Blockchain Traceability: How Every Transaction Leaves a Digital Trail

When you send cryptocurrency, it doesn’t just disappear into thin air — it leaves a permanent, unchangeable record on a public ledger. This is blockchain traceability, the ability to track the full history of any digital asset from its origin to its current location. Also known as transaction transparency, it’s what makes crypto different from cash: you can see exactly where every coin came from and where it went. Unlike traditional banking, where records are locked behind closed doors, blockchain traceability lets anyone verify movements without asking permission.

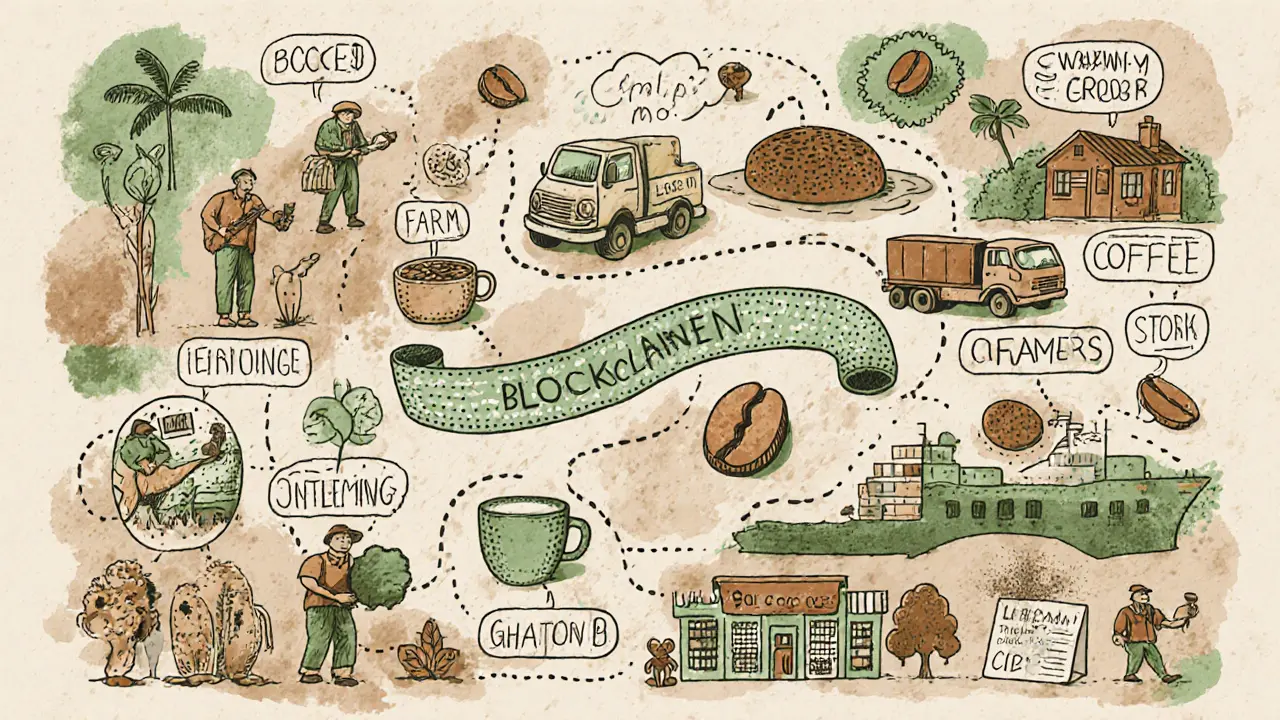

This isn’t just about Bitcoin or Ethereum. It’s used in supply chain blockchain, tracking goods from farm to store using immutable ledgers — think food safety, pharmaceuticals, and ethical mining. It’s also critical for crypto audit, the process of verifying wallet histories to detect fraud or comply with regulations. Regulators, exchanges, and even everyday users rely on this to spot stolen funds, avoid tainted coins, and prove legitimacy. Tools like blockchain analytics platforms scan these trails to flag suspicious activity — like when a wallet linked to a darknet market suddenly receives a large deposit.

But traceability isn’t always a win for privacy. While it helps stop crime, it also means there’s no true anonymity — just pseudonymity. Your wallet address might not have your name, but every transaction it makes is public. That’s why some projects build privacy layers on top, while others, like stablecoins used in cross-border payments, lean into traceability to meet legal standards. In places like the U.S. and Singapore, compliance with blockchain analytics, the use of data tools to monitor and interpret on-chain behavior is now mandatory for exchanges handling U.S. users. If you’re trading, holding, or even just sending crypto, you’re part of this system.

What you’ll find below are real-world examples of how traceability works — from tracking Bitcoin mining power across countries to spotting how airdrop tokens move through wallets after distribution. You’ll see how a failed project like Caduceus CMP left behind a trail of abandoned tokens, how whale activity shows up in public ledgers, and why some crypto exchanges got shut down because their transaction history couldn’t hide illegal flows. This isn’t theory. It’s the backbone of how crypto actually works — and how you can use it smarter.

Blockchain for Supply Chain Transparency: How It Works and Why It Matters

Blockchain for supply chain transparency creates tamper-proof records of every product step, from raw materials to store shelves. It cuts fraud, speeds up recalls, and builds trust with consumers and regulators.

View More