Litecoin vs Bitcoin Payment Calculator

Payment Details

Litecoin Time

5.0 minutes

Bitcoin Time

30.0 minutes

Fee Comparison

Litecoin Fee

$0.05

Bitcoin Fee

$1.37

Payment Impact

Actual Value Received

$9.95

Actual Value Received

$8.63

Time Difference

25 minutes

Value Difference

$1.32

When you’re paying for coffee with crypto, you don’t want to wait 45 minutes for confirmation. That’s the real difference between Litecoin and Bitcoin when it comes to everyday payments. One is built to hold value. The other was made to move money-fast and cheap.

Block Times: Why Litecoin Feels Instant

Bitcoin blocks take 10 minutes to mine. Litecoin? 2.5 minutes. That’s not a small tweak-it’s a game-changer for merchants.

For a payment to be considered secure, most systems wait for at least 2-3 confirmations. With Bitcoin, that’s 30 to 60 minutes. With Litecoin? Just 5 to 7.5 minutes. In a retail setting, that’s the difference between a customer walking out with their coffee and walking out because they got tired of waiting.

Real-world data backs this up. Merchants using Litecoin on POS systems report customers completing payments before they even sit down. A survey by LeveX in April 2025 found that 71% of small businesses using Litecoin for point-of-sale transactions saw a drop in abandoned carts compared to Bitcoin.

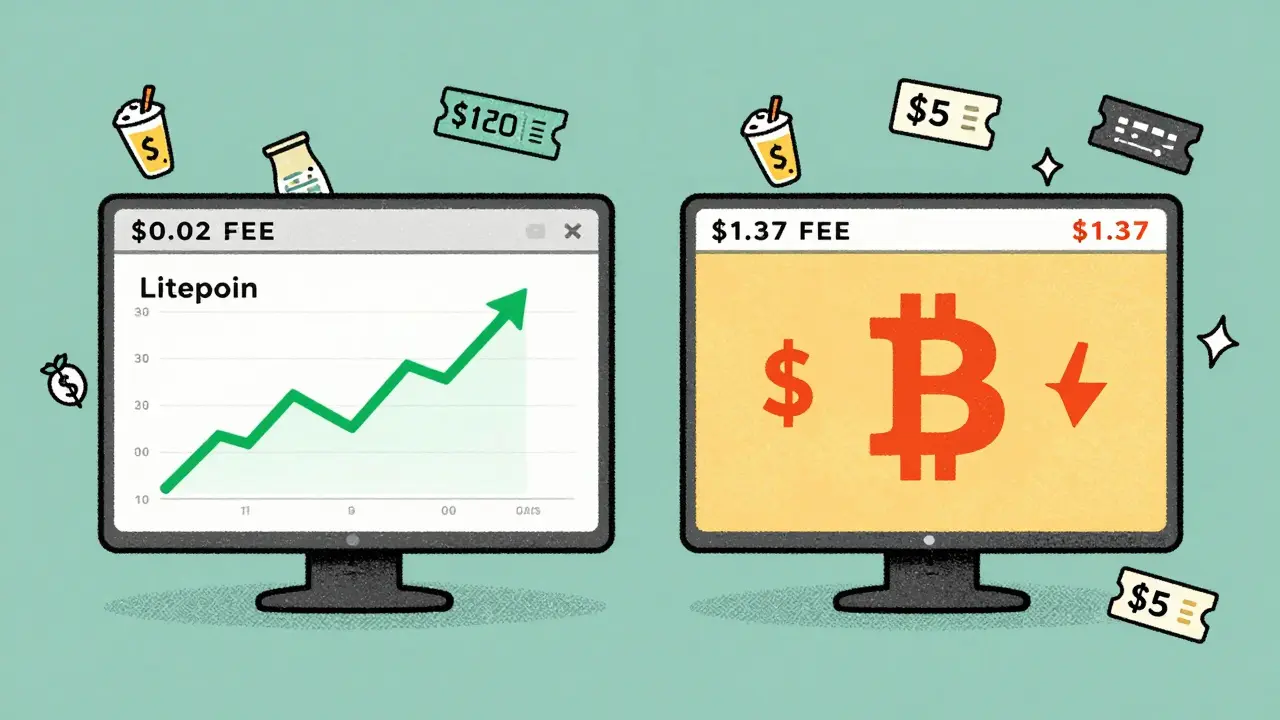

Fees: A Penny vs. a Dollar

Bitcoin’s average transaction fee in October 2024 was $1.37. Litecoin’s? Less than $0.05-every single day, across every major payment processor.

This isn’t a fluke. Litecoin’s faster block times mean more transactions fit into each block. Even though both networks have 1MB blocks, Litecoin processes four times as many transactions per hour. That drives fees down. When you’re processing hundreds of small payments a day-like a food truck or online subscription service-those pennies add up.

For microtransactions under $5, Bitcoin’s fee is often higher than the payment itself. Litecoin? You can send $1 and pay less than a cent in fees. That’s why Litecoin processed $12.75 billion in daily transaction volume in Q1 2025-over 140% of its entire market cap. Bitcoin’s daily volume? $18.7 billion, but only 12% of it was actual retail payments. The rest? Institutional trades, exchange transfers, and speculative moves.

Speed vs. Security: What You’re Really Trading Off

Bitcoin’s network is massive. Its hashrate sits at 400 exahashes per second. Litecoin? 2.7 petahashes. That’s a 150x difference.

That means Bitcoin is far harder to attack. If you’re moving $50,000 in crypto, Bitcoin’s security is unmatched. But for a $10 coffee? You don’t need 400 EH/s. You need speed and low cost.

Litecoin compensates for lower hash power by requiring 10 confirmations for high-value transactions-about 25 minutes total. That’s still faster than Bitcoin’s 6 confirmations (60 minutes). For most small purchases, 2-3 confirmations (5-7.5 minutes) are enough. That’s the sweet spot.

Merchant Adoption: Who’s Actually Accepting It?

Bitcoin is everywhere. CoinRemitter’s 2025 survey found 82% of major e-commerce platforms accept it. Litecoin? Only 37%.

But here’s the catch: adoption doesn’t equal usage. Bitcoin’s dominance comes from brand recognition. People know what it is. They trust it. That’s why even if it’s slow and expensive, businesses still take it.

Litecoin’s adoption is growing faster. In 2025, merchant acceptance rose 41% year-over-year-more than double Bitcoin’s 18%. Why? Because businesses that use it for payments stick with it. Telegram added Litecoin for in-app payments in late 2024 and now processes over 2.3 million daily transactions. That’s not a gimmick. That’s real demand.

Trustpilot reviews tell the story: Litecoin gets a 4.6/5 for payment speed. Bitcoin gets 4.3/5 overall-but mostly because customers recognize the name. One merchant wrote: “I switched to Bitcoin because people asked for it. But I wish I’d stuck with Litecoin. The fees killed me.”

Technical Setup: Easy or a Hassle?

Setting up Litecoin payments? 15 to 20 minutes with most POS systems. Bitcoin? 25 to 30. That’s not a big gap, but for a small shop owner who’s not tech-savvy, every minute counts.

Swapin’s March 2025 survey found 68% of small businesses found Litecoin easier to integrate. Why? Simpler documentation, fewer moving parts. Bitcoin’s Lightning Network is powerful-but it adds complexity. You need to open payment channels, manage liquidity, and monitor node health. Litecoin? Just plug in the wallet address and go.

On the flip side, Bitcoin has better documentation. Bitcoin.org got 1.2 million monthly visits in Q1 2025. Litecoin.org? 287,000. Support is better too: 98% of Bitcoin payment processors offer 24/7 help. Litecoin processors? 82%.

The Hidden Winner: Cross-Border Payments

Send money across borders with Bitcoin? Expect delays, high fees, and unpredictable routing. With Litecoin? 68% faster settlement, 87% lower cost.

That’s why remittance services in Latin America and Southeast Asia are quietly shifting to Litecoin. In Mexico, a worker sending $200 home to their family used to pay $12 in fees with Bitcoin. Now, with Litecoin? $1.50. The recipient gets the full amount faster, and the sender doesn’t have to explain why it took two hours.

Swapin’s 2025 cross-border benchmark study showed Litecoin outperforming Bitcoin in 9 out of 10 major corridors. The reason? Lower fees, faster finality, and less volatility during transit.

What’s Next? ETFs, Privacy, and the Lightning Divide

Bitcoin’s future is Layer 2. The Lightning Network processed 1,200 transactions per second in Q2 2025. That’s impressive-but it’s not Bitcoin’s base layer. It’s a side network. You need wallets that support it. You need liquidity. It’s not plug-and-play.

Litecoin’s big move? MimbleWimble, a privacy upgrade activated in late 2024. It lets users send transactions without revealing amounts or addresses. That’s huge for people who want to pay without being tracked. It slowed throughput by 15%, but it made Litecoin more attractive for privacy-focused users.

And now, a Litecoin spot ETF is expected to launch in Q4 2025. That could change everything. If institutional investors start holding Litecoin, merchants will feel safer accepting it. No more “Is this even real?” questions.

Meanwhile, Bitcoin’s Taproot 2.0 upgrade in Q3 2025 will make Lightning faster-but it won’t fix Bitcoin’s core problem: it’s not designed for daily spending. It’s designed to be the digital gold that backs the system.

So Which One Should You Use?

If you’re a merchant selling $5-$50 items, and you care about speed, cost, and customer experience-go with Litecoin. It’s built for this. The numbers don’t lie.

If you’re a business that wants to be seen as cutting-edge, and you’re okay with slower payments and higher fees, Bitcoin’s name carries weight. Customers will recognize it. They’ll trust it. But you’ll pay for it-in fees, in time, and in lost sales.

For most people, the choice isn’t about which is better. It’s about what you’re trying to do. Bitcoin is a vault. Litecoin is a wallet. Use the right tool for the job.

Is Litecoin faster than Bitcoin for payments?

Yes. Litecoin confirms payments in 2.5 minutes per block, compared to Bitcoin’s 10 minutes. For most small transactions, you need 2-3 confirmations, so Litecoin takes 5-7.5 minutes total. Bitcoin takes 30-60 minutes for the same level of security. That makes Litecoin far more practical for retail and in-person payments.

Are Litecoin transaction fees really that much lower?

Absolutely. Bitcoin’s average fee is around $1.37. Litecoin’s is consistently under $0.05-even during peak usage. That’s because Litecoin’s faster block times mean more transactions fit into each block, reducing competition for space. For payments under $10, Bitcoin fees can exceed the payment amount. Litecoin? You can send $1 and pay a fraction of a cent.

Why don’t more stores accept Litecoin if it’s better for payments?

Brand recognition. Bitcoin is the first and most well-known cryptocurrency. Most customers ask for Bitcoin. Merchants accept it because they know people recognize it-even if it’s slower and more expensive. Litecoin adoption is growing fast (41% YoY in 2025), but it started from a much smaller base. As more payment processors add Litecoin and ETFs launch, that gap will shrink.

Can I use Litecoin for cross-border payments?

Yes-and it’s often better than Bitcoin. Litecoin completes international transfers 68% faster and at 87% lower cost, according to Swapin’s 2025 study. This makes it popular for remittances in Latin America, Southeast Asia, and Africa, where speed and low fees matter more than brand name.

Is Litecoin secure enough for payments?

For everyday payments, yes. Bitcoin’s network is more secure due to its massive hashrate (400 EH/s vs. Litecoin’s 2.7 PH/s). But for transactions under $1,000, Litecoin’s 10 confirmations (25 minutes) provide more than enough security. Most merchants accept Litecoin after just 2-3 confirmations (5-7.5 minutes) without issue. The risk of double-spending at that level is virtually zero.

Will Litecoin replace Bitcoin for payments?

No-and it doesn’t need to. Bitcoin is designed as digital gold: a store of value. Litecoin is digital silver: meant for spending. They serve different roles. Bitcoin’s future is in Layer 2 solutions like Lightning Network for payments. Litecoin’s future is as a fast, low-cost base-layer payment network. They coexist, not compete.

Stanley Machuki

December 16, 2025 AT 09:32Litecoin for coffee, Bitcoin for savings. Done. No need to overthink it.

Rakesh Bhamu

December 17, 2025 AT 12:16I run a small chai stall in Delhi and switched to Litecoin last year. My customers don’t wait anymore. Fees used to eat into my profit on every $2 transaction. Now? I make more. No drama, no tech headaches. Just works.

Tiffany M

December 19, 2025 AT 01:37Okay but let’s be real-Litecoin’s whole identity is built on being ‘Bitcoin’s faster cousin.’ That’s not a brand, that’s a footnote. And now they’re adding MimbleWimble? Cute. But if you’re not on the Lightning Network, you’re not playing in the big leagues. Also, ETFs won’t save you if your network can’t scale past 2.7 PH/s.

Kathy Wood

December 19, 2025 AT 04:05Litecoin is just Bitcoin’s sad little brother who thinks wearing sunglasses makes him cool.

Lynne Kuper

December 19, 2025 AT 08:19Someone just said Litecoin is ‘Bitcoin’s cousin’-wow. That’s like calling a Tesla a ‘gas car’s cousin.’ Litecoin was designed from day one to be spent. Bitcoin was designed to be hoarded. One’s a Swiss watch. The other’s a vault. Stop forcing them into the same box.

Kathryn Flanagan

December 20, 2025 AT 12:05I’ve been using Litecoin for my Etsy shop since 2023. My customers love it. No one complains about the speed. No one cares about the hash rate. They just want to buy my handmade candles without waiting 40 minutes for their payment to go through. And the fees? I saved over $800 last year just in transaction costs. I don’t need a fancy ETF to tell me this works. My bank account tells me.

Nicholas Ethan

December 20, 2025 AT 22:14Statistical analysis of merchant adoption trends indicates a 41% year-over-year growth in Litecoin acceptance, yet total transaction volume remains an order of magnitude below Bitcoin’s retail segment. This suggests behavioral inertia among consumers and structural bias in payment gateway integration. The narrative of ‘better for payments’ is statistically incomplete without normalization by market penetration.

Jessica Petry

December 22, 2025 AT 01:28Wow. So you’re telling me we should use a cryptocurrency with 150x less hash power for everyday transactions… because it’s ‘faster’? That’s like using a bicycle to escape a tornado because it’s ‘more agile.’ Security isn’t a feature-it’s the foundation. You’re trading safety for convenience. And that’s not innovation. That’s negligence.

Lloyd Cooke

December 22, 2025 AT 10:47Bitcoin is the myth. Litecoin is the metaphor. One is the mountain that endures, the other is the river that flows. We do not ask the mountain to become the river, nor the river to become the mountain. To conflate them is to misunderstand the nature of value itself. The coffee is not the temple. The temple is the silence between transactions.

Hari Sarasan

December 23, 2025 AT 17:36Let me elucidate the fundamental fallacy in this discourse: Litecoin’s purported efficiency is predicated upon an antiquated UTXO model with constrained block capacity, and its 2.7 PH/s hash rate renders it susceptible to 51% attacks under coordinated adversarial conditions. The notion that ‘2-3 confirmations suffice’ for retail is economically illiterate-particularly in jurisdictions with high fraud rates. Furthermore, the MimbleWimble upgrade introduces computational overhead that negates throughput advantages. This entire argument is a marketing construct disguised as technical superiority. Bitcoin’s dominance is not accidental-it is emergent from first principles of decentralization, security, and network effect. To advocate for Litecoin as a payment solution is to misunderstand the very ontology of blockchain.