Germany Lets You Keep All Profits on Bitcoin After 12 Months - Here’s How

If you’ve held Bitcoin or any other cryptocurrency in Germany for more than a year, you might not owe a single euro in taxes when you sell. That’s not a rumor. It’s the law - and it’s one of the most generous crypto tax rules in the entire European Union.

Most countries tax you when you sell crypto for profit. The U.S. does it. France does it. Even the UK, with its £6,000 annual allowance, still takes a cut. But Germany? If you wait 365 days, your gains are completely tax-free. No cap. No limits. Just pure profit.

This isn’t some loophole. It’s official policy. Backed by Section 23 of the German Income Tax Act (EStG), and reinforced by guidance from the Federal Central Tax Office (BZSt) in March 2025, this rule applies to Bitcoin, Ethereum, Solana, and every other recognized cryptocurrency. As long as you hold it for at least 12 months, you can sell, swap, or spend it without paying income tax.

How the 12-Month Rule Actually Works

The clock starts ticking the moment you buy your crypto - not when you transfer it to a wallet, not when you stop trading, but the exact date and time your transaction is confirmed on the blockchain.

It’s not 365 trading days. It’s 365 calendar days. If you bought Bitcoin on January 15, 2024, at 3:42 PM, you can sell it tax-free starting January 15, 2025, at 3:43 PM. Miss that minute by an hour? You’re in the taxable zone.

And here’s the catch: Germany uses FIFO (First-In, First-Out) accounting. That means if you bought Bitcoin at $30,000 in January and again at $50,000 in June, and you sell 0.5 BTC in February 2025, the tax office assumes you sold the first batch - the one bought at $30,000. Even if you wanted to sell the newer, more expensive one, the system doesn’t let you pick. This can accidentally trigger short-term gains if you’re not careful.

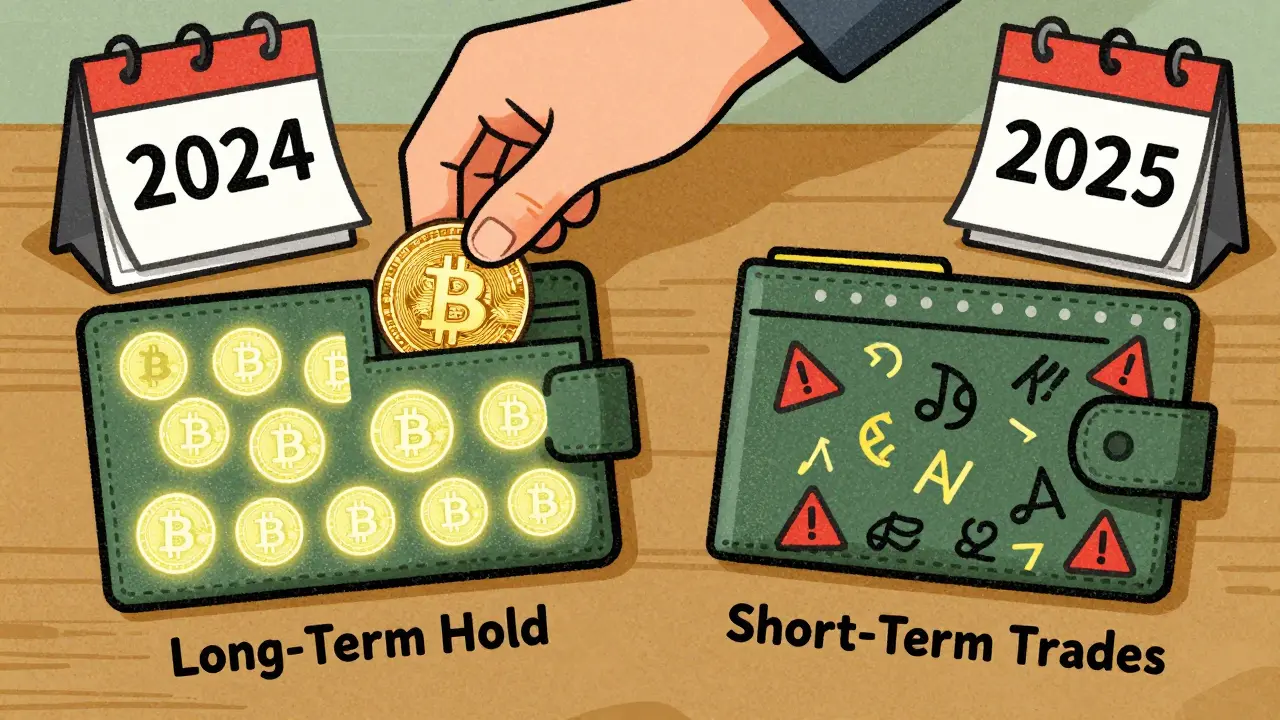

That’s why serious holders use separate wallets. One wallet for assets you plan to hold over a year. Another for short-term trades. Mixing them is a recipe for unexpected taxes.

What Happens If You Sell Before 12 Months?

Short-term crypto trades - anything under 365 days - are taxed as regular income. Rates range from 14% to 45%, depending on your total yearly income. Add the 5.5% Solidarity Tax, and the top rate hits 47.475%.

But there’s a small buffer: the €1,000 annual exemption. If your total net gains from all short-term crypto sales in 2025 are €950, you pay nothing. No reporting needed. But if you make €1,050? You pay tax on the full €1,050, not just the €50 over the limit. This rule changed in January 2024, up from €600, but many experts say it’s still too low. With inflation at 6.2% in 2024, even small trades can push you over.

And here’s the brutal part: Germany doesn’t allow tax-loss harvesting. If you lose €5,000 on one trade and make €8,000 on another, you still pay tax on the full €8,000. There’s no offset. No carry-forward. No relief. That’s why many German crypto investors avoid active trading altogether.

What Else Is Taxable?

The 12-month exemption only applies to disposal - selling, trading, or spending crypto. Other activities are taxed differently.

- Staking rewards: Taxed as income when received. But if you hold those rewards for 12 months after receiving them, you can sell them tax-free later.

- Mining income: Taxable as business or personal income the moment you receive the coins. No exemption.

- DeFi yields: Every time you earn interest or rewards from liquidity pools, it’s a taxable event. Even if you reinvest it.

- Receiving crypto as payment: If you get paid in Bitcoin for freelance work, that’s income. You pay tax on its value in euros at the time you received it.

- NFTs and stablecoins: Same rules as Bitcoin. Hold 12 months, sell tax-free. Trade before, pay income tax.

Any crypto income over €256 per year must be reported, even if it’s below the €1,000 trading threshold. That includes airdrops, referral bonuses, or rewards from crypto apps.

How to File: Elster, Software, and Real-World Tips

You file crypto taxes in Germany through the Elster online portal. Paper filings are still allowed, but the tax office strongly discourages them. The system has improved since its 2023 launch - user satisfaction jumped from 2.1/5 to 3.7/5 - but it’s still clunky.

Most people use tax software. Koinly, BitcoinSteuer, and Blockpit are the most popular. They connect to your exchanges, pull transaction history, calculate FIFO, and generate the right Elster-ready forms. The average cost? Around €285 per year if you hire a tax pro. Many users spend €50-€150 on software instead.

Experienced holders swear by three habits:

- Always screenshot the exact timestamp of every purchase and sale. Blockchain explorers like Etherscan or Blockchain.com show this - keep a folder of these.

- Use separate wallets. One for long-term holds. One for short-term trades. Never mix them.

- Don’t wait until July to start. The filing deadline is July 31, but if you’re late, you can get a free extension until September 30. Still, early prep avoids panic.

And here’s a real story: One Reddit user in Berlin held 1.2 BTC for 366 days, then sold. Saved €8,450 in taxes. Another trader in Hamburg sold ETH 12 hours too early. Lost €3,200. One hour made the difference between tax-free and tax-bill.

Germany vs. the Rest of Europe

Germany isn’t the only country with crypto tax perks - but it’s one of the few with real teeth.

Portugal used to be the favorite. Hold for 28 days? Tax-free. But in 2024, they tightened rules. Now, only long-term gains from personal investments are exempt - and even that’s murky.

France? Flat 30% on all crypto gains, no matter how long you hold.

UK? £6,000 annual allowance. But that’s dropping to £3,000 in 2026.

Germany’s 12-month rule is clearer, broader, and more predictable. It’s why 29.7% of Germans own crypto - second only to Portugal in the EU. And it’s why over 18,500 foreign nationals moved to Germany in 2024 specifically for the tax treatment. They call it the “crypto immigrant” trend.

But here’s the shadow: the EU’s DAC8 directive. Set to roll out in 2026, it could force all member states to adopt a uniform 15% capital gains tax after 365 days. That would erase Germany’s advantage. Industry analysts say there’s a 60% chance this happens by 2027. But if it does, existing holdings may be grandfathered in.

Is This Rule Going to Last?

Germany’s tax system is built on trust - trust that people will hold long-term, not trade constantly. It works. 73% of German crypto owners hold assets longer than 12 months just to qualify for the exemption, according to CoinGecko’s 2025 survey.

The government isn’t losing revenue. Short-term traders still pay high rates. And the €1,000 exemption mostly helps small investors. The real winners? Long-term holders who treat crypto like savings, not speculation.

But pressure is growing. The EU wants harmonization. Tax authorities warn that automated data sharing with exchanges (starting in 2026) will make evasion nearly impossible. The BZSt is already syncing with Coinbase, Kraken, and Bison. Your transaction history won’t be secret anymore.

So is this rule safe? For now, yes. But if you’re planning to hold for the long term, don’t wait. The clock is ticking - and once you cross 365 days, your gains are yours to keep.

What’s Next? Don’t Miss the Window

If you bought crypto in early 2024, you’re eligible for tax-free sales starting in early 2025. If you bought in July 2024, you’ll need to wait until July 2025.

Check your purchase dates. Organize your wallets. Use software to track FIFO. And if you’re unsure - get help. A single misstep can cost thousands.

This isn’t about getting rich quick. It’s about holding smart. In Germany, patience isn’t just a virtue - it’s a tax strategy.

Do I pay tax if I swap Bitcoin for Ethereum after 12 months?

No. Swapping one cryptocurrency for another after holding it for 12 months or longer is considered a tax-free event in Germany. The 12-month exemption applies to all disposals - including trades, sales, and spending. As long as the asset you’re selling or swapping was held for 365+ days, no tax is due.

What if I bought Bitcoin in 2023 and sold part of it in 2025? Do I pay tax on the whole amount?

No. Only the portion you sell that was held for less than 12 months is taxable. Germany uses FIFO accounting, so the system assumes you sell your oldest coins first. If your earliest purchase was in 2023, and you sold 0.5 BTC in 2025, that entire portion qualifies for the exemption - even if you made other purchases in 2024. You only pay tax on coins bought within the last 12 months.

Can I avoid taxes by moving to another country after holding crypto for 11 months?

No. Germany taxes you based on your tax residency at the time of the sale. If you move after 11 months and sell your crypto in your new country, you’ll be subject to that country’s rules - which likely won’t be as favorable. To benefit from Germany’s exemption, you must be a German tax resident when you sell. Simply holding crypto while living abroad doesn’t trigger the exemption.

Are NFTs treated the same as Bitcoin under Germany’s tax law?

Yes. Since the March 2025 guidance from the Federal Ministry of Finance, NFTs are treated the same as other cryptocurrencies for tax purposes. If you hold an NFT for 12 months and then sell it, your profit is tax-free. If you sell it before 12 months, it’s taxed as income. The same €1,000 short-term exemption applies.

Do I need to report crypto even if I didn’t sell anything?

Yes - if you earned income from crypto. Staking rewards, mining, DeFi yields, or payments received in crypto must be reported if they exceed €256 in value for the year. You don’t need to report holdings or unsold assets. But if you received any crypto as income, even if you didn’t sell, you must include it in your tax return.

What happens if I forget to report a crypto sale under 12 months?

The BZSt is now automatically collecting transaction data from major German exchanges starting in 2026. Even if you don’t report, they’ll know. Penalties for underreporting can reach 10% of the unpaid tax, plus interest. If you made a mistake, file an amended return (Berichtigung) as soon as possible. Voluntary disclosure usually results in lighter penalties.

Is there a limit to how much crypto I can hold tax-free?

No. There’s no cap on the value of your holdings or the size of your gains. Whether you made €5,000 or €500,000 from selling Bitcoin after holding it for 12 months, you pay zero tax. The exemption is unlimited - as long as the holding period is met.

Can I use the 12-month exemption for crypto I received as a gift?

Yes - but the holding period starts from when the original owner bought it, not when you received it. If your friend gifted you Bitcoin they bought in January 2023, and you sell it in February 2025, you’ve held it for 25 months - so it’s tax-free. You need proof of the original purchase date, which can be tricky. Keep records of the gift transfer and the sender’s acquisition history if possible.

Does the 12-month rule apply to crypto held in foreign exchanges?

Yes. Where you hold your crypto doesn’t matter. Whether it’s on Coinbase, Kraken, Binance, or a personal wallet, the German tax rules apply as long as you’re a German tax resident. The BZSt is already receiving data from foreign exchanges through international agreements, so hiding assets abroad won’t help you avoid reporting.

Will Germany’s crypto tax law change in 2026?

It’s possible, but not guaranteed. The EU’s DAC8 directive could force Germany to adopt a standardized 15% capital gains tax after 365 days by 2027. However, experts believe existing holdings will be grandfathered in. If you’ve already held crypto for over a year by 2026, you’re likely protected. New purchases after 2026 might face new rules - but the 12-month exemption isn’t disappearing tomorrow.