OJK Licensing: What Crypto Businesses in Indonesia Need to Know

When it comes to OJK licensing, the official cryptocurrency regulatory framework enforced by Indonesia’s Financial Services Authority. Also known as Otoritas Jasa Keuangan, it's the only legal pathway for crypto exchanges and service providers to operate in Indonesia. If you're running a crypto business there, skipping OJK licensing isn’t an option—it’s a federal crime.

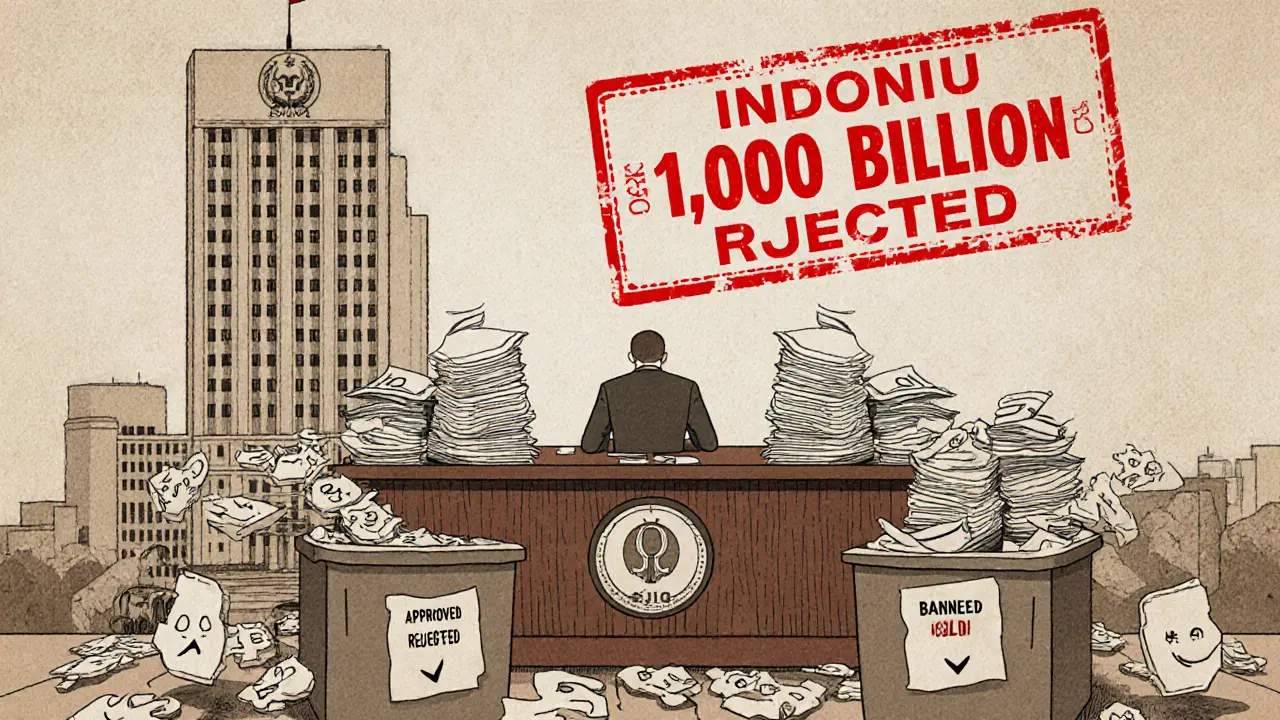

OJK licensing doesn’t just mean filling out forms. It demands real infrastructure: local bank partnerships, anti-money laundering systems, KYC procedures that meet Indonesian standards, and a physical office presence. Many foreign exchanges thought they could serve Indonesian users through offshore platforms, but OJK shut them down hard. In 2023 alone, over 150 unlicensed platforms were blocked. The agency doesn’t just regulate—it enforces. Fines can reach billions of rupiah, and executives face jail time.

What does this mean for traders? If you’re using an exchange without OJK approval, your funds aren’t protected. There’s no insurance, no recourse if the platform vanishes. Even peer-to-peer traders aren’t safe—OJK has cracked down on Telegram groups and local payment processors that facilitate unlicensed trades. The only legal way to trade crypto in Indonesia is through platforms like OJK-licensed exchanges such as Indodax, Pintu, or Tokocrypto. These are the only ones allowed to hold rupiah deposits, offer fiat on-ramps, and display their license numbers publicly.

It’s not just about exchanges. OJK licensing now extends to DeFi projects, NFT marketplaces, and crypto wallet providers if they serve Indonesian users. Even if your platform is based in the U.S. or Singapore, if Indonesian users can access it, you’re under OJK’s jurisdiction. This has forced many startups to either build a local entity or leave the market entirely.

The good news? OJK isn’t trying to kill crypto. It’s trying to control it. The agency has approved dozens of licenses and is working with global regulators to align standards. They’ve even started accepting applications from blockchain gaming and tokenized asset platforms. But approval isn’t easy. You need local legal counsel, audited financials, and a clear path to consumer protection. Most small teams can’t afford it.

What you’ll find in the posts below aren’t guides on how to bypass OJK. They’re real case studies on what happens when you ignore it, what works when you follow it, and how Indonesia’s rules are shaping crypto adoption across Southeast Asia. From the collapse of unlicensed platforms to the rise of compliant local exchanges, these stories show the cost of compliance—and the price of ignoring it.

Indonesian Crypto Exchange Licensing Requirements 2025: Capital, Compliance, and Key Changes

Indonesia's crypto exchange rules changed in 2025 under OJK. Learn the new capital requirements, licensing steps, compliance rules, and tax changes that now govern crypto trading in the country.

View More