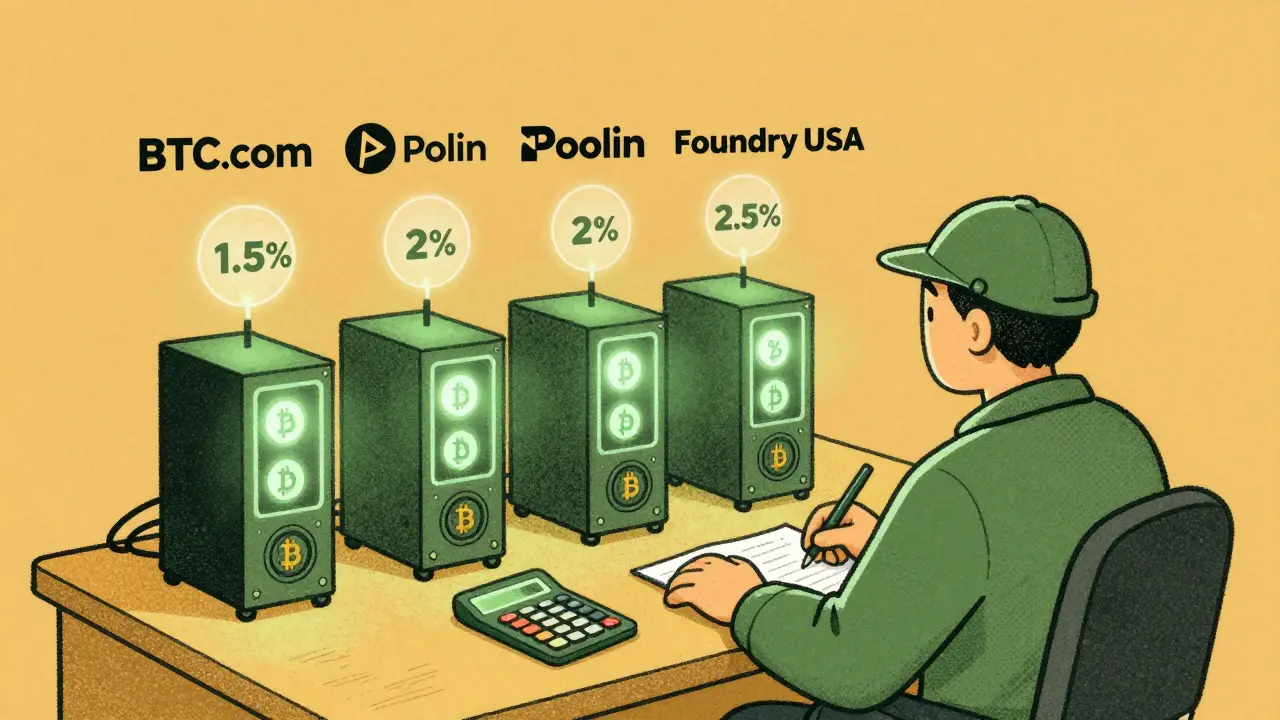

What you won’t find in a pool? Centralized control. Most pools are run by companies, but the Bitcoin protocol itself doesn’t care who runs them. What matters is transparency—how they report shares, how often they pay, and whether they charge fees. Some pools take 1-3%, others take nothing. Some let you switch payouts between Bitcoin and stablecoins. Others lock your earnings until you hit a minimum. These details make a real difference in your bottom line.

And it’s not just about profit. Pools help keep Bitcoin secure. The more distributed the hash rate, the harder it is for one group to take over the network. That’s why the top pools don’t all sit in one country. Kazakhstan, Russia, and Canada still play big roles, even as the U.S. pulls ahead. This global spread is what makes Bitcoin resilient—not just the technology, but the way people choose to mine together.

Below, you’ll find real-world breakdowns of how mining pools operate, where they’re located, who controls the most power, and how changes in difficulty or energy costs affect your earnings. No fluff. Just what you need to know if you’re mining, investing, or just trying to understand how Bitcoin stays alive.

Bitcoin Mining Pool Fees Comparison: Top Pools, Rates, and What You Really Pay in 2025

Compare Bitcoin mining pool fees in 2025 to find the best payout structure. Learn how FPPS, PPLNS, and PPS models affect your earnings, which pools charge the least, and hidden costs that hurt your profits.

View More