Iranian Crypto: How Iranians Trade Bitcoin Under Sanctions

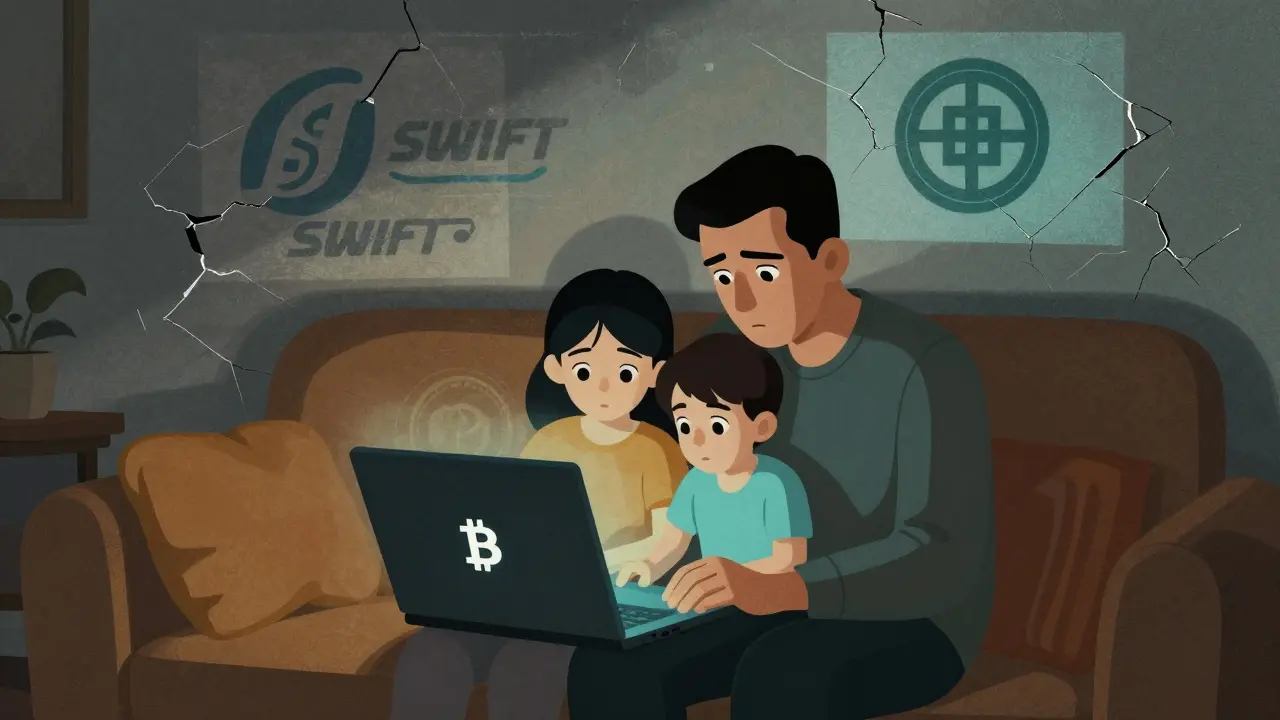

When a country blocks access to global banking, people turn to Iranian crypto, the underground network of Bitcoin, USDT, and local exchanges that keeps money moving despite state restrictions. Also known as crypto under sanctions, it’s not a trend—it’s survival. In Iran, banks can’t process international payments. Credit cards don’t work abroad. Remittances from family overseas? Blocked. So millions turned to crypto—not to get rich, but to eat, pay rent, and keep businesses alive.

At the center of this is EXIR exchange, Iran’s only legal crypto platform, slow and clunky but the only one approved by the government. Also known as EXIR crypto, it lets Iranians buy and sell Bitcoin and Tether without leaving the country. But there’s a catch: no mobile app, low liquidity, and long wait times for withdrawals. Still, it’s the only legal option. Outside of EXIR, peer-to-peer markets run on Telegram, where traders trade USDT for Iranian rials at rates that shift by the minute. This isn’t speculation—it’s daily life. People sell crypto to pay for medicine, send money to relatives in Turkey, or buy food when inflation hits 40%.

Crypto under sanctions, a system built by necessity, not ideology. Also known as crypto trading Iran, it’s not about DeFi yields or NFTs. It’s about bypassing a broken system. The government bans crypto as a payment tool, calls it haram, and threatens jail—but enforcement is patchy. Underground networks thrive. Students use it to pay for online courses. Small shop owners accept USDT to avoid bank fees. Women trade crypto to support their families when male relatives are blocked from working abroad. This isn’t a fringe movement. It’s a national workaround.

What you’ll find below aren’t just articles. They’re real stories from inside Iran’s crypto underground. You’ll see how EXIR works, what people actually pay in fees, why USDT dominates over Bitcoin, and how traders avoid detection. You’ll also find comparisons to other sanctioned economies—like Afghanistan and Venezuela—where crypto became a lifeline. This isn’t theory. It’s what happens when people have no choice but to build their own financial system.

How the FATF Blacklist Is Reshaping Crypto Use in Iran

The FATF blacklist has cut Iran off from global banking, forcing millions to turn to cryptocurrency. Bitcoin is now the lifeline for remittances, imports, and survival-but every transaction carries risk, surveillance, and uncertainty.

View More