DFA Trading Provider: What It Is and How It Connects to Crypto Markets

When people ask about DFA Trading Provider, a term that appears in crypto circles but lacks clear public documentation. It’s not an exchange, not a wallet, and not a regulated broker—yet it shows up in trading logs, compliance reports, and obscure forum threads. Also known as Digital Financial Asset Trading Provider, it refers to a class of intermediaries that connect institutional buyers and sellers to blockchain markets, often operating under gray-area legal frameworks. Unlike Coinbase or Binance, DFA Trading Providers don’t advertise. They don’t have apps. They don’t have customer service lines. They exist in the background—handling large crypto orders, managing custody for hedge funds, or routing trades through compliant channels to avoid sanctions or banking restrictions.

These providers relate closely to blockchain trading, the process of executing crypto transactions at scale, often using private APIs and off-exchange liquidity pools. They’re the reason some traders can move $5 million in Bitcoin without moving the price. They also tie into crypto compliance, the legal and operational systems that track, report, and verify crypto flows under OFAC, FinCEN, and other global rules. If you’ve read about Exenium being a scam or Arbidex locking up funds, you’re seeing what happens when trading infrastructure lacks transparency. DFA Trading Providers, when legitimate, avoid those pitfalls by working with audited custodians, using KYC/AML checks, and staying off public radars.

They’re also linked to decentralized finance, the ecosystem of protocols that let users lend, borrow, and trade without traditional banks. But here’s the twist: even in DeFi, large players still rely on these hidden providers to move assets between chains, settle over-the-counter deals, or bypass liquidity shortages on DEXs. Think of them as the quiet middlemen in a noisy system. You won’t find them on CoinMarketCap. You won’t see them in YouTube tutorials. But if you’re trading large amounts of crypto—especially across borders—you’ve likely interacted with one.

What you’ll find in the posts below isn’t a direct guide to DFA Trading Provider—because there isn’t one. Instead, you’ll see real examples of how crypto trading infrastructure actually works: from how OFAC sanctions affect crypto businesses, to how blockchain finality impacts trade settlement, to how airdrops and vesting terms shape who gets access to capital. These aren’t random articles. They’re pieces of the same puzzle. If you’ve ever wondered why some traders move faster, safer, or bigger than others, the answer often lies in the hidden layers of trading infrastructure—and that’s exactly what these posts reveal.

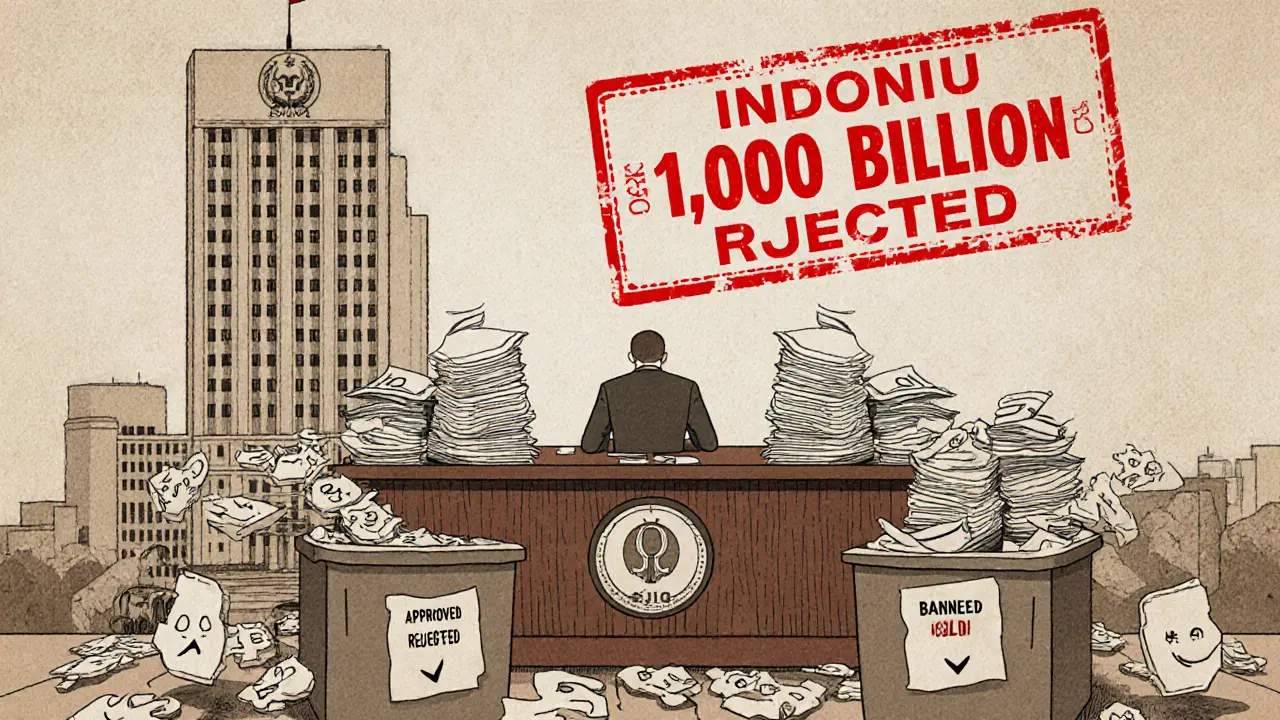

Indonesian Crypto Exchange Licensing Requirements 2025: Capital, Compliance, and Key Changes

Indonesia's crypto exchange rules changed in 2025 under OJK. Learn the new capital requirements, licensing steps, compliance rules, and tax changes that now govern crypto trading in the country.

View More