Blockchain Bridge Speed: How Fast Do Cross-Chain Transfers Really Take?

When you move crypto from Ethereum to Solana, or from Polygon to Avalanche, you're using a blockchain bridge, a protocol that connects two separate blockchains so tokens and data can flow between them. This isn't magic—it's code, and that code has limits. The speed of that transfer, or blockchain bridge speed, can mean the difference between catching a price dip or missing it entirely.

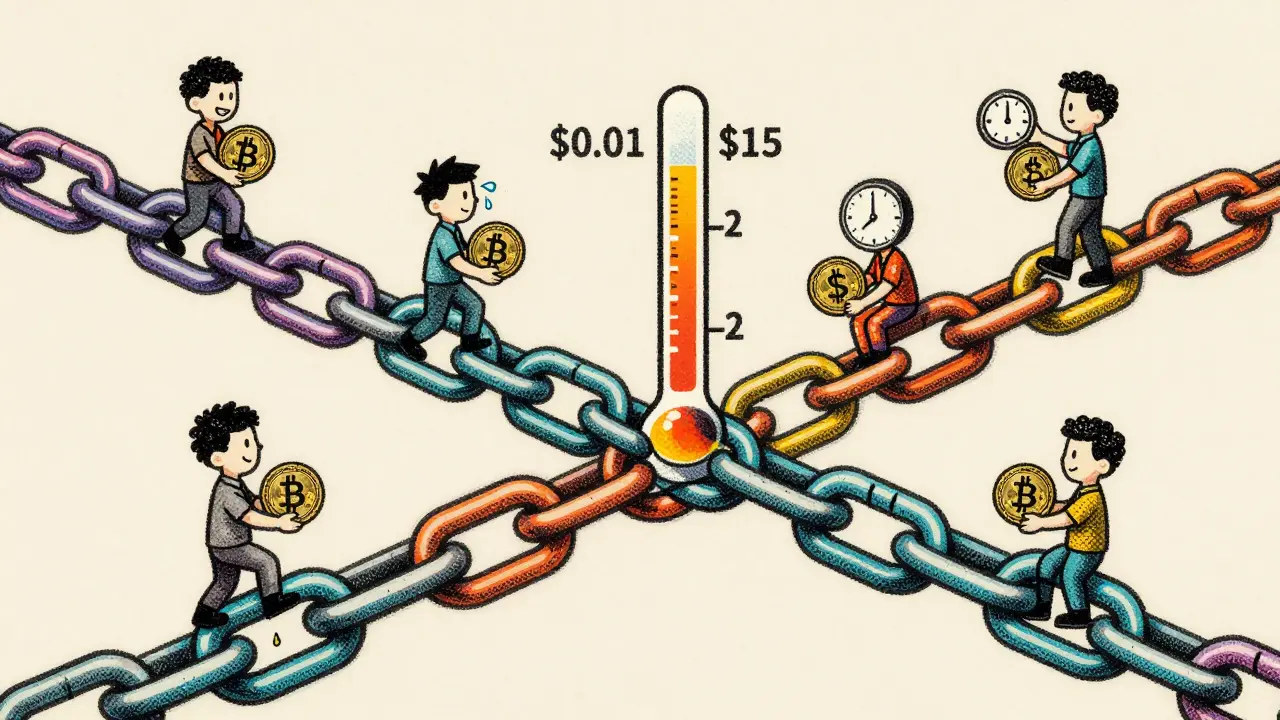

Not all bridges are built the same. Some, like the Polygon PoS Bridge, confirm transfers in under a minute because they use trusted validators and optimized consensus. Others, like older Bitcoin sidechain bridges, can take 10 to 30 minutes because they wait for multiple Bitcoin confirmations. Then there are bridges that claim instant transfers but actually lock your funds in a smart contract while they wait for off-chain verification—slow in practice, fast in marketing. cross-chain transfers depend on three things: the destination chain’s block time, the bridge’s security model, and whether it’s centralized or decentralized. A bridge that relies on a single company to sign off on transactions? That’s faster but riskier. One that uses thousands of nodes across multiple chains? Slower, but far more secure.

And it’s not just about speed. transaction finality matters just as much. If a bridge says your ETH is on Arbitrum in 15 seconds, but the network can still roll back that transaction for the next 5 minutes, you’re not really safe. That’s why some DeFi users avoid bridges with probabilistic finality—like those built on Ethereum L2s—when they’re moving large amounts. They wait for full finality, even if it takes longer. Meanwhile, traders on high-frequency DeFi strategies need bridges that deliver both speed and certainty, which is why projects like LayerZero and Axelar are pushing new designs that combine light client verification with oracle networks to cut delays without sacrificing security.

What you’ll find in the posts below are real-world examples of how bridge speed impacts everyday crypto use. You’ll see how Iranian users rely on slow but sanctioned bridges to access global markets. How Vietnamese traders exploit fast bridges to jump between play-to-earn games. Why the collapse of one major bridge in 2022 sent shockwaves through DeFi because users lost confidence in its timing and reliability. And how newer bridges are now measuring performance not just in seconds, but in guaranteed outcomes. This isn’t theoretical—it’s the hidden rhythm behind every cross-chain trade you make. Let’s look at what’s working, what’s broken, and what’s changing right now.

Bridge Fees and Transaction Times: What You Really Pay and Wait for Cross-Chain Transfers

Bridge fees and transaction times vary widely depending on the platform, blockchain, and transfer size. Learn how much you really pay and wait when moving crypto between chains-and how to avoid costly mistakes.

View More