Crypto Licensing Requirements: What You Need to Know in 2025

When it comes to running a crypto business in North America, crypto licensing requirements, the legal rules that govern who can operate digital asset services and under what conditions. Also known as crypto regulatory compliance, these rules aren’t suggestions—they’re enforced by federal agencies like FinCEN and OFAC, with penalties ranging from fines to prison. If you’re running an exchange, wallet service, or even a crypto payment processor, you’re not just building software—you’re operating under a financial license framework designed for banks.

One of the biggest players in this space is OFAC cryptocurrency sanctions, the U.S. Treasury’s tool to block transactions with sanctioned individuals and entities in the crypto space. This isn’t theoretical. In 2025, multiple crypto firms were fined millions for failing to screen users against the OFAC SDN list. Even if you’re based in Canada or Mexico, if you serve U.S. customers, OFAC rules apply. That means you need identity verification, transaction monitoring, and a compliance officer—no exceptions. Then there’s crypto compliance, the ongoing process of following anti-money laundering (AML) and know-your-customer (KYC) rules. This includes keeping records for five years, reporting suspicious activity, and training staff. It’s not just about avoiding fines—it’s about staying in business. Without it, platforms like Exenium or Arbidex end up as ghost sites with no users and no legal protection.

Some countries, like Singapore, make licensing clear and predictable: you apply, you meet strict standards, and you get a license to operate. Others, like Algeria or Iran, ban crypto entirely—so licensing doesn’t exist, only risk. In the U.S., each state has its own rules too. New York’s BitLicense, for example, costs over $50,000 just to apply. Meanwhile, states like Wyoming have created crypto-friendly frameworks that attract startups. The bottom line? blockchain regulations aren’t one-size-fits-all. They’re a patchwork of local, national, and international rules that change constantly.

And it’s not just exchanges that need licenses. If you’re running a DeFi protocol that interacts with U.S. users, or if you’re issuing tokens that act like securities, the SEC can come after you—even if you’re anonymous and based overseas. Recent cases show that regulators are tracking wallet addresses, not just corporate names. That’s why smart teams build compliance into their code from day one, not as an afterthought.

What you’ll find below are real-world examples of how these rules play out: from how Algerians risk jail to trade crypto, to how Singapore’s strict rules actually helped it become a global hub. You’ll see how OFAC sanctions impact daily operations, how compliance failures sink projects, and why some crypto ventures succeed while others vanish overnight. These aren’t hypotheticals—they’re cases that happened, and they’re happening right now.

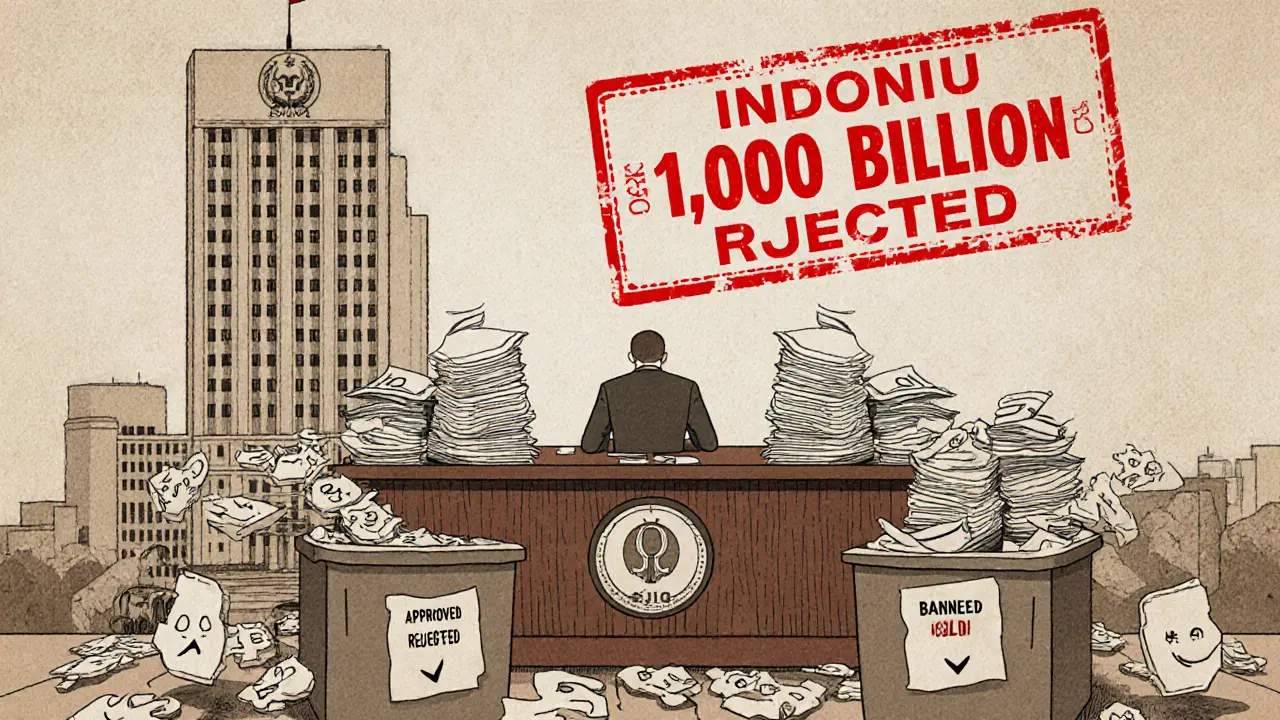

Indonesian Crypto Exchange Licensing Requirements 2025: Capital, Compliance, and Key Changes

Indonesia's crypto exchange rules changed in 2025 under OJK. Learn the new capital requirements, licensing steps, compliance rules, and tax changes that now govern crypto trading in the country.

View More