Crypto Sanctions: What They Are, Who They Target, and How They Shape the Market

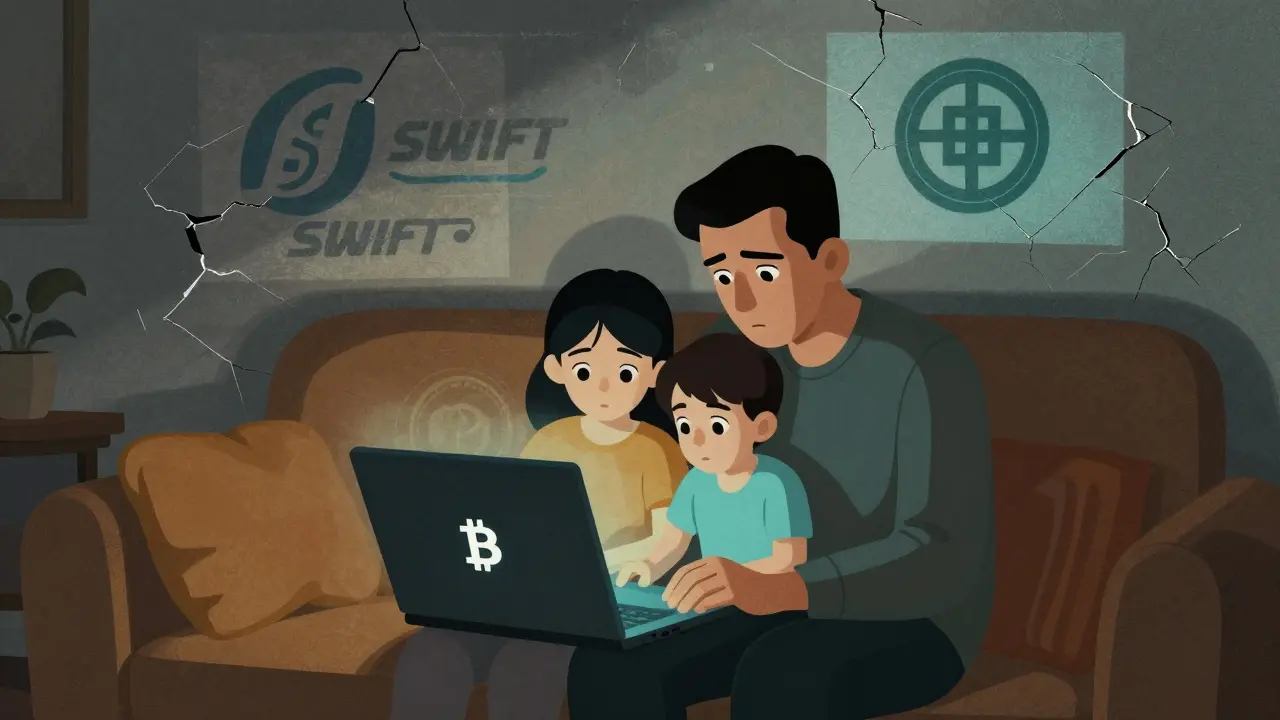

When governments block access to crypto sanctions, government-imposed restrictions on cryptocurrency transactions involving specific individuals, entities, or countries. Also known as crypto freezes, these measures are used to cut off financial flows to rogue regimes, terrorists, and sanctioned actors. Unlike traditional banking, crypto doesn’t need a middleman—so when sanctions hit, they don’t just freeze accounts. They force entire networks to adapt, hide, or shut down.

These sanctions aren’t just about Bitcoin or Ethereum. They target sanctioned crypto exchanges, digital platforms legally blocked from serving users in certain countries due to regulatory or political pressure—like EXIR in Iran, which is one of the few legal options left for Iranians after global exchanges pulled out. They also affect crypto compliance, the systems and processes businesses use to follow anti-money laundering and sanctions rules when handling digital assets. Firms that ignore these rules risk fines, loss of banking access, or even criminal charges. In Turkey, for example, you can still buy Bitcoin—but using it to pay for coffee is illegal. That’s not a technical limit. That’s a sanction in disguise.

And it’s not just countries. Individuals get targeted too. If you’re on a sanctions list, even holding crypto in a self-custody wallet can trigger red flags. Tools like blockchain analytics help regulators trace transactions across chains, making it harder than ever to hide funds. That’s why projects like Zenrock and Moola Celo EUR exist—to offer privacy-respecting, compliant ways to move value without relying on centralized gatekeepers.

What’s happening in Afghanistan and Vietnam tells the real story. After the Taliban banned crypto, people kept trading Bitcoin and USDT underground. In Vietnam, the government bans crypto as payment—but $91 billion still moves through the system every year. Why? Because when traditional finance fails, crypto becomes a lifeline. Sanctions don’t stop adoption. They just push it into the shadows.

And here’s the thing: these rules aren’t just about control. They’re reshaping the entire crypto landscape. Mining hubs shift as countries like Kazakhstan and Russia face pressure. Stablecoins like mCEUR grow because people need reliable, non-sanctioned money. Even meme coins like BilliCat and DogeGPU survive because they’re too small to care about sanctions—until they aren’t.

What you’ll find below isn’t a list of headlines. It’s a real-world map of how crypto sanctions play out—from the banks that enforce them, to the people who dodge them, to the tools that make it possible. Whether you’re a trader in the U.S., a remittance user in Somalia, or just trying to understand why your favorite exchange disappeared overnight, these posts show you what’s really going on.

How the FATF Blacklist Is Reshaping Crypto Use in Iran

The FATF blacklist has cut Iran off from global banking, forcing millions to turn to cryptocurrency. Bitcoin is now the lifeline for remittances, imports, and survival-but every transaction carries risk, surveillance, and uncertainty.

View More