Crypto Donation Fee Calculator

Calculate how much your nonprofit could save by accepting cryptocurrency donations instead of traditional methods. Based on 2025 industry data from the article.

Enter your donation amount to see the fee difference

Blockchain is Changing How We Give

Imagine sending a donation to a disaster relief fund in Uganda and seeing it arrive in under an hour-no bank delays, no middlemen, and every step recorded on a public ledger you can check yourself. That’s not science fiction. It’s happening right now, thanks to blockchain. In 2025, over $2.5 billion in cryptocurrency has been donated to charities worldwide, up from just $1 billion in 2024. That’s a 386% jump in two years. And it’s not just tech enthusiasts giving. Universities, hospitals, and global aid groups are accepting Bitcoin, USDC, and other digital assets because donors want transparency, speed, and lower fees.

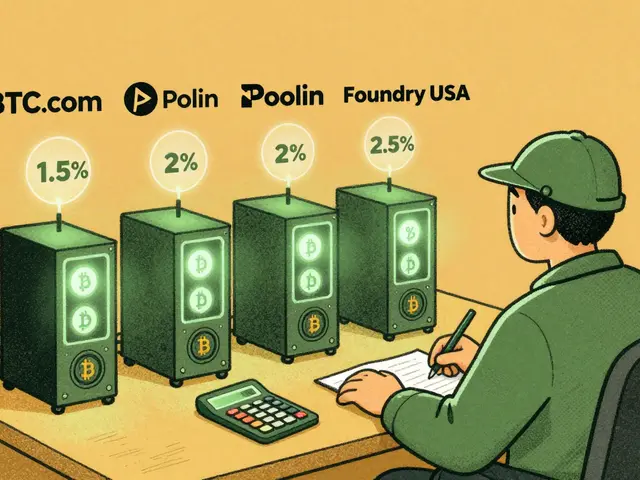

Why Crypto Donations Are Faster and Cheaper

Traditional donations through credit cards or bank wires come with hidden costs. Processing fees can hit 2-3% of the donation, and it can take days for the money to reach the nonprofit. Blockchain cuts that cost to under 0.5% and settles transactions in 10 to 60 minutes. For example, a $1,000 donation via credit card might cost the charity $25 in fees. The same donation in Bitcoin? Around $5. That’s 90% less. And because blockchain records every transaction publicly, donors can track exactly where their money goes-down to the specific supplier or program. No more guessing if your donation actually helped.

Who’s Giving and Why

The biggest shift isn’t just in technology-it’s in who’s giving. Crypto donors are younger. Most are in their 20s and 30s. They’re not just donating money; they’re backing causes that match their values. A 2025 survey found that 68% of Gen Z donors prefer supporting organizations that align with their beliefs, not just big names. These donors also give bigger amounts. The average crypto donation is $250,000. The average traditional donation? Just $104. That’s not a typo. One donor might send 0.5 BTC to a climate nonprofit, and that’s worth over $60,000 at current prices. These aren’t small contributions-they’re game-changers for nonprofits that struggle with fundraising.

Top Causes Getting Crypto Donations

Not all charities benefit equally. In 2025, educational institutions received the largest share of crypto donations at 16%. That’s because universities like MIT and Stanford have crypto research labs and see blockchain as part of their future. Humanitarian groups came in second at 14.2%, followed by environmental causes (12.7%), healthcare (11.8%), and women’s empowerment nonprofits (9.3%). Why? These causes often operate across borders. Blockchain removes currency conversion headaches. A donor in Japan can send USDC directly to a refugee aid group in Kenya, and the recipient gets it in dollars without waiting for a wire transfer or paying exchange fees.

The Tech Behind the Giving

Behind every crypto donation is a simple setup. Nonprofits don’t need to become blockchain experts. They use platforms like The Giving Block, BitPay, or Coinbase Commerce. The Giving Block handles 68% of all crypto donations, thanks to its easy integration and clear documentation. These services connect to a nonprofit’s website with a simple button. When someone clicks, they’re directed to a secure wallet interface. The donation goes into a cold storage wallet (like Ledger or Trezor) for safety. Then, the platform automatically converts it to stablecoins like USDC or USDT to avoid Bitcoin’s price swings. Within minutes, the nonprofit gets the equivalent in U.S. dollars, ready to spend.

Real Impact: New York Cares Case Study

New York Cares, a nonprofit that supports public schools, launched its ‘Crypto for Good’ program in October 2025. They added a Bitcoin donation button through MoonPay Commerce. In the first three months, they raised over $400,000. Donors completed transactions in under five minutes-compared to 25 minutes on their old form. Ninety-five percent of donors said they chose crypto because they could see exactly how their gift was used. One donor, a software engineer, sent 1.2 BTC to fund new laptops for Title I schools. He tracked the transaction on a public blockchain explorer and saw the laptops were purchased, delivered, and installed-all verified by receipts uploaded to the chain. That kind of proof builds trust no brochure ever could.

Challenges Still Exist

But it’s not all smooth sailing. Price volatility is still a problem. In early 2025, Bitcoin swung 15-20% in a single day. A nonprofit that received 1 BTC worth $100,000 could see it drop to $80,000 if they held it too long. That’s why 63% of charities convert crypto to stablecoins immediately. Another issue? Regulation. The U.S. IRS treats crypto as property, so donors need to report its value at the time of donation. Nonprofits must provide tax documentation, which many aren’t used to. Platforms like The Giving Block now auto-generate IRS Form 8283 equivalents, but smaller charities still struggle. And while 70% of the Forbes Top 100 charities accept crypto now, that’s still only 70%. The rest don’t have the staff, time, or tech know-how to get started.

The Rise of Smart Contracts and AI

The next leap isn’t just about sending money-it’s about automating it. By 2027, AI-powered smart contracts could trigger donations automatically. Imagine a wildfire breaks out in California. An AI system monitors satellite data, news feeds, and social media. When it detects a major disaster, it releases funds from a pre-funded blockchain wallet to relief organizations. No one has to make a call. No fundraising campaign needed. Cornell University’s research team estimates this could cut emergency response times by 72 hours. That’s three full days faster than traditional systems. And it’s not theoretical. Platforms like Unchained are already testing 1:1 matching grants triggered by on-chain activity. If a donor gives 1 BTC to a clean water project, the system matches it-only if the project hits its first milestone, like drilling a well.

What’s Next: The $89 Billion Forecast

By 2035, crypto donations could hit $89.27 billion. That’s not a guess-it’s a projection based on current growth rates and the Great Wealth Transfer. Over $84 trillion will pass from baby boomers to Gen Z and Millennials by 2045. These younger generations don’t trust traditional banks or charities. They trust code, transparency, and peer networks. They’re also more likely to own crypto. In 2025, 41% of crypto donors are Gen Z. Only 19% of traditional donors are. That gap is widening. Tokenized real-world assets-like fractional shares of solar farms or clean water projects-are also emerging. Donors can now give $50 toward a solar panel that powers a school in Malawi and see its output tracked on-chain. This isn’t just giving. It’s investing in impact.

Should Your Nonprofit Accept Crypto?

If you’re a nonprofit leader wondering whether to jump in, here’s the reality: You don’t need to be a tech expert. Start small. Pick one platform-The Giving Block is the easiest for beginners. Set up a cold wallet. Train one staff member on tax reporting. Launch a simple ‘Donate Crypto’ button. Track how much you raise in six months. You’ll likely see higher average gifts and new donors you never reached before. And if you wait? You risk falling behind. In 2025, 92% of nonprofit executives surveyed said they plan to expand crypto giving, not scale back. The trend isn’t coming. It’s already here.

Nora Colombie

November 30, 2025 AT 11:00Let’s be real-this whole crypto charity thing is just Silicon Valley’s way of avoiding real government accountability. We don’t need blockchain to give money; we need Congress to stop starving public programs. Every dollar sent in Bitcoin is a dollar taken away from taxes that could fund real infrastructure. And don’t even get me started on how these ‘transparent’ ledgers are just glorified spreadsheets that only tech bros understand. If you really cared about Uganda, you’d lobby for fair trade policies, not buy a damn NFT to feel good.

Christy Whitaker

December 1, 2025 AT 10:42Ugh. I saw someone post a screenshot of their ‘crypto donation receipt’ on Instagram last week. Total flex. Like, congrats, you spent $60k on a laptop donation while I’m still trying to pay my rent. And now we’re supposed to believe this is ‘impact’? Meanwhile, actual people on the ground in Kenya are still waiting weeks for cash transfers because the NGO’s ‘blockchain partner’ had a server outage. This isn’t innovation-it’s performative altruism with a side of crypto bro ego.

Nancy Sunshine

December 1, 2025 AT 12:45While the technological potential of blockchain in philanthropy is undeniably profound, we must not overlook the ethical imperatives embedded within its implementation. The reduction of transactional friction is commendable, yet the environmental cost of certain consensus mechanisms remains a critical concern. Furthermore, the demographic skew toward younger, affluent donors raises questions about equity of access. Nonprofits must ensure that digital inclusion is not an afterthought but a foundational pillar. The transition from traditional to crypto-based giving should be accompanied by robust educational frameworks for both donors and recipients, particularly in Global South contexts where digital literacy varies widely. Transparency, while valuable, must be paired with cultural sensitivity and operational humility.

Alan Brandon Rivera León

December 2, 2025 AT 20:37I’ve seen this play out in my community-old-school nonprofits are terrified of crypto, but the ones that tried it? They’re getting donations from people who never gave before. One guy in Texas sent $200k in USDC to a local food bank, no questions asked. The staff didn’t know what a wallet was, but the platform walked them through it. Now they’re using the money to buy fresh produce from Black farmers. It’s not perfect, but it’s working where bureaucracy failed. Maybe the real story isn’t the tech-it’s that people finally trust the system enough to give big.

Ann Ellsworth

December 4, 2025 AT 04:48It’s astonishing how the entire discourse around crypto philanthropy has been co-opted by Luddites who conflate decentralization with chaos. The 0.5% fee structure is not merely advantageous-it’s revolutionary in the context of SWIFT’s 3.2% cross-border extraction economy. Moreover, the integration of AI-triggered smart contracts represents a paradigmatic shift from reactive charity to predictive altruism. The IRS Form 8283 equivalency protocols are not ‘clunky’-they are an elegant legal-technical bridge between fungible assets and fiduciary compliance. To dismiss this as ‘crypto bro’ theater is to misunderstand the ontological shift in trust architecture. We are witnessing the birth of a new fiduciary episteme.

Ankit Varshney

December 5, 2025 AT 02:14My uncle runs a small school in Bihar. He got a $500 crypto donation last month. Didn’t know what Bitcoin was. The platform converted it to rupees in 12 minutes. He bought 200 notebooks and 10 fans. No paperwork. No middlemen. Just… done. I don’t care what you call it-blockchain, crypto, whatever. It worked. And that’s all that matters.