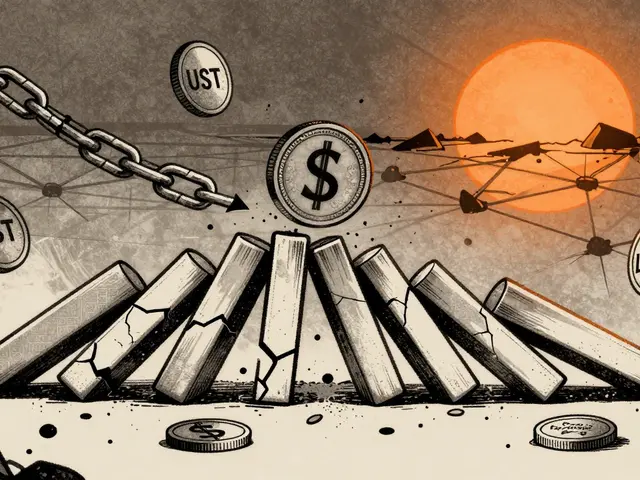

Before 2025, trading cryptocurrency in Morocco wasn’t just risky-it was illegal. If you bought Bitcoin, sold Ethereum, or used Tether to pay for something, you were breaking the law. The government didn’t just warn people-it fined them. And those fines weren’t small. Penalties for crypto trading in Morocco ranged from MAD 20,000 to MAD 100,000 (about $2,000-$10,000 USD) for individuals. Businesses? They could be hit with up to MAD 500,000 ($50,000 USD). Repeat offenders faced criminal charges. This wasn’t a gray area. It was a hard line.

Why Did Morocco Ban Crypto in the First Place?

Morocco’s 2017 ban wasn’t random. It was a reaction to concerns over capital flight and money laundering. The central bank, Bank Al-Maghrib, worried that people were using cryptocurrencies to bypass foreign exchange controls. Imagine someone in Casablanca buying Bitcoin to pay for property in Spain. That’s exactly what the government wanted to stop. Cryptocurrencies didn’t go through banks. They didn’t leave a paper trail. And that made regulators nervous.

It wasn’t just about security. Morocco’s economy relies heavily on remittances and controlled currency flows. If people started using crypto to send money abroad or buy foreign assets, it could destabilize the Moroccan dirham. So the government shut it down completely. No licenses. No exceptions. Even peer-to-peer trading was technically illegal.

Who Got Fined-and How?

Enforcement wasn’t random. Authorities targeted specific activities:

- Operating unlicensed crypto exchanges

- Using digital assets to pay for goods or services

- Buying real estate with Bitcoin or Ethereum

- Running businesses that accepted crypto as payment

In February 2025, Moroccan financial investigators started tracking property purchases made with crypto. They didn’t just look at big transactions-they followed small ones too. If someone used Litecoin to pay for a garage in Marrakech, that was enough to trigger an audit. The goal wasn’t to punish every trader. It was to stop crypto from becoming a loophole in the financial system.

Most fines were applied to businesses. Individuals trading on platforms like Binance or Kraken were harder to catch. But if you were running a crypto-related business-like a local exchange, a payment processor, or even a crypto ATM-you were in the crosshairs.

The Big Shift: Morocco’s New Crypto Law (2025)

Here’s the twist: Morocco is changing its mind.

In November 2024, Abdellatif Jouahri, governor of Bank Al-Maghrib, announced a draft law to legalize and regulate cryptocurrency. This wasn’t a softening-it was a strategic pivot. The government realized the ban wasn’t working. People were still trading. Millions of dirhams were moving through crypto networks. The only thing the ban achieved was pushing activity underground, where no taxes were paid and no rules applied.

The new framework, expected to take effect in 2025, brings three major changes:

- All crypto exchanges must get licensed by Bank Al-Maghrib.

- Platforms must follow strict Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) rules.

- Crypto profits will be taxed like stocks or securities.

Under the new rules, you won’t be fined just for owning Bitcoin. But you will be required to report your trades. Capital gains from crypto will be taxed between 15% and 30%, depending on your income level. Corporate entities face rates from 20% to 31%. If you don’t report your gains? You’ll be treated like any other tax evader-fines, interest, and possible criminal charges.

What Happens to Old Penalties After 2025?

The old fines won’t disappear overnight. They’ll still apply until the new law is officially passed. That means right now, you’re still breaking the law if you trade without a license. But once the new rules are in place, the penalties will shift. Instead of being punished for simply trading, you’ll be punished for not complying with the new system.

For example:

- If you run a crypto exchange without a license after 2025? You’ll lose your license and face the old fines (MAD 20,000-500,000) plus possible criminal charges.

- If you don’t report your crypto gains? You’ll get hit with standard tax evasion penalties, not the old crypto-specific fines.

- If you use crypto to pay for a car or rent? That’s still illegal under the new law-it’s not a payment method, it’s an asset.

The message is clear: The government isn’t giving up control. It’s just changing how it exercises it.

What About Peer-to-Peer Trading?

Here’s the gray zone. If you’re buying Bitcoin from a friend in Rabat using a bank transfer, are you breaking the law? Technically, yes-under the current ban. But enforcement is uneven. The government hasn’t gone after individual traders yet. They’re focused on businesses, platforms, and large-scale transactions.

But that could change. Once the new law takes effect, even P2P traders will need to report their gains. The tax authority, DGI, is already building systems to track crypto transactions through bank records and wallet analytics. So even if you’re not fined today, you might be audited tomorrow.

How Is Morocco Preparing for the Future?

Morocco isn’t just legalizing crypto-it’s building its own digital currency. Bank Al-Maghrib has been testing a central bank digital currency (CBDC) since 2024. The goal? To replace cash and reduce reliance on private crypto networks. The CBDC could launch as early as 2027.

Meanwhile, the Moroccan Capital Market Authority (AMMC) is now reviewing Initial Coin Offerings (ICOs). If you want to launch a token in Morocco, you need approval. No more shady crypto projects. No more rug pulls. Investors will be protected.

This isn’t just about regulation. It’s about control. Morocco wants to capture the economic value of crypto without letting it run wild.

What Should You Do If You Trade Crypto in Morocco?

If you’re a trader in Morocco right now, here’s what you need to know:

- Don’t assume you’re safe just because no one’s come after you. The law hasn’t changed yet.

- Keep records of every trade-dates, amounts, platforms, and bank transfers.

- Don’t use crypto to pay for anything. Stick to traditional banking for purchases.

- Wait for the official law to be published. Don’t assume it’s safe until it’s in writing.

- Be ready to report your gains in 2025. The tax deadline won’t wait.

There’s no way around it: Morocco is moving toward a regulated crypto market. The old penalties are fading. But the new rules will be stricter, more transparent, and harder to ignore.

What’s Next for Crypto in Morocco?

The market is growing fast. Even under the ban, Morocco’s crypto trading volume is projected to hit $278.7 million in 2025. That’s more than any other country in North Africa. People are using crypto-not because they hate banks, but because they’re looking for better options.

The government knows this. That’s why they’re switching from punishment to participation. They’re not trying to kill crypto. They’re trying to own it.

By 2026, you’ll be able to trade legally-if you follow the rules. But if you don’t? The penalties will still be harsh. Just not the same ones.

Callan Burdett

January 19, 2026 AT 16:22Meanwhile, I’m over here buying Dogecoin with my coffee money and laughing.

Christina Shrader

January 19, 2026 AT 17:02And honestly? Smart move. If you can’t beat ‘em, digitize ‘em. But don’t fool yourself-this is about sovereignty, not innovation.

Anthony Ventresque

January 20, 2026 AT 08:58Also, 15-30% tax on gains? That’s brutal for someone who made $5k in a year. Are they going to audit every small trader? Or just the ones who cash out over $10k?

Nishakar Rath

January 21, 2026 AT 17:57morocco banned crypto like a dad banning video games then turns around and opens a casino next door

they want the money but not the chaos

they think they can control blockchain like they control the weather

good luck with that bro

people are already using crypto to buy cars and pay rent in casablanca

the law is already dead

they just haven’t buried it yet

Andre Suico

January 22, 2026 AT 05:32Key takeaway: The real risk isn’t trading. It’s not reporting. The new law shifts the burden of compliance to the individual. If you’re holding crypto, you’re now responsible for knowing the rules, keeping records, and filing taxes. Ignorance won’t protect you anymore.

Also worth noting: The CBDC isn’t a competitor to crypto-it’s a counterweight. Morocco is hedging its bets. They’re not betting against crypto. They’re betting on their own version of it. That’s not surrender. That’s strategy.