Mining Pool Fees Explained: What You Pay and How It Affects Your Profits

When you join a mining pool, a group of cryptocurrency miners who combine their computing power to find blocks more frequently. Also known as mining collective, it’s how most people earn Bitcoin today—not by mining alone, but by sharing rewards with others. But every pool takes a cut. That cut is the mining pool fee, and it’s one of the most overlooked factors in your mining profit calculation.

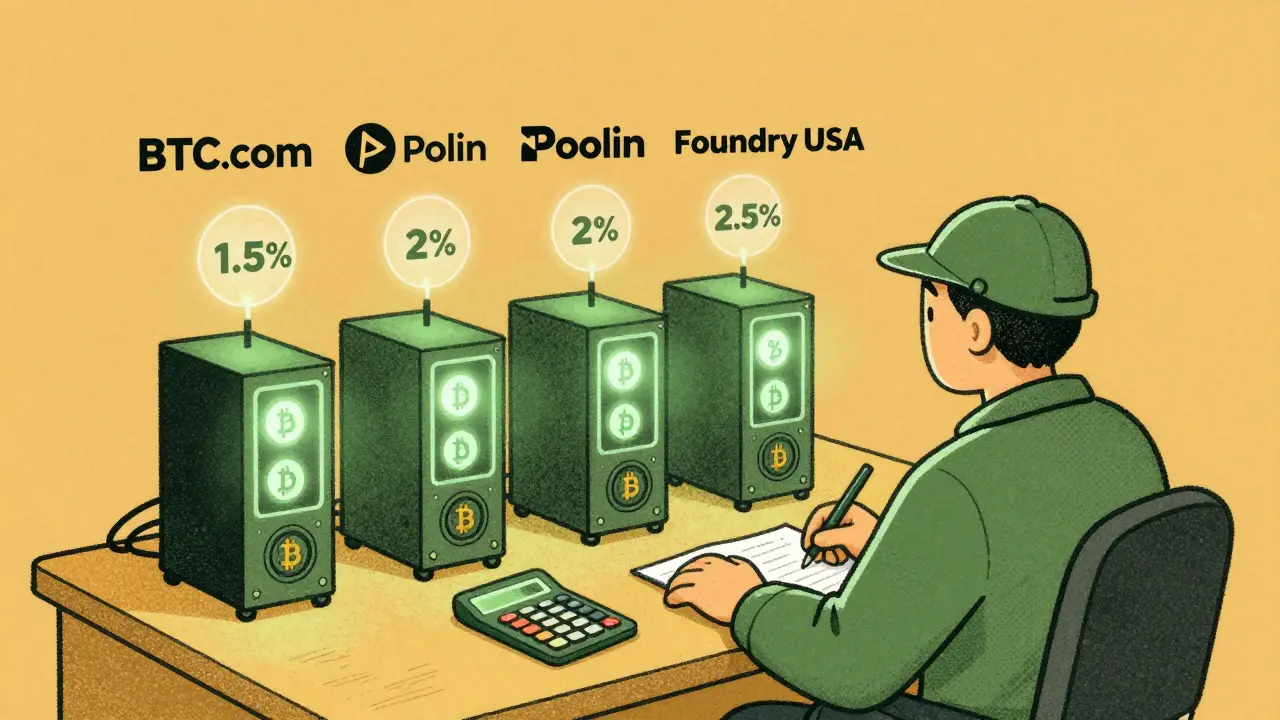

These fees range from 0% to 4%, depending on the pool. Some, like Slush Pool or F2Pool, charge around 1-2%. Others, especially newer or niche pools, might go higher. Why? Because running a pool isn’t free. They need servers, software, bandwidth, and staff to handle payouts and monitor hardware. The fee covers that. But here’s the catch: a lower fee doesn’t always mean more money in your pocket. A pool with a 0.5% fee but poor payout timing or frequent downtime might leave you worse off than one with a 2% fee that pays daily and stays online.

Miners don’t just care about fees—they care about hash rate, the total computing power contributed by all miners in the pool. Also known as mining power, it directly affects how often the pool finds blocks and how regularly you get paid. A small pool with low hash rate might take weeks to find a block. Even if the fee is zero, you’re waiting months for a payout. A large pool with high hash rate finds blocks every few hours. You get paid more often, even with a 2% fee. That’s why most serious miners pick reliability over low fees.

Then there’s mining rewards, the Bitcoin or cryptocurrency earned for helping secure the network. Also known as block rewards, these are what you’re actually trying to collect. Every 10 minutes, a new block is added to Bitcoin’s chain. Right now, that’s 3.125 BTC. The pool splits that among all participants based on how much hash power each miner contributed. Your share? That’s your reward minus the pool’s fee. If you’re mining with a 100 TH/s rig and the pool has 100 EH/s total, you’re contributing 0.1% of the power. That means you’re entitled to 0.1% of the block reward—before the fee is taken.

Some pools use different payout systems—PPS, PPLNS, SOLO. PPS (Pay Per Share) pays you immediately for each valid share you submit, no waiting. But that often comes with a higher fee. PPLNS (Pay Per Last N Shares) waits until a block is found, then pays based on your recent contributions. Lower fee, but you might wait days. It’s a trade-off: instant cash or bigger payouts later?

And don’t forget your hardware costs. Electricity, cooling, and equipment wear can eat up 60-80% of your mining profit. A 1% fee might seem small, but if you’re spending $1,000 a month on power, that 1% could be $50 you’re giving up. Compare that to a pool with 3% fees and lower power bills—you might actually come out ahead.

What you’ll find in these posts isn’t just theory. You’ll see real breakdowns of top mining pools, how their fees stack up, which ones pay out reliably, and how recent shifts in Bitcoin’s hash rate distribution—from the U.S. leading at 44% to Kazakhstan and Canada rising—have changed the game for small miners. You’ll also see how mining pools adapt when regulations tighten, like in Turkey or Algeria, and how that impacts payouts. Whether you’re using a GPU, ASIC, or even a home rig, understanding mining pool fees isn’t optional. It’s the difference between breaking even and actually making money.

Bitcoin Mining Pool Fees Comparison: Top Pools, Rates, and What You Really Pay in 2025

Compare Bitcoin mining pool fees in 2025 to find the best payout structure. Learn how FPPS, PPLNS, and PPS models affect your earnings, which pools charge the least, and hidden costs that hurt your profits.

View More