Cryptocurrency in Iran: How Iranians Trade Crypto Under Sanctions

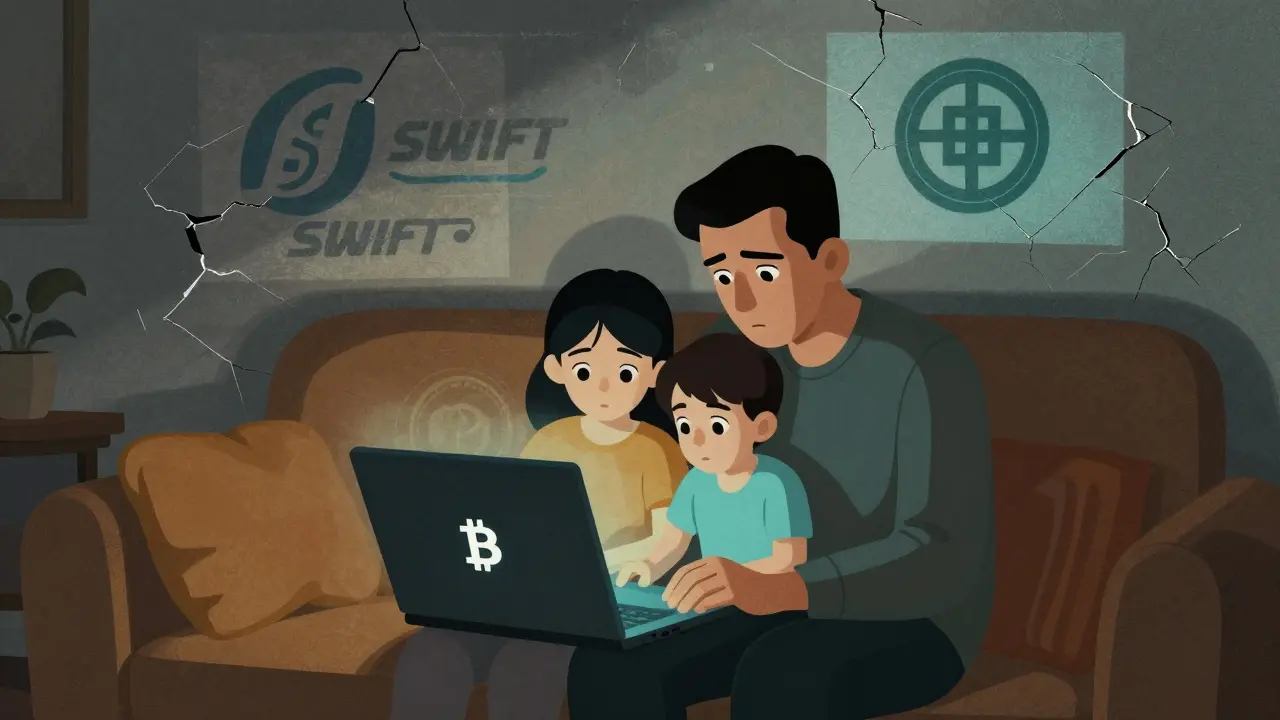

When banks cut off access and foreign currency vanishes, people turn to cryptocurrency, a decentralized digital money system that bypasses traditional financial controls. Also known as digital currency, it’s become a survival tool for millions in Iran, where inflation hits 40% and the rial loses value daily. Unlike in most countries, crypto isn’t just an investment here—it’s how families pay for medicine, send remittances, and buy food.

One of the few legal options left is the EXIR exchange, Iran’s only government-approved crypto trading platform. Also known as EXIR crypto, it’s slow, has no mobile app, and offers poor liquidity—but it’s still the only way most Iranians can trade without risking jail. Even then, the government blocks international gateways, so users rely on peer-to-peer networks and local traders to move funds. Bitcoin and USDT dominate because they’re the most liquid and hardest to trace. People don’t buy crypto to get rich—they buy it to keep from starving. Meanwhile, sanctions have forced Iran to build its own crypto infrastructure, with mining operations popping up in cities like Tehran and Isfahan, powered by subsidized electricity. The state doesn’t endorse crypto, but it can’t stop it.

What you’ll find in this collection isn’t hype or speculation. It’s real stories, hard data, and practical guides from inside Iran’s underground crypto economy. You’ll see how people navigate exchange limits, avoid scams disguised as airdrops, and use stablecoins to protect savings. There’s no sugarcoating—this isn’t about making profits. It’s about staying alive in a broken system.

How the FATF Blacklist Is Reshaping Crypto Use in Iran

The FATF blacklist has cut Iran off from global banking, forcing millions to turn to cryptocurrency. Bitcoin is now the lifeline for remittances, imports, and survival-but every transaction carries risk, surveillance, and uncertainty.

View More