Mining Pool Rates: How Much You Really Earn and Where to Mine Smart

When you mine cryptocurrency, your earnings don’t come from mining alone—they come from mining pool rates, the system that divides rewards among participants in a group of miners working together. Also known as pool payout structures, these rates decide whether you make enough to cover electricity, hardware wear, and time—or just break even. Without understanding them, you’re mining blind. It’s not about how powerful your rig is. It’s about how fairly and frequently the pool pays out.

Miners join pools because solo mining Bitcoin is nearly impossible today. The network’s hash rate, the total computing power securing the Bitcoin network has hit record highs, with the U.S. alone controlling 44% of it. That means you need to team up. But not all pools are equal. Some take higher fees. Some pay out less often. Some use payout methods like PPLNS or FPPS that change how your share is calculated. Your mining profitability, the net return after costs like power and hardware depreciation depends on these details. A pool offering 0.5% fees might seem better than one with 2%, but if it pays out every two weeks instead of daily, your cash flow suffers. And if the pool has low uptime or gets hacked? You lose everything.

What you’re really comparing isn’t just the rate—it’s reliability, transparency, and payout speed. Some pools show real-time stats. Others hide their fee structure in fine print. Some pay in Bitcoin. Others pay in altcoins you have to convert. And if you’re mining Ethereum or other coins? The rules change again. The best pools give you clear dashboards, low minimum payouts, and consistent performance—even when the market drops. You don’t need a supercomputer. You need to pick the right team.

Below, you’ll find real-world breakdowns of how mining pools operate, what fees actually cost you, and which ones still deliver value in 2025. Some posts cover how hash rate distribution affects your odds. Others show why certain pools vanish overnight. One even explains why GPU mining for meme coins like DOGPU still makes sense for some. These aren’t theory pieces. They’re lessons from people who’ve been there—and lost money because they didn’t ask the right questions.

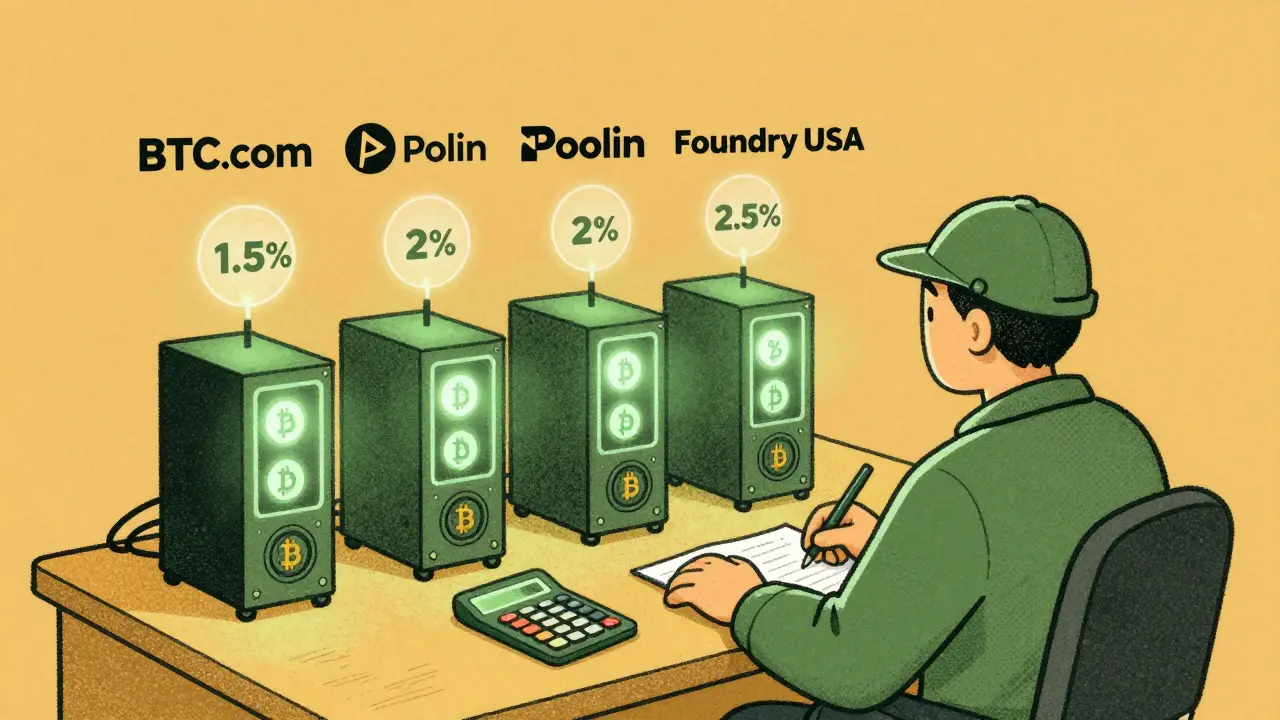

Bitcoin Mining Pool Fees Comparison: Top Pools, Rates, and What You Really Pay in 2025

Compare Bitcoin mining pool fees in 2025 to find the best payout structure. Learn how FPPS, PPLNS, and PPS models affect your earnings, which pools charge the least, and hidden costs that hurt your profits.

View More