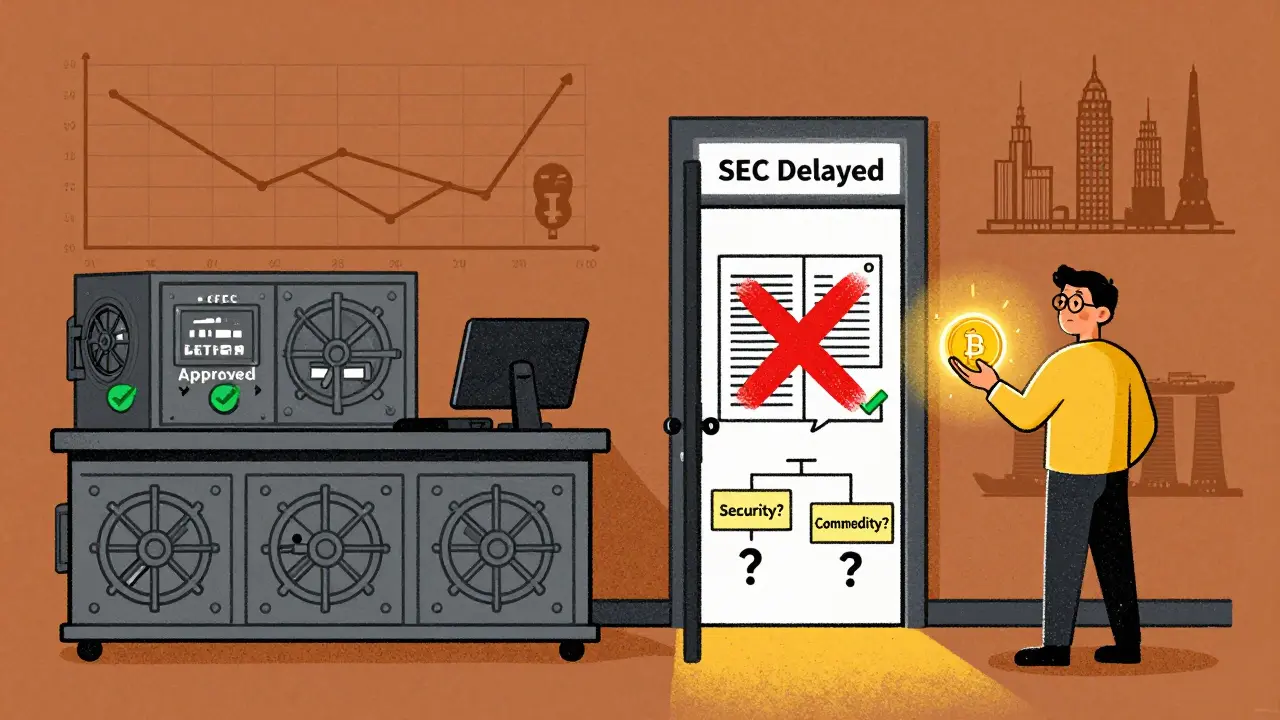

The U.S. crypto industry is caught in a regulatory tug-of-war between two federal agencies that can’t agree on who’s in charge. The SEC says most crypto tokens are securities. The CFTC says they’re commodities. And no one-neither exchanges, developers, nor investors-knows for sure what that means for their business or portfolio.

How It All Started

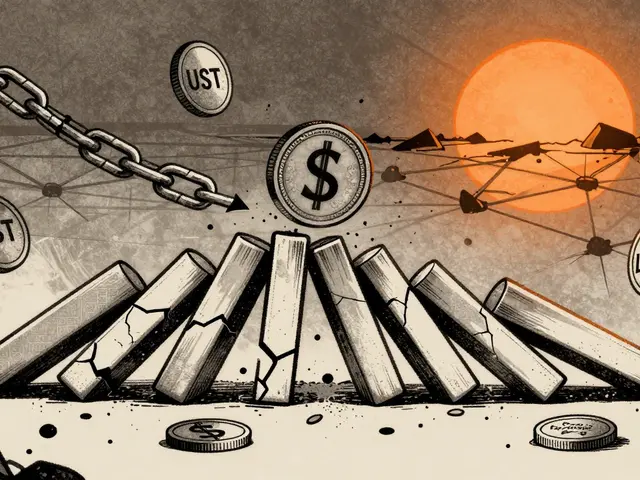

The fight began in 2015, when the CFTC stepped in after a Bitcoin options platform called Coinflip, Inc. got caught running an unregulated derivatives market. The CFTC didn’t just shut it down-they declared Bitcoin a commodity under the Commodity Exchange Act. That was the first official crack in the wall. A few years later, in 2018, a federal court backed them up in CFTC v. McDonnell, ruling that virtual currencies are goods traded in markets, just like wheat or oil. That gave the CFTC a solid legal footing to police fraud and manipulation in spot crypto markets-even though their main power is over futures and derivatives. Meanwhile, the SEC was watching. They didn’t care about Bitcoin. They cared about tokens sold in ICOs-those early fundraising rounds where startups raised millions by selling digital tokens to the public. The SEC applied the Howey Test, a 75-year-old legal standard from a 1946 citrus farming case. If a token is sold with the promise that investors will profit from the work of others, it’s a security. That’s how the SEC labeled most ICO tokens: not as digital coins, but as unregistered stocks.Who Gets What? The Technical Divide

It’s not just about what they say-it’s about what the law lets them do. The CFTC’s job is to oversee futures, options, and swaps. That’s why they approved Bitcoin futures in 2017 and Ether futures in 2023. They’re comfortable with markets where people bet on price changes, not ownership. They can go after fraud in spot markets, but they can’t require companies to register as exchanges or brokers. The SEC, on the other hand, controls everything tied to securities: exchanges, brokers, investment advisors, and public offerings. If you’re selling a token that passes the Howey Test, you need to register with the SEC, disclose financials, and follow strict rules. The SEC doesn’t regulate spot trading of Bitcoin or Ether directly-only if those assets are being traded as securities on a platform. That creates a messy gray zone. Take a token like Solana or Cardano. Are they commodities because they’re decentralized and used as currency? Or are they securities because early investors bought them hoping the team would make the network valuable? There’s no bright line. And that’s where the lawsuits start.The Coinbase Case That Changed Everything

In June 2023, the SEC sued Coinbase, claiming the exchange was operating as an unregistered securities exchange by letting users trade tokens the SEC said were securities. The case was a bombshell. Coinbase argued they couldn’t comply because the SEC had never clearly said which tokens were securities. The court initially sided with the SEC in March 2024, saying the agency had made a plausible case. Then, on February 27, 2025, something unexpected happened. The SEC dropped the case entirely. They filed a joint motion with Coinbase to dismiss it. No explanation. No admission of error. Just… gone. Industry insiders saw it as a sign. The SEC, under new leadership, might be backing off from aggressive enforcement. Maybe they realized they couldn’t win in court without clear rules. Maybe they were tired of being the bad guy. Or maybe they were waiting for Congress to act.

What the Agencies Are Doing Now

The CFTC hasn’t slowed down. In April 2025, they approved the first spot Ethereum ETFs-something the SEC has delayed for months. That’s a big deal. Spot ETFs let investors buy real Ethereum, not just bets on its price. By approving them, the CFTC is saying: We’re the ones who regulate the actual asset, not just the derivatives. The SEC, meanwhile, has kept filing lawsuits. In 2023 alone, they brought 23 enforcement actions against crypto firms. Most were for unregistered offerings or exchanges. But the pattern is changing. Instead of going after every token, they’re focusing on platforms that facilitate trading of tokens they’ve already labeled as securities. They’re trying to control the infrastructure, not the assets themselves. Meanwhile, the CFTC is quietly building its authority. They’ve approved Bitcoin and Ether futures, started investigating spot market manipulation, and now ETFs. They’re acting like the central regulator for crypto-as-a-commodity.Why This Matters to You

If you’re a crypto investor, this isn’t just bureaucracy-it’s your money. The SEC’s approach means many tokens you hold might be illegal to trade in the U.S. If you bought Solana or Polygon in 2021, you might have bought an unregistered security. The SEC could come after your exchange tomorrow and freeze trading. If you’re a developer, you’re stuck. Launching a new token? You need a legal team to run a Howey Test analysis. That costs $185,000 and takes months. And even then, you might get sued anyway. The SEC doesn’t give pre-approvals. The CFTC doesn’t care unless you’re doing futures. So you’re left guessing. Exchanges like Kraken and Gemini are spending 35% more on compliance because they’re trying to follow both agencies at once. They list tokens as commodities when the CFTC says so, and as securities when the SEC says so. It’s a mess.

What’s Coming Next?

Congress is finally stepping in. The House passed the CLARITY Act in April 2024. It’s simple: if a digital asset is decentralized, runs on a mature blockchain, and doesn’t give ownership rights, it’s a commodity-and the CFTC runs it. Everything else? SEC territory. The Senate hasn’t voted yet. But the writing’s on the wall. The CFTC has won the courts. They’ve won the ETF approvals. They’ve got bipartisan support. The SEC is holding on by a thread. The biggest clue? The SEC’s silence on Bitcoin ETFs. They delayed decisions until August 2025. Meanwhile, the CFTC approved Ethereum ETFs. That’s not an accident. It’s a signal.The Global Picture

While the U.S. fights over who’s in charge, Europe moved forward. The EU’s MiCA regulation, which took effect in June 2024, created one clear rulebook for all crypto assets. No turf wars. No confusion. Companies know exactly what to do. The result? U.S. crypto firms lost market share. In 2020, American companies controlled 32% of global crypto volume. By 2024, it was down to 14%. The Boston Consulting Group says regulatory clarity could bring back $500 billion in investment by 2027. But if Congress doesn’t act, that money will keep flowing to Singapore, Dubai, and Switzerland.Bottom Line

The SEC and CFTC aren’t just disagreeing-they’re creating a regulatory trap. Companies are stuck between two conflicting rules. Investors don’t know what’s legal. Developers can’t launch products. And the longer this goes on, the more U.S. crypto gets pushed offshore. The CFTC has the legal wins. The House has the plan. The SEC’s enforcement strategy is crumbling. The next 12 months will decide whether the U.S. becomes a leader in crypto regulation-or a cautionary tale.Is Bitcoin a security or a commodity?

Bitcoin is considered a commodity by both the CFTC and federal courts. The SEC doesn’t classify it as a security because it’s decentralized, has no central team promoting profits, and functions more like digital gold than an investment contract. Courts have consistently upheld this view since 2015.

Why does the SEC care about Ethereum?

The SEC argues that Ethereum’s initial sale in 2014 met the Howey Test-investors bought tokens expecting profits from the Ethereum Foundation’s efforts. Even though Ethereum is now decentralized, the SEC claims past sales create ongoing liability. The CFTC, however, has declared Ether a commodity and approved Ether futures and spot ETFs, signaling a different view.

Can I still trade crypto in the U.S.?

Yes, but with risk. Major exchanges like Coinbase and Kraken still operate, but they’ve delisted tokens the SEC claims are securities. You can still trade Bitcoin, Ether, and other widely accepted assets. But if you’re holding lesser-known tokens, check if your exchange still lists them. If it doesn’t, the SEC may have flagged it.

What’s the difference between a spot ETF and a futures ETF?

A spot ETF holds the actual cryptocurrency-like real Bitcoin or Ether-in a vault. A futures ETF holds contracts betting on future prices, not the asset itself. The CFTC approves futures ETFs because they fall under derivatives. The SEC has been hesitant to approve spot ETFs because they involve direct ownership, which the SEC sees as a securities issue. The CFTC’s approval of spot Ethereum ETFs in 2025 is a major shift.

Will the SEC ever stop suing crypto companies?

Probably not-until Congress gives them clear boundaries. The SEC’s strategy has been enforcement-first: sue first, clarify later. But after losing momentum in the Coinbase case and seeing the CFTC gain ground, they’re shifting focus. Instead of targeting every token, they’re now going after platforms that enable trading of securities. That’s a more sustainable approach, but it still leaves uncertainty for developers and investors.

How does this affect crypto startups?

It’s extremely hard. Startups must spend $185,000 and 3-6 months just to figure out if their token is a security. Even then, they risk being sued. Many delay launches or move operations overseas. Over 80% of U.S.-based crypto firms report regulatory uncertainty has delayed product releases, costing billions in lost investment.

What’s the CLARITY Act and why does it matter?

The CLARITY Act is a House bill that would officially split crypto regulation: the CFTC handles digital commodities (like Bitcoin and Ether) if they’re decentralized and don’t offer ownership rights. The SEC keeps control over tokens that act like securities. It’s the first real attempt to end the jurisdictional war. If passed, it would bring clarity to exchanges, investors, and developers-finally giving U.S. crypto a stable legal foundation.

Alex Strachan

December 27, 2025 AT 18:13So the SEC just ghosted Coinbase like a bad date? 😂 Meanwhile, the CFTC is out here approving spot ETH ETFs like it’s Black Friday and we’re all shopping for digital gold. Someone tell Gary Gensler his 2018 playbook is outdated. Crypto’s not a pyramid scheme-it’s a tech revolution they’re trying to regulate with a typewriter.

Rick Hengehold

December 29, 2025 AT 05:54Enough with the bureaucracy. If Bitcoin’s a commodity, regulate it like one. If a token is a security, prove it with a clear rule-not 23 lawsuits a year. The CFTC’s got the legal ground. The SEC’s got the ego. Congress needs to pick a side before we lose the entire industry to Dubai.

Antonio Snoddy

December 29, 2025 AT 13:20Think about it deeper, folks. This isn’t just about jurisdiction-it’s about identity. The SEC sees crypto as an investment vehicle, a relic of human greed wrapped in blockchain code. The CFTC sees it as a new kind of market fluidity, a digital oil field with no kingpin. But what if we’re asking the wrong question? What if crypto isn’t a security OR a commodity… but a third category entirely? A new form of property, born from code, not contract law? We’re trying to fit quantum physics into Newtonian boxes. And until we evolve our legal imagination, we’ll keep chasing shadows with flashlights made of paper.

It’s not about who’s right. It’s about whether our institutions can handle the future-or if they’re just fossilized bureaucracies pretending to be regulators.

And don’t even get me started on how the SEC still thinks the Howey Test applies to a decentralized network where no one owns the protocol. That’s like suing the wind for blowing too hard.

Meanwhile, the CFTC is quietly building the infrastructure for a new financial era. Futures? ETFs? Spot markets? They’re not just regulating-they’re architecting. The SEC? They’re still trying to sue innovation into compliance.

And we wonder why startups flee to Singapore. We’re not fighting over crypto-we’re fighting over whether we’re still living in the 20th century.

Maybe the real question is: Who’s afraid of decentralization? The SEC. And that’s why they’re losing.

Let’s not forget: the first Bitcoin block was mined by a ghost. And now we’re arguing over who gets to license the ghost’s wallet.

Ryan Husain

December 31, 2025 AT 02:53This regulatory ambiguity is unsustainable and harms innovation. The CFTC’s approach is pragmatic: focus on market integrity, not speculative intent. The SEC’s enforcement-first model creates chilling effects for legitimate projects. The CLARITY Act represents the most viable path forward-it’s balanced, technically sound, and acknowledges the reality of decentralization. Congress must act before U.S. leadership in blockchain becomes a historical footnote. We need clarity, not chaos.

Rajappa Manohar

December 31, 2025 AT 19:14so the sec is just… gone? no explaination? lol. i thought they were gonna sue every coin ever. guess they got bored or scared. 😅

nayan keshari

January 2, 2026 AT 18:18Everyone’s acting like the CFTC won. Newsflash: they’re still regulating futures, not the actual coins. Spot ETFs don’t change the fact that Ethereum’s original sale was a security. The SEC’s not wrong-they’re just slow. And the CLARITY Act? It’s a political gimmick. Decentralized doesn’t mean unregulated. You can’t have a currency without accountability. This whole debate is just rich people arguing over who gets to tax the new gold rush.

alvin mislang

January 3, 2026 AT 04:18Let me get this straight: you’re telling me a bunch of anonymous devs can create a token, sell it to retail investors, promise returns, and then say ‘oops, it’s decentralized now’-and suddenly it’s legal? That’s not innovation, that’s fraud with a blockchain logo. The SEC is the only one still trying to protect ordinary people. The CFTC is just giving crypto a free pass so Wall Street can keep gambling. I’m not mad-I’m disappointed.