FATF Blacklist: What It Means for Crypto Traders in North America

When you hear FATF blacklist, a list of countries identified by the Financial Action Task Force for failing to combat money laundering and terrorist financing. Also known as the "Grey List", it’s not just a diplomatic snub—it directly blocks crypto exchanges, wallets, and even peer-to-peer traders from operating legally in North America. If a country ends up on this list, U.S. and Canadian financial institutions are forced to cut ties with anyone linked to it. That means no deposits, no withdrawals, and no access to major exchanges like Coinbase or Kraken for users in those regions.

The FATF guidelines, a global standard for tracking virtual asset service providers (VASPs) and enforcing know-your-customer rules are what make this blacklist so powerful. These rules require exchanges to collect and share customer data across borders. If a country refuses to comply, FATF says it’s too risky. That’s why exchanges shut down services in places like Iran, North Korea, or Myanmar—no matter how many users are there. The virtual asset providers, companies that offer crypto trading, custody, or conversion services in these countries don’t just lose customers—they lose their ability to connect to the global financial system.

North American traders aren’t just watching this from the sidelines. The FATF blacklist shapes what coins you can buy, where you can send money, and even how your taxes are reported. If you’ve ever been asked for extra ID when sending crypto to a friend overseas, that’s FATF in action. Some people use mixers or privacy coins to bypass it, but those tools are increasingly flagged as high-risk. The real impact? If you’re trading from a country under scrutiny, your options shrink fast. You might find yourself stuck with a wallet full of crypto and no way out—unless you use risky bridges or underground channels.

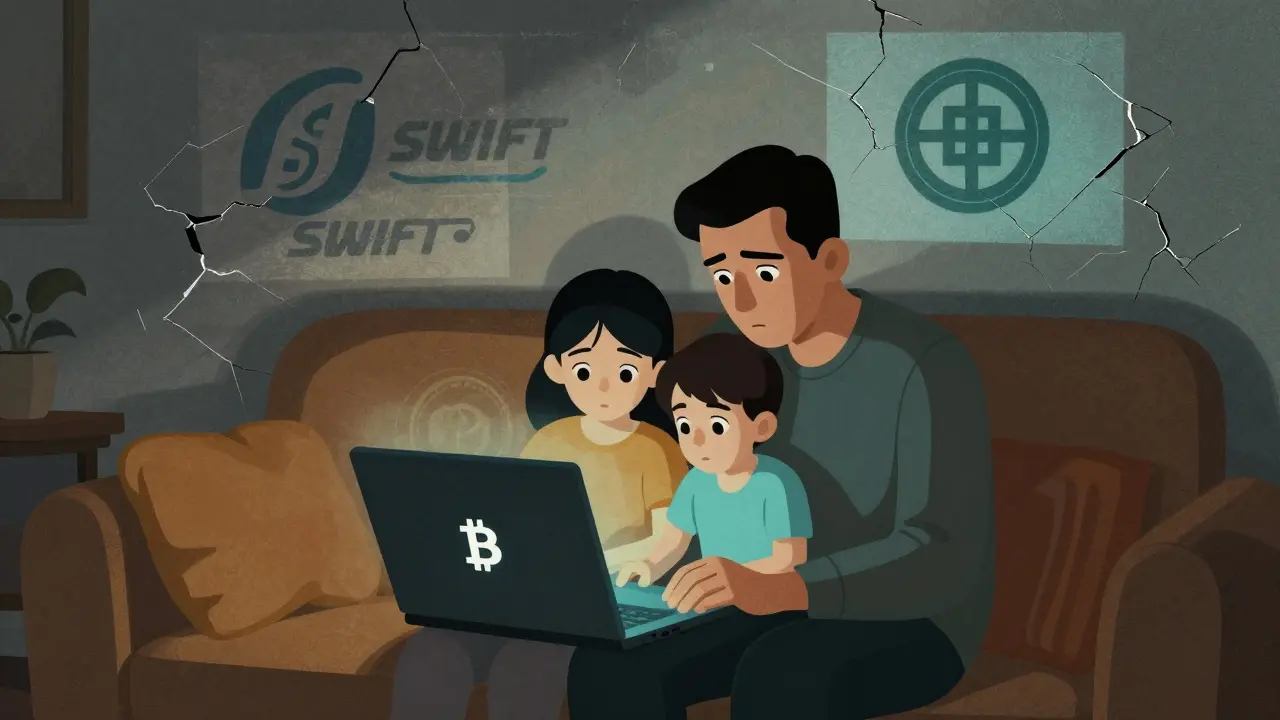

What you’ll find in the posts below aren’t just news updates. These are real stories from traders caught in the crossfire: Iranians using EXIR because it’s the only legal option, Vietnamese users moving $91 billion in crypto despite a ban, and Afghans turning to Bitcoin after their government outlawed it. Each one shows how the FATF blacklist doesn’t just target governments—it targets people. And the rules keep changing. What was allowed last year might be blocked today. You need to know who’s on the list, why it matters, and how to protect yourself before you lose access to your assets.

How the FATF Blacklist Is Reshaping Crypto Use in Iran

The FATF blacklist has cut Iran off from global banking, forcing millions to turn to cryptocurrency. Bitcoin is now the lifeline for remittances, imports, and survival-but every transaction carries risk, surveillance, and uncertainty.

View More