Pool Fee Comparison: Find the Lowest Costs on Major Crypto Exchanges

When you swap tokens on a decentralized exchange, you’re not just paying for the trade—you’re paying a pool fee, a charge paid to liquidity providers who supply the assets you’re trading. Also known as trading fees, this cost varies wildly between platforms and can eat up your profits if you don’t check it first. Some DEXs charge 0.01%, others 0.3% or more. That difference might seem tiny, but on a $1,000 trade, it’s $1 vs. $3. Over time, that adds up.

Not all pool fees are created equal. On Uniswap, a leading Ethereum-based DEX that uses automated market makers, the standard fee is 0.3% for most token pairs. But on PancakeSwap, a popular BSC platform optimized for lower gas costs, you’ll often see 0.2% or even 0.1% for high-volume pairs. Then there are newer chains like Sui, a high-speed blockchain designed for low-cost DeFi transactions, where fees can drop below 0.05% because of how the network handles transactions. The key isn’t just the percentage—it’s what’s behind it: liquidity depth, token popularity, and the underlying blockchain’s efficiency.

Why does this matter? Because if you’re swapping regularly—whether you’re trading stablecoins, moving between Layer 2s, or harvesting yield—you’re paying these fees every single time. Some platforms let you pay in their native token for discounts, like $CAKE on PancakeSwap or $ARB on Arbitrum-based DEXs. Others hide fees inside slippage or gas costs. You need to compare apples to apples: look at the total cost, not just the fee rate. Tools like DEX Screener or DeFi Llama show real-time fee data across dozens of platforms, so you’re not guessing.

And it’s not just about saving pennies. Lower fees mean you can trade smaller amounts profitably, which opens up opportunities for beginners and micro-traders. If you’re using a platform where every swap costs 0.3%, you might avoid trading under $500 just to break even. But on a 0.05% fee platform, that same $500 trade becomes viable. That’s the difference between being locked out and being active.

Below, you’ll find real-world examples from actual platforms—some that cut fees to attract users, others that charge more because they offer better liquidity or faster settlement. You’ll see how fee structures changed after new token launches, how chain upgrades affected costs, and which platforms quietly raised fees without warning. This isn’t theory. It’s what traders in North America are seeing right now, and it’s the kind of info that helps you make smarter moves before you hit confirm.

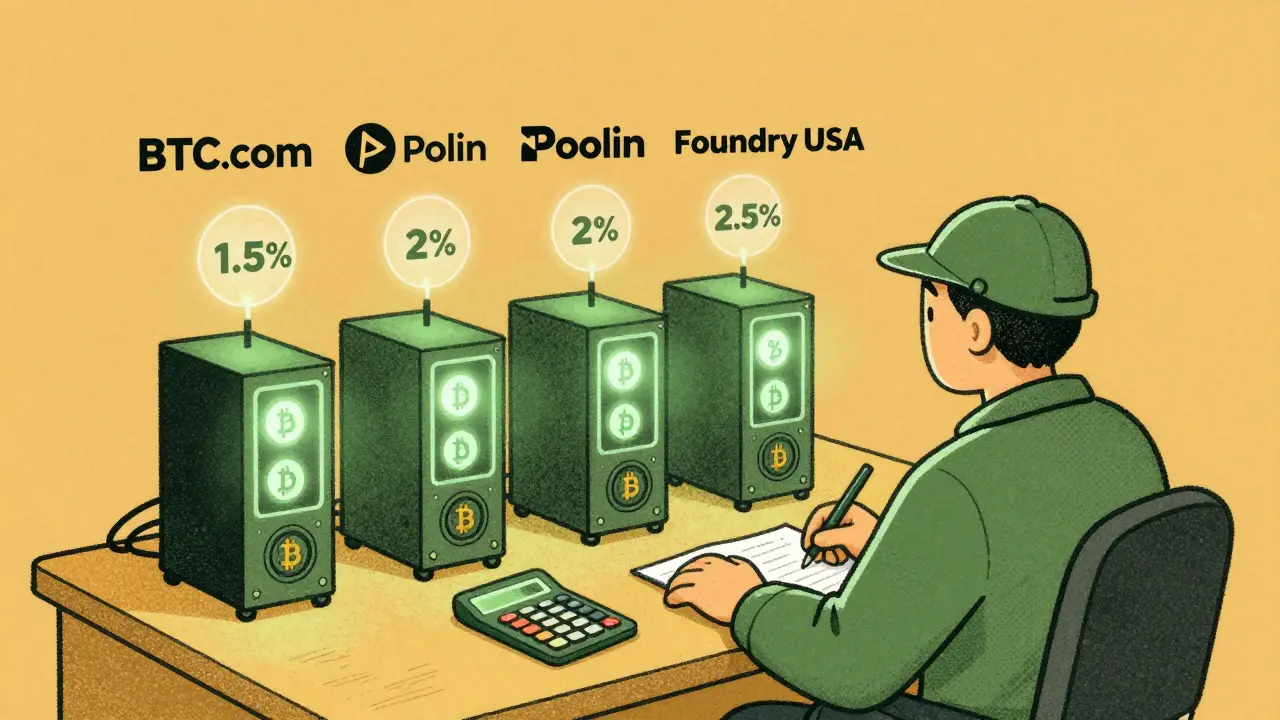

Bitcoin Mining Pool Fees Comparison: Top Pools, Rates, and What You Really Pay in 2025

Compare Bitcoin mining pool fees in 2025 to find the best payout structure. Learn how FPPS, PPLNS, and PPS models affect your earnings, which pools charge the least, and hidden costs that hurt your profits.

View More