Iran Crypto Adoption Impact Calculator

This tool simulates how FATF sanctions impact Iran's cryptocurrency ecosystem based on data from the article. Enter values to see potential consequences on adoption rates, transaction volumes, and system stability.

Simulated Impact

Iran’s economy has been cut off from the global financial system for years. Banks can’t send or receive money through SWIFT. Foreign companies won’t process payments. Even humanitarian aid gets stuck in bureaucratic limbo. In this vacuum, cryptocurrency didn’t just become popular-it became essential. And the FATF blacklist didn’t just make things harder. It turned crypto into Iran’s last lifeline to the outside world.

What the FATF Blacklist Actually Does to Iran

The Financial Action Task Force (FATF) doesn’t just issue warnings. When a country lands on its blacklist-officially called the ‘Call for Action’-it triggers real, global consequences. Banks everywhere are forced to treat any transaction linked to Iran as high-risk. Many refuse to process them at all. Iran’s access to the global banking network was already shrinking. By 2025, it had dropped from 28 correspondent banking relationships to just three. The FATF blacklist didn’t cause that collapse-it finished it. This isn’t theoretical. European banks stopped processing payments to Iranian entities. Asian financial institutions tightened controls. Even third-party payment processors like PayPal and Wise blocked Iranian users. The result? Ordinary Iranians can’t pay for medical supplies, textbooks, or even basic software. Their savings are trapped. Their businesses can’t import raw materials. And that’s when crypto stepped in-not as a speculative asset, but as a survival tool.Why Iranians Are Using Crypto More Than Ever

In 2024, Iran accounted for $9.2 billion of the $15.8 billion in cryptocurrency transactions flowing into all sanctioned countries. That’s more than Russia, Venezuela, and North Korea combined. It’s not because Iranians are day-trading Bitcoin. It’s because they have no other choice. Centralized exchanges like Nobitex and Wallex are domestic platforms, but they’re trapped. They can’t send money abroad. So users convert their rials into Bitcoin or Ethereum, then move it offshore-to Binance, Bybit, or other international platforms. Monthly outflows from Iranian exchanges jumped from $290 million in January 2024 to over $480 million by December. That’s not speculation. That’s capital flight. That’s people trying to protect what little they have. Bitcoin makes up 78% of these transactions. Why? Because it’s the most decentralized, hardest to block. Ethereum follows at 14%. Privacy coins like Monero are used too, but sparingly-mostly by those who know the risks. The average transaction size dropped to under $1,500. Why? To avoid triggering automated flags. People are breaking their money into small pieces, like pouring water through a cracked sieve, hoping some of it gets out.The Catch: Every Move Is Tracked

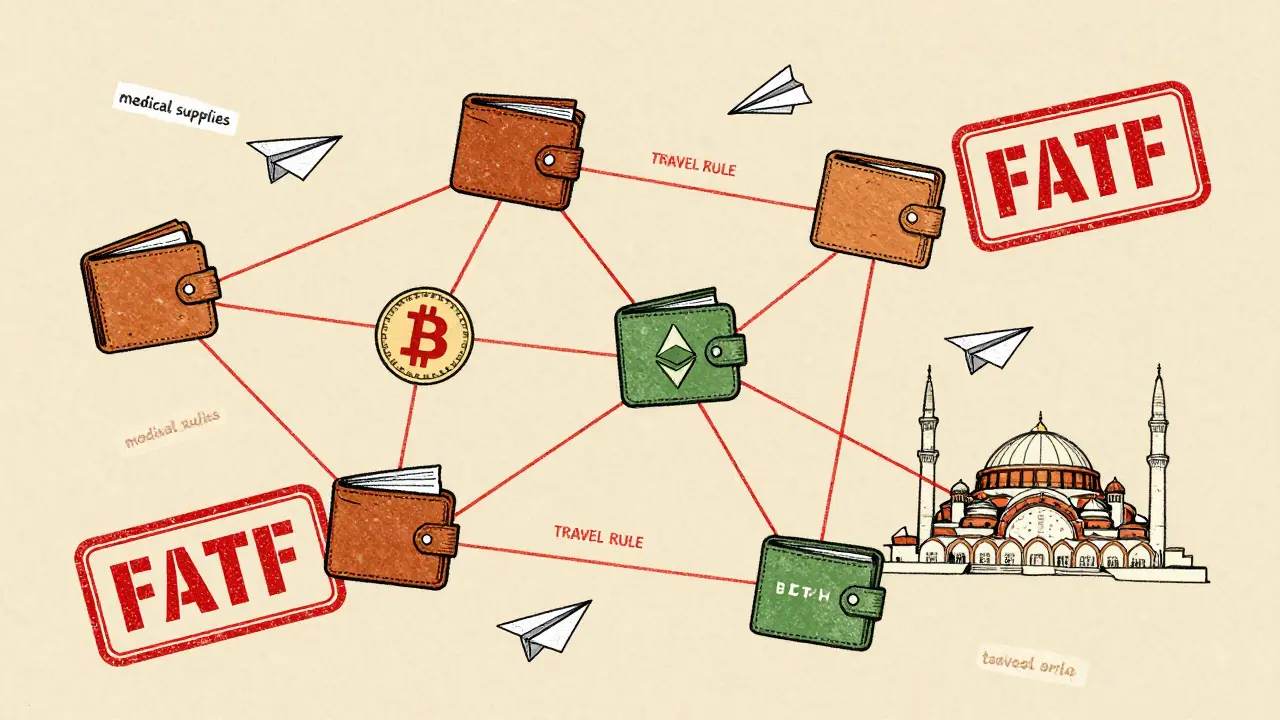

Here’s the cruel irony: the same systems that let Iranians bypass sanctions also make them vulnerable. Global exchanges like Binance are required by FATF to follow the ‘travel rule’-they must collect and share personal data on every transaction over $1,000. So when an Iranian user signs up, they provide their ID, phone number, and address. That data gets stored. And if Iranian authorities request it-and they do-those exchanges are forced to comply. Many Iranian users have had their accounts frozen after just a few small transfers. One Reddit user reported Binance locking his $8,200 account after three transactions under $1,500. That’s not a mistake. That’s policy. And it’s not just exchanges. The Iranian government monitors internet traffic. You need a registered SIM card to access the web. Many users rely on apps like Soroush+, which try to hide their activity, but 41% of these tools get blocked anyway. Even using a non-custodial wallet like Trust Wallet doesn’t make you invisible. Your IP address, your device fingerprint, your transaction patterns-they’re all traceable.

How People Are Getting Around It (And What It Costs)

Some Iranians have found workarounds, but they’re risky and expensive. Peer-to-peer (P2P) trading on platforms like LocalBitcoins works-but with a 22% premium. You pay more because sellers know you’re desperate. Decentralized exchanges like PancakeSwap are used too, but liquidity is thin. Slippage hits 15%, meaning you lose value just by trading. And even these aren’t foolproof. In July 2025, a UAE-based exchange called Rain shut down all Iranian accounts overnight after FATF issued a public warning. 317 people lost $4.1 million. The most promising alternative? Localized networks. One group in Shiraz built a peer-to-peer system using atomic swaps-direct, trustless trades between wallets-that bypasses exchanges entirely. One user moved 2.3 BTC to Turkey in 17 minutes without KYC. But these systems are small, unofficial, and often untested. Security breaches are common. A GitHub project called ‘IranCryptoKit’ helps users bypass government firewalls, but 37% of users who downloaded it reported malware or stolen keys.The Human Cost of Financial Isolation

Behind the numbers are real people. A teacher in Tabriz uses crypto to buy English textbooks for her students. A small business owner in Mashhad imports medical equipment using Bitcoin because no bank will touch his payment. A family in Isfahan sends money to relatives in Turkey to pay for cancer treatment. These aren’t criminals. They’re ordinary people trying to live. A September 2025 survey by the Iran Crypto Association found 82% of users said crypto was their ‘only viable option’ for international transactions. But 68% said they no longer trusted the exchanges they used. The system is unreliable. Transactions fail. Accounts vanish. Support teams take 14 hours to respond-when they respond at all. And yet, adoption keeps growing. In 2025, 18.7 million Iranians-42% of the adult population-are using cryptocurrency. That’s more than the population of Canada. It’s not a trend. It’s a necessity.

What’s Next? A System on the Brink

Iran’s Central Bank launched a gold-backed ‘Halal Stablecoin’ in August 2025. 4.2 million people used it in its first month, transacting $280 million. But it’s still trapped inside Iran. No foreign exchange can touch it. It doesn’t solve the core problem: isolation. FATF insists it’s enforcing global standards. But critics argue the blacklist is backfiring. Dr. Emad Kiyaei, a sanctions expert, wrote in September 2025 that ‘the blacklist has become counterproductive’-it’s accelerating crypto adoption without reducing the risks it was meant to stop. If nothing changes, projections suggest Iran’s crypto usage could hit 25 million users by 2027. But if global exchanges keep freezing accounts and liquidity dries up, there’s a 60% chance the system could collapse by mid-2026. People won’t lose money-they’ll lose hope.Can This Be Fixed?

Iran has taken small steps. It ratified two international anti-terrorism treaties in 2024 and 2025. But FATF hasn’t responded. It won’t say whether these measures are enough. That silence is the real punishment. There’s no easy fix. Lifting the blacklist without real reforms would undermine global financial security. But keeping it in place is forcing millions of ordinary people into a dangerous, unregulated underground economy. Right now, crypto isn’t a luxury for Iranians. It’s a lifeline. And the world’s financial regulators are watching it fray.Why can’t Iranians use traditional banks anymore?

Iran was placed on the FATF blacklist in 2019 for failing to meet global anti-money laundering and counter-terror financing standards. As a result, banks worldwide are required to cut off or severely restrict transactions involving Iranian entities. SWIFT, the global payment network, stopped processing Iranian payments. Most international banks now refuse to open accounts or process transfers tied to Iran, leaving citizens without access to global finance.

Is using crypto illegal in Iran?

No, using cryptocurrency isn’t illegal in Iran, but it’s heavily restricted. The government allows domestic crypto exchanges like Nobitex and Wallex, but they’re barred from cross-border transfers. The Central Bank monitors all transactions, and using crypto to bypass sanctions or import banned goods can lead to legal consequences. Many users operate in a gray area-technically compliant with local rules but violating international sanctions.

Why is Bitcoin the most popular crypto in Iran?

Bitcoin is the most widely used because it’s the most decentralized and hardest to block. Unlike stablecoins or altcoins tied to centralized issuers, Bitcoin operates on a global, permissionless network. It doesn’t require approval from banks or governments to move. In 2024, 78% of all crypto transactions from sanctioned countries like Iran were in Bitcoin, according to Chainalysis.

Can Iranians use Binance or other global exchanges?

Technically yes, but it’s risky. Global exchanges like Binance and Bybit require KYC verification, which means Iranian users must submit personal documents. This data can be accessed by Iranian authorities or used by exchanges to freeze accounts under FATF rules. Many Iranian users report account freezes after just a few small transactions. Some use VPNs to access these platforms, but 99.8% of global exchanges now block Iranian IP addresses automatically.

What’s the Halal Stablecoin, and does it help?

Iran’s Central Bank launched a gold-backed stablecoin called the Halal Stablecoin (HSC) in August 2025. It’s designed to be compliant with Islamic finance rules and is pegged to gold. Over 4 million Iranians used it in its first month. But it only works inside Iran’s closed system. It can’t connect to global exchanges or be transferred abroad due to FATF restrictions, so it doesn’t solve the core problem of international isolation.

Are there safe ways to send crypto out of Iran?

There are no truly safe methods, only less risky ones. Peer-to-peer trades using atomic swaps on decentralized networks (like the one used in Shiraz) avoid exchanges entirely and don’t require KYC. But these systems are unregulated, and users report 15-20% price premiums. Using privacy coins like Monero adds anonymity but increases suspicion from regulators. Most users accept risk because they have no alternatives.

How many Iranians are using crypto today?

As of October 2025, an estimated 18.7 million Iranians-42% of the adult population-are using cryptocurrency. That’s more than the entire population of Canada. Growth continues despite account freezes, exchange outages, and surveillance, because for many, crypto is the only way to access foreign goods, pay for medical care, or send money to family abroad.

What happens if the FATF blacklist stays in place?

If the FATF blacklist remains unchanged, crypto usage in Iran will likely keep growing, possibly reaching 25 million users by 2027. But the system is fragile. As global exchanges cut off Iranian users and liquidity dries up, transaction costs will rise, success rates will fall, and trust in platforms will erode. Experts warn there’s a 60% chance the crypto infrastructure could collapse by mid-2026 if no alternative payment channels emerge.

Yzak victor

December 5, 2025 AT 22:55It's wild how crypto became the only thing keeping ordinary people alive in Iran. I used to think of Bitcoin as just a gamble or a tech toy, but now I see it as a lifeline. People aren't trading for profit-they're trading so their kids can get medicine or their teachers can buy textbooks. It's not about speculation, it's about survival. And the fact that global systems are punishing them for it? That’s the real crime.

Josh Rivera

December 6, 2025 AT 22:59Oh please. So now crypto is the hero because Iranians are broke? Let me guess-next you’ll say the FATF is the villain because they don’t want terrorists laundering cash through Monero? Wake up. This isn’t humanitarian aid-it’s sanctions evasion dressed up as ‘survival.’ If you want to help, lobby for policy change, not for turning Iran into a crypto free-for-all where every scammer and spy hides behind a wallet.

Neal Schechter

December 7, 2025 AT 17:24For anyone who thinks this is just about money, think again. What’s happening in Iran is a textbook case of how financial isolation pushes innovation into the shadows. People are building their own systems-atomic swaps, local P2P networks, even blockchain-based barter groups. They’re not trying to break the system; they’re trying to rebuild it from scratch, with no tools and no support. The fact that they’re doing it under surveillance, with 22% premiums and malware risks, is both heartbreaking and astonishing. This isn’t crypto culture-it’s human resilience in digital form.

Madison Agado

December 7, 2025 AT 20:46There’s a quiet tragedy here that no one talks about: the erosion of trust. These people aren’t just losing money-they’re losing faith in systems that were supposed to protect them. Exchanges freeze accounts. Governments monitor traffic. Even their own tools turn against them. And yet, they keep trying. Not because they believe in Bitcoin, but because they believe in the idea that someone, somewhere, might still let them connect. That’s not a tech trend. That’s a cry for dignity.

Tisha Berg

December 9, 2025 AT 17:09It’s so easy to say ‘just use crypto’-but have you ever tried sending $1,200 in Bitcoin when every transaction gets flagged? People are breaking it into $500 chunks. They’re using fake names, borrowed phones, public Wi-Fi. They’re scared. And when an exchange freezes their account after three tiny transfers? That’s not a glitch. That’s a betrayal. And the worst part? They still don’t know why. No one explains. No one apologizes. They just… disappear.

Billye Nipper

December 11, 2025 AT 09:46This is the most important thing happening in the world right now, and no one’s talking about it!!! People aren’t just using crypto-they’re reinventing how humans exchange value under oppression!!! And yes, it’s messy, risky, and imperfect-but it’s alive!!! Imagine being so desperate that your only hope is a decentralized network you barely understand, just to pay for your mom’s chemo!!! This isn’t finance-it’s survival!!! And if we’re not screaming about this, we’re part of the problem!!!