Crypto Regulation Indonesia: What’s Legal, What’s Not in 2025

When people ask if crypto regulation Indonesia, the set of legal rules governing cryptocurrency use, trading, and taxation within Indonesia. Also known as digital asset rules Indonesia, it's not about banning crypto—it's about controlling how it's used. The Indonesian government doesn't stop you from owning Bitcoin or Ethereum. But it does ban using them to pay for goods or services. That’s the big twist. You can buy, hold, and trade crypto legally through licensed exchanges like Indodax or Pintu, but you can’t use it to buy coffee or pay your rent. This isn’t a ban—it’s a restriction with a loophole.

Why does this matter? Because Indonesia has one of the highest crypto adoption rates in Southeast Asia. Over 16 million people own crypto, mostly young, tech-savvy users who see it as a way to save money, send remittances, or invest outside the local banking system. The central bank, Bank Indonesia, pushes for digital rupiah projects and wants to keep crypto out of daily spending. Meanwhile, the Capital Market and Financial Institutions Supervisory Agency (Bappebti) licenses exchanges and forces them to report large transactions. This creates a weird middle ground: crypto is a commodity, not currency. You’re not breaking the law if you trade it, but you are if you use it like cash.

There’s also the issue of taxes. The government treats crypto as a taxable asset. If you sell and make a profit, you owe capital gains tax. Many users don’t know this—or ignore it. Enforcement is patchy, but audits are increasing. And while peer-to-peer trading is common, platforms that don’t follow Bappebti’s KYC rules risk being shut down. The real risk isn’t the law itself—it’s the uncertainty. Rules change fast. One day, a new decree bans foreign exchange-linked trading. The next, a major exchange gets suspended for not reporting user data. You need to stay updated, not just on prices, but on policy.

What’s missing from most headlines? The underground. Despite the rules, crypto flows through informal channels—WhatsApp groups, local traders, and offshore wallets. People use it for cross-border work, freelancing, and even small business payments. The government sees this as a threat. But it’s also a symptom of a system where traditional finance doesn’t reach everyone. The same people who can’t get bank loans use crypto to fund small startups or send money home to family. That’s why regulation here isn’t about stopping crypto—it’s about trying to control its flow without killing the demand.

Below, you’ll find real reviews, breakdowns, and case studies from users navigating this system. You’ll see how traders in Jakarta avoid pitfalls, how investors track regulatory shifts, and why some exchanges survive while others vanish overnight. This isn’t theory. It’s what’s happening on the ground—in homes, in cafes, on phones—where crypto actually lives in Indonesia.

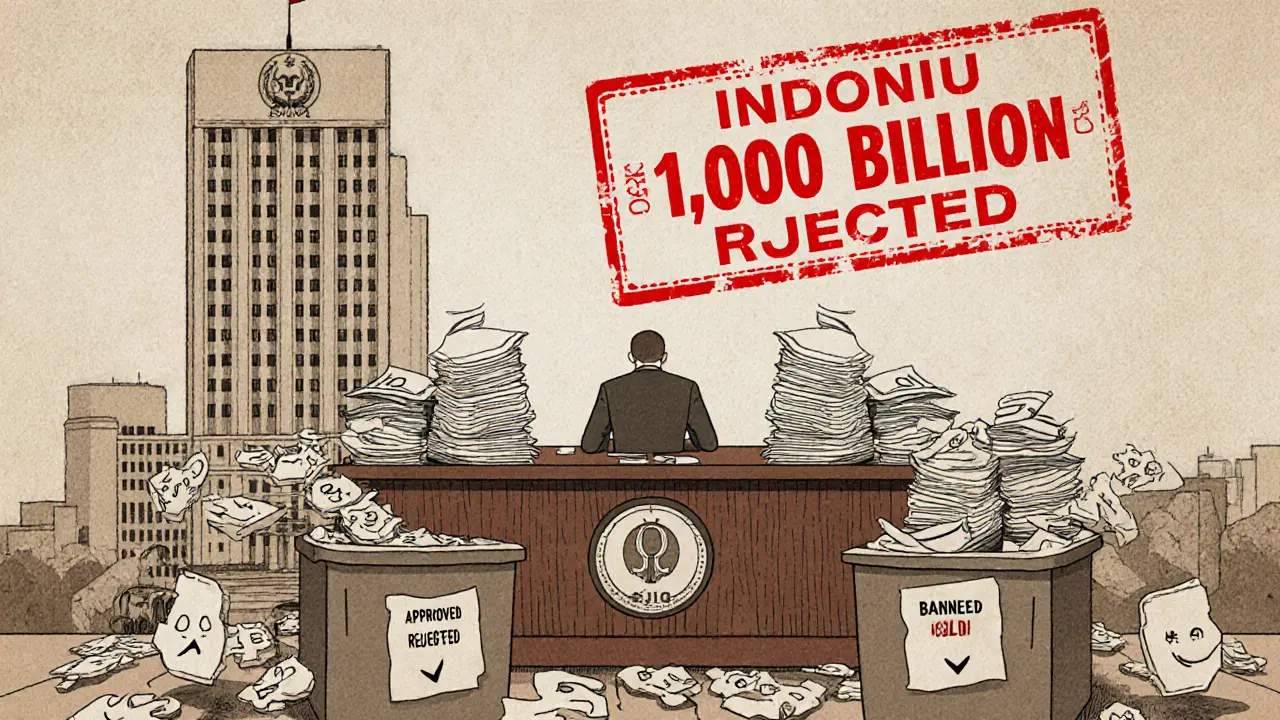

Indonesian Crypto Exchange Licensing Requirements 2025: Capital, Compliance, and Key Changes

Indonesia's crypto exchange rules changed in 2025 under OJK. Learn the new capital requirements, licensing steps, compliance rules, and tax changes that now govern crypto trading in the country.

View More