When you trade crypto in India, you’re not just buying Bitcoin or Ethereum-you’re navigating one of the world’s strictest regulatory environments. CoinDCX and WazirX, once seen as pioneers of India’s crypto boom, now operate under a cloud of compliance, audits, and penalties. The rules changed overnight in March 2023, and again in September 2025. If you’re still using these platforms, you need to understand what’s really going on behind the scenes.

What Changed in March 2023?

Before March 2023, Indian crypto exchanges operated in a gray zone. KYC was optional for small trades. AML checks were patchy. Many users trusted WazirX and CoinDCX because they were local, easy to use, and had Indian customer support. Then came the FIU-IND Financial Intelligence Unit of India, the government body enforcing anti-money laundering rules under the Prevention of Money Laundering Act (PMLA). Suddenly, every crypto exchange had to register as a Virtual Digital Asset (VDA) service provider. No exceptions.

That meant full banking-level KYC: government ID, proof of address, source of funds-all verified. Every transaction had to be logged. Suspicious activity? Reported within 24 hours. This wasn’t just a formality. It was a full system overhaul. CoinDCX spent months reengineering its backend. WazirX, still recovering from a 2021 user data leak, struggled to catch up.

The $230 Million Hack That Changed Everything

In early 2024, WazirX got hacked. Not a small leak. Not a phishing scam. A full-scale breach that stole $230 million in cryptocurrency assets from user wallets. The attack exposed weak hot wallet controls, outdated encryption, and poor internal access protocols. Users lost life savings. Social media exploded. Reddit threads turned into grief support groups.

What made it worse? The recovery took months. Meanwhile, international platforms like BingX got hacked too-but they restored service in under 24 hours. WazirX didn’t just lose money. It lost trust. Regulators took notice. The FIU-IND Financial Intelligence Unit of India, the government body enforcing anti-money laundering rules under the Prevention of Money Laundering Act (PMLA) didn’t just fine WazirX. They demanded a full cybersecurity audit.

September 2025: The Cybersecurity Mandate

That’s when everything shifted again. In September 2025, the FIU-IND Financial Intelligence Unit of India, the government body enforcing anti-money laundering rules under the Prevention of Money Laundering Act (PMLA) made it law: every Indian crypto exchange must get a cybersecurity audit from a CERT-In Indian Computer Emergency Response Team, the government’s official cybersecurity response unit-approved firm. No audit? No license. No license? No trading.

Companies like Pi42 a cybersecurity firm specializing in crypto compliance audits for Indian VASPs and Mudrex a crypto platform offering compliance-as-a-service tools for exchanges saw a surge in demand. Smaller exchanges couldn’t afford the $50,000-$150,000 audits. Some shut down. Others merged.

CoinDCX, India’s first crypto unicorn, passed its audit. WazirX? Took three tries. The third audit found 17 critical vulnerabilities. They had to rebuild their cold storage system from scratch. Users saw delays in withdrawals. Support queues hit 72 hours. The message was clear: compliance isn’t optional. It’s survival.

The Travel Rule: India’s Global-Standard Compliance

Most countries have a $1,000 threshold for the FATF Travel Rule-requiring sender and receiver info only for large transfers. India? No threshold. Ever. Every single crypto transaction, no matter how small, must include full identity data of both parties. That’s stricter than the EU. Stricter than the U.S.

For users, this means every trade you make on CoinDCX or WazirX is linked to your PAN card and bank account. No anonymous swaps. No privacy coins like Monero or Zcash are even listed anymore. Exchanges had to build new systems to capture, store, and report this data. If you tried to send 0.001 BTC to a friend? The system flagged it. You got an email asking for your friend’s full ID. If you didn’t reply? The transaction froze.

This isn’t just about money laundering. It’s about traceability. The government wants to know who’s trading what, when, and why. It’s not paranoia. It’s policy.

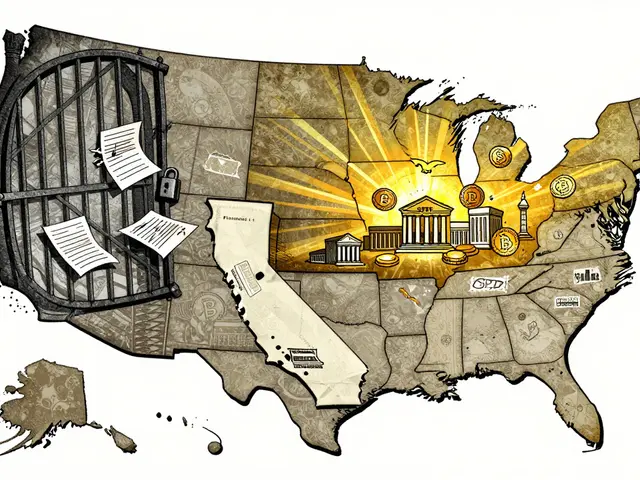

What About Offshore Exchanges Like Binance and KuCoin?

While CoinDCX and WazirX scrambled to comply, offshore platforms like Binance, KuCoin, and Huobi kept serving Indian users. They didn’t register. They didn’t report. They just kept running.

Then came the notices. In late 2025, the FIU-IND Financial Intelligence Unit of India, the government body enforcing anti-money laundering rules under the Prevention of Money Laundering Act (PMLA) issued 45-day compliance notices to 25 offshore exchanges. Binance paid a $2.2 million penalty. KuCoin paid $41,000. Both registered. BingX? Still silent. Now it’s blocked for Indian IPs.

Users who relied on these platforms for lower fees and more coins are now stuck. Some switched to compliant domestic exchanges. Others use VPNs. A few are waiting to see if the government will back down. It won’t. The message is clear: if you want to serve Indian users, you register. Or you’re banned.

Who’s Winning? Who’s Losing?

Big players like CoinDCX are thriving. They have teams of lawyers, compliance officers, and cybersecurity engineers. They’ve turned regulation into a competitive edge. Their marketing now says: “Trusted by FIU-IND.” That’s a badge now.

WazirX? Still rebuilding. Their app is slower. Their customer service is stretched thin. They’ve lost market share. But they’re still here. Because they registered. Because they paid the fines. Because they fixed their systems.

Smaller exchanges? Most are gone. Over 40 local platforms shut down between 2023 and 2025. The ones that survived either partnered with CoinDCX for infrastructure or pivoted to NFTs or tokenization services outside the VDA scope.

International firms like Liminal Custody a Singapore-based digital asset custody provider registered with FIU-IND to serve Indian institutional clients are stepping in. They offer secure custody for Indian institutions that want to hold crypto legally. It’s a new business model: compliance as a service.

What Does This Mean for You?

If you’re trading on CoinDCX or WazirX today, you’re on a platform that’s been through hell to stay legal. Your funds are safer than they were in 2023. But you’re paying for it-in time, in restrictions, in friction.

You can’t trade privacy coins. You can’t send crypto without ID. You can’t use an offshore app without risking a sudden freeze. Withdrawals take longer. Support takes days.

But here’s the upside: your money isn’t getting stolen. Not like in 2024. Not like in 2025. The hacks stopped. The audits forced change. The regulators didn’t kill crypto. They forced it to grow up.

Many users are now diversifying: keeping small amounts on CoinDCX for quick trades, larger holdings in Liminal Custody for security, and using international platforms only for niche assets they can’t get locally. It’s not perfect. But it’s the new normal.

What’s Next?

The government isn’t done. Next up: mandatory insurance for exchange hot wallets. Real-time transaction monitoring powered by AI. Possibly, a national crypto registry where every wallet is tied to a unique ID.

India isn’t banning crypto. It’s controlling it. And that control is becoming more sophisticated every month. The exchanges that survive won’t be the ones with the most users. They’ll be the ones with the cleanest audits, the strongest security, and the deepest pockets.

If you’re still using an unregistered platform, you’re gambling. Not on price. On policy. And the house always wins.

Wayne mutunga

January 29, 2026 AT 02:57Been using CoinDCX since 2022. The KYC was a pain at first, but now I actually feel safer. No more sleepless nights wondering if my coins are gonna vanish like in 2024. WazirX still gives me anxiety though - their app crashes if I so much as look at it wrong.

Still, I’d rather deal with slow withdrawals than lose everything to a hack. Regulators aren’t perfect, but they forced the industry to grow up. Kinda proud to be part of that.

Gavin Francis

January 30, 2026 AT 22:07Bro the travel rule is wild 😅

Send 0.0001 BTC to your mate? Gotta send them your PAN, their Aadhaar, their mom’s birth certificate. India didn’t just raise the bar - they built a whole new stadium and made everyone sit in the front row.

Gary Gately

January 31, 2026 AT 22:48Wazirx got haxxed and now they act like its no big deal? lol. I lost my rent money in that mess and they took 3 months to even say sorry. CoinDCX on the other hand? They actually fixed stuff. Not perfect but at least they try.

Also why is everyone still using vpn for binance? Just switch already. The fines are paid, the rules are clear. Stop being lazy.

Brandon Vaidyanathan

February 1, 2026 AT 04:20Let me break this down for you people who think this is "growth" - this isn’t regulation, it’s state-controlled crypto. You think you’re safe now? Nah. You’re just being watched harder.

Every transaction logged. Every wallet tied to your ID. They’re building a financial panopticon and you’re clapping like it’s a concert. Wake up. This is how authoritarian regimes control dissent - by making money traceable.

And don’t even get me started on how CoinDCX is now selling "FIU-IND Trusted" like it’s a Nike collab. They’re not heroes. They’re collaborators.

Meanwhile, real crypto people are using Monero on the darknet and laughing at all of you. You traded freedom for convenience. And now you’re proud of it.

Pathetic.

Gareth Fitzjohn

February 2, 2026 AT 14:42The shift from chaos to compliance has been painful but necessary. Smaller exchanges couldn't compete with the cost of audits, and that’s a natural market correction. The real winners are users who value security over speculation.

Offshore platforms had their chance. They chose not to comply. Now they’re blocked. That’s not oppression - it’s consequence.

India didn’t ban crypto. It demanded accountability. That’s not unusual. It’s responsible.