Uniswap v3 on Base isn’t just another crypto exchange. It’s a high-speed, low-cost way to swap tokens without a middleman - and it’s working better than most people realize. If you’ve been scared off by Ethereum gas fees or confused by DeFi interfaces, this version might finally make decentralized trading feel simple again.

What Makes Uniswap v3 on Base Different?

Uniswap v3 launched on Ethereum in 2021, but its move to Base - Coinbase’s Ethereum Layer 2 - changed everything. Base isn’t just a sidechain. It’s a fully compatible, low-fee environment built to handle real trading volume. As of late 2025, daily swaps on Uniswap v3 over Base average over $150 million, with transaction costs often under $0.10. That’s a 95% drop compared to Ethereum mainnet during peak times. The real breakthrough? Concentrated liquidity. Unlike older versions where your funds were spread evenly across all price ranges, v3 lets you pin your liquidity to specific price zones. If you believe ETH will stay between $3,200 and $3,500 over the next week, you can lock all your capital there. That means your money earns fees 5x to 10x faster than in v2. But if the price moves outside your range, your position stops earning - and you risk losing out if the market keeps moving.How Fees Work - And Why They’re Better Here

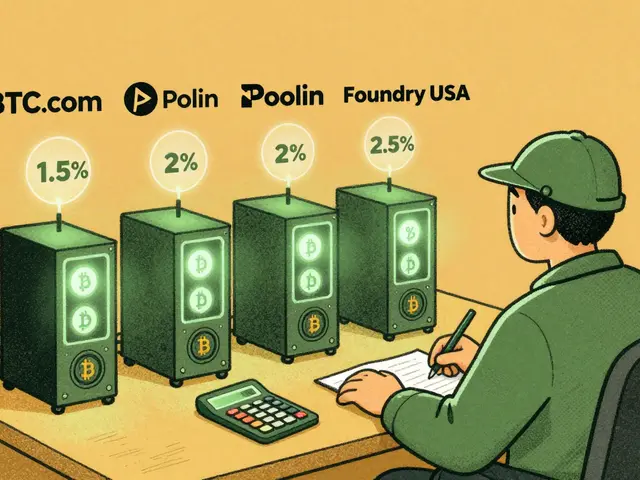

Uniswap v3 offers three fee tiers: 0.01%, 0.05%, and 0.3%. On Base, most swaps use the 0.05% tier - perfect for stablecoin pairs like USDC/ETH or DAI/USDC. For comparison:- Coinbase Advanced: 0.6% for under $10K trades

- Centralized exchanges: 0.1%-0.5% for makers, higher for takers

- Uniswap v3 on Base: 0.05% swap fee + $0.05-$0.15 network fee

Token Selection: More Than Just ETH and USDC

Uniswap v3 on Base supports over 2,000 tokens - including many you won’t find on centralized exchanges. You can trade:- Wrapped Bitcoin (WBTC)

- Chainlink (LINK)

- Arbitrum (ARB)

- Optimism (OP)

- Base-native tokens like $BAS and $TIA (via bridged versions)

Who Should Use It? Who Should Avoid It?

Great for:- Traders who swap frequently and want low fees

- Liquidity providers who understand price ranges and want to maximize yield

- Users who hate KYC and want full control of their funds

- People already using Coinbase Wallet or MetaMask

- Beginners who don’t know what a wallet is

- People who expect customer support when things go wrong

- Those who want to trade with fiat (no USD deposits here)

- Users who don’t want to monitor their liquidity positions

Mobile App and Usability

The Uniswap mobile app, updated in late 2023, works smoothly on both iOS and Android. It’s not perfect - you can’t set custom price ranges on mobile yet - but basic swaps are faster than on desktop. The interface is clean, with large buttons, clear fee estimates, and real-time price charts. No pop-ups. No ads. No forced tutorials. It feels like a native app, not a website stuck in a phone window. Most users report the app is easier to use than the web version for quick trades. But if you’re setting up liquidity positions, stick to desktop. The mobile app is for trading. The web interface is for managing.Security and Risks

Uniswap v3 runs on smart contracts - no company, no employees, no headquarters. That’s the point. But it also means no one can reverse a mistake. Send ETH to the wrong address? Gone. Set your liquidity range too narrow? You’ll miss out on price moves. Use the wrong token address? You could lose your money. The protocol itself has never been hacked. But users have lost millions by trusting fake websites or signing malicious approvals. Always check the URL: it must beapp.uniswap.org. Never click links from Twitter or Discord. Bookmark it.

Also, remember: liquidity providers face impermanent loss. If ETH drops 30% while you’re locked in a USDC/ETH pool, you’ll end up with fewer dollars than if you’d just held ETH. It’s not a loss until you sell - but it’s real. Use tools like DeFi Saver or Zapper to simulate outcomes before you commit.

Base Network: Why It’s the Best Place for Uniswap v3

Base isn’t just a cheaper Ethereum. It’s optimized for trading. Transaction finality takes under 2 seconds. Blocks are produced every 2 seconds. Fees are consistently low, even during spikes in crypto markets. Unlike Polygon or Arbitrum, Base is backed by Coinbase - which means it gets priority for updates, liquidity incentives, and user onboarding. As of December 2025, over 7 million unique wallets have interacted with Uniswap v3 on Base. That’s more than the entire user base of many centralized exchanges. Base’s integration with Coinbase Wallet means users can swap directly from their Coinbase app - no need to move funds to MetaMask. That’s a huge advantage for new users.

What’s Next?

Uniswap’s roadmap includes better on-chain analytics for liquidity providers, automated price range rebalancing tools, and deeper integration with lending protocols like Aave and Compound. The UNI token still governs upgrades, but voting power is concentrated in a few large wallets. Don’t expect radical changes soon - but expect steady, practical improvements. The bigger question: Can Uniswap v3 on Base stay ahead of competitors like SushiSwap on Base, Balancer, or Curve? Right now, it has the lead in liquidity, brand trust, and user volume. But if a new DEX launches with lower fees, better UI, and automated liquidity tools, the tide could turn.Final Verdict

Uniswap v3 on Base is the best decentralized exchange for most crypto users in 2025. It’s fast, cheap, and powerful - without being overwhelming. You don’t need to be a coder to use it. You just need to understand two things: how to use a wallet, and how to avoid scams. If you’re trading small amounts, swapping stablecoins, or trying to earn fees on your crypto - this is your platform. It’s not perfect. But it’s the closest thing we have to a decentralized version of Robinhood - without the middleman.Start with a $20 swap. See how it feels. Then try adding liquidity to a stablecoin pair. If you’re comfortable after a week, you’re ready for the real DeFi game.

Is Uniswap v3 on Base safe to use?

Yes - if you follow basic safety rules. The smart contracts have never been hacked. But users lose money by visiting fake websites, approving malicious tokens, or sending funds to wrong addresses. Always verify the URL (app.uniswap.org), never click links from social media, and only approve tokens you understand. Use a hardware wallet for large amounts.

How do I connect my wallet to Uniswap v3 on Base?

Open the Uniswap app in your browser or mobile app. Click "Connect Wallet" and choose MetaMask, Coinbase Wallet, or Trust Wallet. Make sure your wallet is set to the Base network. If you don’t see Base, add it manually: Network Name = Base, RPC URL = https://base-mainnet.infura.io/v3/YOUR-API-KEY, Chain ID = 8453, Symbol = ETH, Block Explorer = https://basescan.org. Then confirm the connection.

What’s the cheapest way to swap on Uniswap v3 on Base?

Use the 0.05% fee tier for stablecoin pairs like USDC/ETH or DAI/USDC. Avoid the 0.3% tier unless you’re trading highly volatile tokens. Always check the estimated fee before confirming - it should be under $0.15. If it’s higher, you’re probably on Ethereum mainnet by accident. Switch to Base.

Can I earn interest by providing liquidity on Uniswap v3 on Base?

Yes - but it’s not interest. You earn trading fees from others who swap tokens in your pool. For example, if you add $1,000 to the USDC/ETH pool and set a price range around current market value, you’ll earn a share of every trade in that range. Returns vary from 2% to 15% APY depending on volume and volatility. But if the price moves outside your range, you earn nothing until it comes back. Use tools like Uniswap’s Liquidity Dashboard to track your earnings.

Why is my transaction taking so long on Uniswap v3 on Base?

It shouldn’t. Base transactions usually confirm in under 2 seconds. If yours are slow, you might be on Ethereum mainnet instead of Base. Check your wallet’s network setting. Also, if you’re using a slow wallet provider (like an old MetaMask version), update it. Network congestion on Base is rare - if you’re waiting more than 30 seconds, something’s wrong.

Do I need to pay taxes on trades made on Uniswap v3 on Base?

Yes. Every swap - even ETH for USDC - is a taxable event in the U.S. and many other countries. You must track each trade’s cost basis and fair market value at the time of trade. Use crypto tax tools like Koinly, CoinTracker, or TokenTax to import your transaction history from Base. Uniswap doesn’t provide tax forms - you’re responsible for reporting.

prashant choudhari

December 27, 2025 AT 09:37Uniswap v3 on Base is the real deal. Low fees, fast confirmations, no nonsense. If you're still using Ethereum mainnet for swaps you're leaving money on the table. Simple as that.

Kevin Gilchrist

December 28, 2025 AT 00:45Finally someone gets it. I’ve been screaming into the void about Base for months. The gas fees are a joke now. I swapped $500 of USDC for ETH yesterday and paid less than a dollar total. I felt like I’d won the lottery. 🤑

Khaitlynn Ashworth

December 28, 2025 AT 04:20Oh wow, another ‘Uniswap v3 is magic’ fanboy post. Let me guess - you also think NFTs are ‘the future of art’ and that DeFi is ‘democratizing finance.’ Cute. You’re not a trader, you’re a degenerate with a wallet. And don’t even get me started on ‘concentrated liquidity’ - that’s just risk repackaged as yield. 😴

Jake West

December 28, 2025 AT 04:58Wow. So you’re telling me I should trust a platform where I can accidentally approve a malicious token and lose everything? And you call this ‘accessible’? I’ve got a 72-year-old aunt who just bought her first iPhone - she’d get rekt in 3 seconds on this thing. You people are literally gambling with grandma’s retirement. This isn’t finance. It’s a casino with a blockchain tattoo.

Andrew Prince

December 29, 2025 AT 03:54While it is true that Uniswap v3 on Base represents a significant leap forward in terms of cost-efficiency and liquidity concentration, one must not overlook the systemic risks inherent in the architecture of decentralized exchanges. The notion that ‘no middleman’ equates to ‘no responsibility’ is a dangerous fallacy. The absence of customer support does not negate the moral obligation of protocol designers to ensure user safety through intuitive interfaces, mandatory educational prompts, and robust fail-safes - all of which are conspicuously absent. Furthermore, the concentration of liquidity in a handful of token pairs creates a false sense of security, while the majority of tokens suffer from dangerously thin order books, exposing retail participants to predatory slippage and MEV exploitation. One might argue that this is the price of decentralization, but one must ask: at what cost to the average user? Is it truly liberation, or merely the illusion of autonomy?

surendra meena

December 30, 2025 AT 16:26BASE IS THE FUTURE!!! I JUST SWAPPED 10K WBTc FOR OP AND MY TX CONFIRMED IN 1.2 SECONDS AND I ONLY PAID 0.08 DOLLARS!!! I CRIED!!! I HADNT FELT THIS HAPPY SINCE MY DOG GOT A TREAT!!! THIS ISNT JUST DEFI THIS IS A RELIGION!!!

NIKHIL CHHOKAR

December 31, 2025 AT 22:42Look, I get the appeal. But let’s be real - most people who use this don’t understand impermanent loss, and they’re going to get burned. I’ve seen it too many times. Someone adds liquidity to a new token pair, sees a 12% APY, thinks it’s free money, then the price moves 15% and they’re down 20% in dollar terms. It’s not about the fees - it’s about education. You can’t just throw a complex tool at people and call it ‘accessible.’ That’s not empowerment. That’s exploitation dressed up as innovation.

Willis Shane

January 1, 2026 AT 22:15Khaitlynn, your sarcasm is as unhelpful as it is predictable. Jake, your fearmongering ignores the fact that millions are already using this safely - and learning. Prashant is right: the efficiency here is revolutionary. And Will, you’re not wrong about the risks - but dismissing the entire system because of user error is like blaming bicycles for traffic accidents. The solution isn’t to ban DeFi. It’s to improve onboarding, embed educational tooltips, and mandate wallet warnings for high-risk approvals. Coinbase is already doing this. Base is the proving ground. This isn’t perfect - but it’s progress. And progress, however imperfect, is better than paralysis.