Indonesian Crypto Exchange: What You Need to Know in 2025

When you talk about Indonesian crypto exchange, a digital platform where people in Indonesia buy, sell, or trade cryptocurrencies under local laws and restrictions. Also known as crypto trading platform Indonesia, it’s not just about apps and interfaces—it’s about how real people bypass banking limits, send money to family overseas, and trade without approval from traditional institutions. Indonesia has one of the highest crypto adoption rates in Southeast Asia, with over 16 million users, and most of them don’t use regulated exchanges at all. They use P2P crypto Indonesia, peer-to-peer trading networks that connect buyers and sellers directly, often through WhatsApp or Telegram, using bank transfers or e-wallets like OVO and GoPay. This isn’t a loophole—it’s the main way people trade. The government doesn’t ban crypto, but it bans it as payment and only allows trading on licensed platforms. That’s why Binance Indonesia shut down in 2023, and why users moved to platforms like Tokocrypto, Pintu, and Indodax, or went fully P2P.

What makes the Indonesian crypto exchange, a digital platform where people in Indonesia buy, sell, or trade cryptocurrencies under local laws and restrictions. Also known as crypto trading platform Indonesia, it’s not just about apps and interfaces—it’s about how real people bypass banking limits, send money to family overseas, and trade without approval from traditional institutions. different from places like the U.S. or Singapore? Regulation is messy. The central bank doesn’t oversee crypto like a currency. Instead, the commodities futures agency (Bappebti) regulates it as a commodity, which means exchanges must follow anti-money-laundering rules but don’t need to offer investor protection. That’s why some platforms have no customer support, no insurance, and no clear path to withdraw funds. But users keep coming back because the alternative is worse: slow bank transfers, high fees, and no access to global markets. The real story isn’t in the official exchanges—it’s in the P2P markets, where someone in Jakarta can buy Bitcoin with cash from a seller in Bandung, or send USDT to a relative in the Philippines without touching a bank. This isn’t underground—it’s everyday life.

If you’re looking at crypto regulation Indonesia, the current legal framework that allows cryptocurrency trading under commodity rules but prohibits its use as payment., you’ll see a system that’s trying to control what it can’t stop. The government wants to tax crypto gains, track transactions, and keep capital from leaving the country. But enforcement is weak, and people have already built their own systems. You won’t find a perfect exchange in Indonesia. You’ll find a few regulated ones with low liquidity, and dozens of P2P traders who move more volume than all the official platforms combined. What matters isn’t which app you use—it’s how you move money, who you trust, and how you protect yourself. Below, you’ll find real reviews, warnings about scams, and deep dives into the platforms Indonesians actually use—no fluff, no hype, just what’s working in 2025.

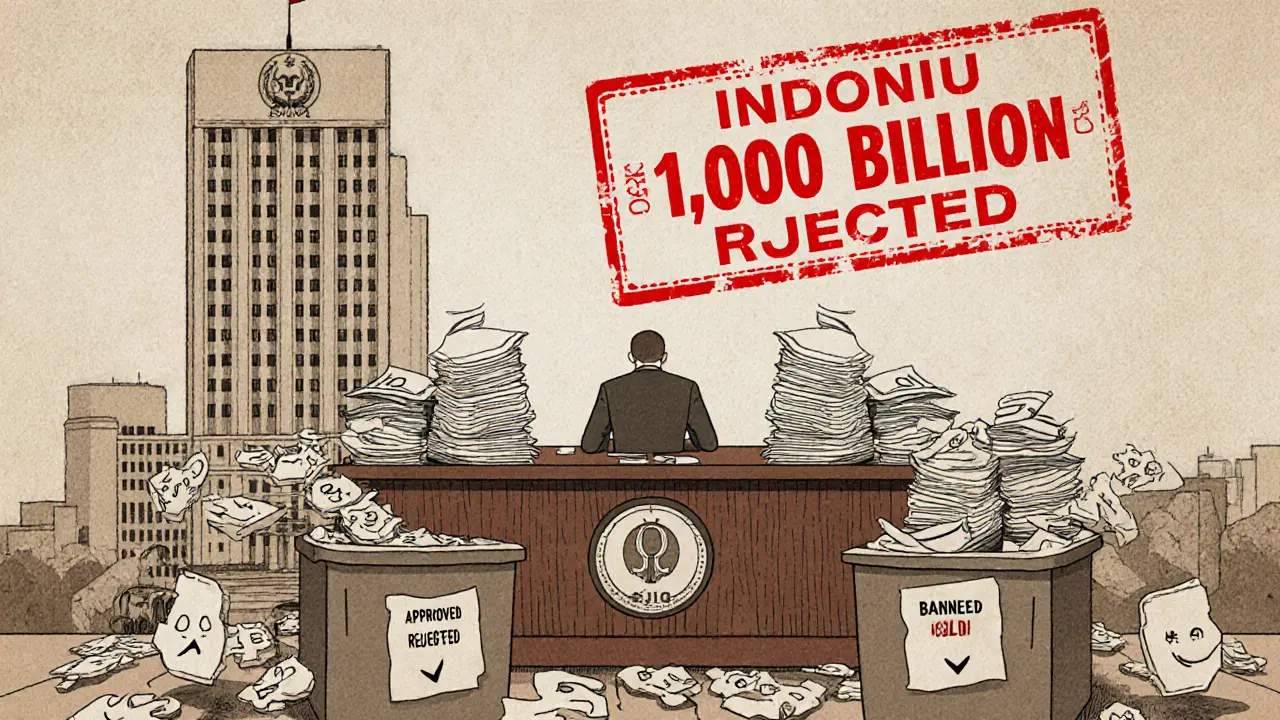

Indonesian Crypto Exchange Licensing Requirements 2025: Capital, Compliance, and Key Changes

Indonesia's crypto exchange rules changed in 2025 under OJK. Learn the new capital requirements, licensing steps, compliance rules, and tax changes that now govern crypto trading in the country.

View More