Airdrop Eligibility Calculator

Enter Your Wallet Activity

Getting free crypto through an airdrop sounds like magic-until you realize most people never qualify. In 2025, airdrops aren’t random giveaways anymore. They’re carefully designed campaigns that reward real engagement, not just sign-ups. If you’re hoping to get tokens without spending money, you need to understand exactly what projects are looking for-and what they’re filtering out.

What Exactly Determines Airdrop Eligibility?

Airdrop eligibility isn’t about luck. It’s about proof. Projects take a snapshot of blockchain activity on a specific date, and that snapshot decides who gets paid. You might think signing up on a website is enough, but if your wallet didn’t interact with their protocol before that snapshot, you’re out. The snapshot captures things like token holdings, transaction history, and even how often you voted in a DAO. It’s not just about owning a token-it’s about using it. Some projects make it simple: if you held at least 100 of their tokens in a non-custodial wallet on June 12, 2025, you qualify. Others look deeper. Did you provide liquidity on their DEX? Did you borrow or lend on their lending platform? Did you trade on their native swap? These actions show you’re not just holding-you’re participating.Three Types of Airdrops (And How to Qualify for Each)

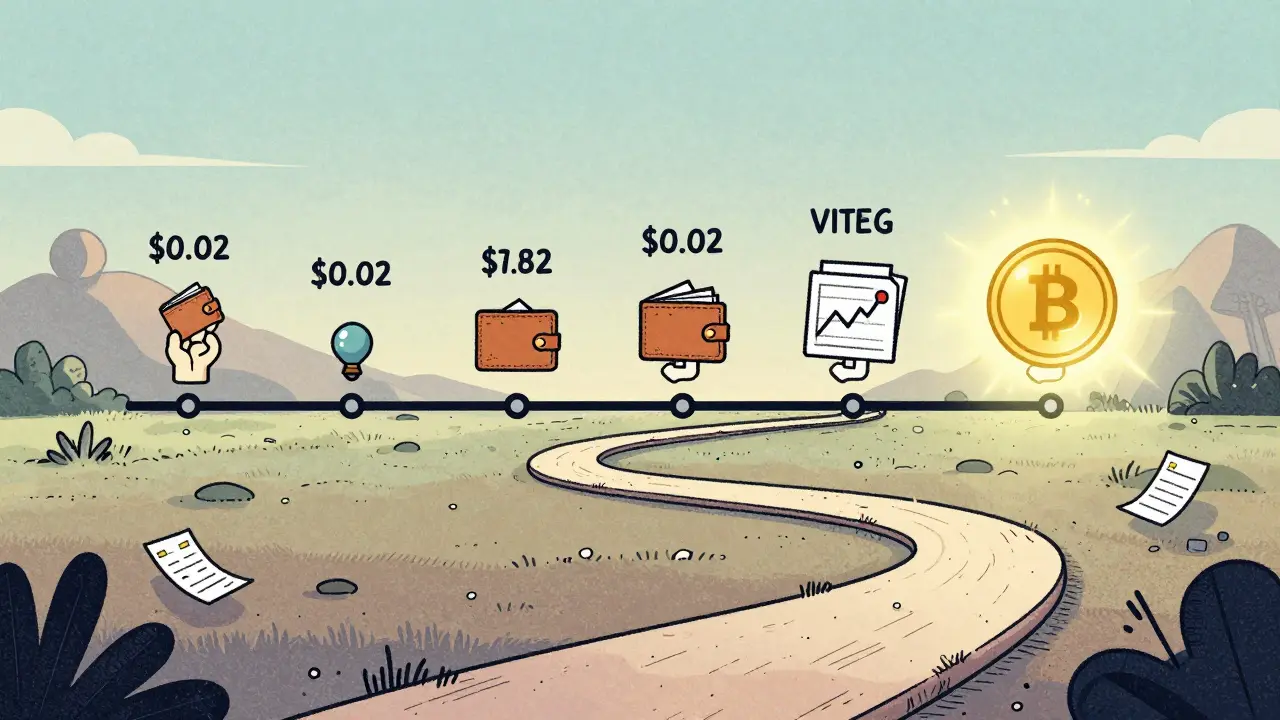

Not all airdrops are created equal. There are three main types, each with different rules. Standard or raffle airdrops are the easiest to enter. You sign up with your wallet address, maybe follow their Twitter or join their Discord, and you’re in the pool. But if 500,000 people sign up and only 10,000 get tokens, you’re relying on chance. Projects use raffles to avoid paying out to bots or people who just want free money. If you’re not doing anything else in the ecosystem, this is your only shot. Bounty airdrops require work. You might need to create a TikTok video explaining the project, write a thread on X, refer five friends who complete the same tasks, or even help test a beta app. These aren’t free-you’re trading time for tokens. Some projects pay in crypto, others in NFTs or future access. The catch? Projects often take weeks to verify your work. You might complete everything, then wait months only to find out your referral didn’t qualify, or your tweet got flagged as spam. Holder or exclusive airdrops are the quiet winners. You don’t do anything special. You just held the token. Maybe you bought it when it was $0.02 and never sold, even when it dropped 70%. That patience gets rewarded. Projects like Uniswap and OpenSea gave massive airdrops to early holders-people who stuck through volatility. This type rewards conviction, not hustle.Ecosystem Participation Is the New Gold Standard

In 2025, the smartest airdrop hunters aren’t chasing every new project. They’re building depth in a few key ecosystems. If you want to qualify for the next big airdrop, you need to be active in the ecosystem before the announcement. That means:- Swapping tokens on the project’s decentralized exchange

- Staking your tokens to help secure the network

- Lending or borrowing through their DeFi protocol

- Voting in governance proposals-even if you don’t fully understand them

- Commenting in Discord or Telegram, not just lurking

- Signing up for their newsletter and opening every email

Wallet Choice Matters More Than You Think

You can’t get an airdrop if your tokens are sitting on Binance or Coinbase. Most projects exclude custodial wallets. Why? Because exchanges control those addresses. The tokens would go to the exchange, not you. You need a non-custodial wallet: MetaMask, Trust Wallet, or Best Wallet. And it has to support the right blockchain. An Ethereum-based airdrop? You need an ERC-20 compatible wallet. A Solana airdrop? You need SPL token support. If you’re hunting airdrops regularly, use a dedicated wallet-don’t mix it with your main holdings. That way, if a scammer tricks you into signing a malicious transaction, your life savings stay safe. Also, make sure your wallet is connected to the right network. If you’re on Ethereum Mainnet but the airdrop is on Polygon, you won’t see the tokens-even if you qualify.Verification and Claiming: The Hidden Steps

Qualifying isn’t the end. You still have to claim. Some airdrops auto-distribute. You check your wallet on the release date, and the tokens are there. Others require you to visit a claim portal, connect your wallet, and sign a transaction. If you miss the window-sometimes just 30 days-you lose it. The project will reallocate those tokens to others or keep them in treasury. Verification can be messy. If you did a bounty task, they might check your Twitter handle, count your followers, or verify your referral link. Some projects use third-party tools to audit your activity. It’s not instant. You might complete everything on day one, then wait three months for approval.How to Find Legitimate Airdrops (And Avoid Scams)

There are thousands of airdrops every year. Most are scams. The real ones come from projects with:- A public team with verifiable LinkedIn profiles

- A published whitepaper or technical documentation

- Clear, written eligibility rules on their official website

- Active, moderated Discord and Telegram channels

- Partnerships with known investors or incubators

Timing Is Everything

The best airdrop strategy isn’t reacting-it’s anticipating. Don’t wait for the announcement. Start engaging with promising projects months before they go public. If you’re active in a new DeFi protocol during its testnet phase, you’re more likely to get a big payout when the mainnet launches. Look for projects backed by a16z, Coinbase Ventures, or other reputable investors. These teams often reward early adopters. You don’t need to invest money-just use the product. Trade on their DEX. Stake your tokens. Vote on governance. Be a user, not a speculator.The Real Cost of Chasing Airdrops

It’s easy to forget the hidden costs. Gas fees add up. Every swap, stake, or vote on Ethereum can cost $5-$20. If you’re doing five actions a week, that’s $100 a month. For a token that might be worth $20 after the airdrop, it’s not worth it. Time is also money. Spending three hours a week on Discord, writing tweets, and checking claim portals is a real commitment. For most people, the return isn’t worth the effort. Focus on quality over quantity. Pick one or two projects you actually believe in. Engage deeply. Don’t chase every airdrop. The ones that pay big are the ones you were already using before they announced the reward.Final Reality Check

Airdrops aren’t free money. They’re a way for projects to build communities. If you treat them like a lottery, you’ll lose. If you treat them like a long-term investment in ecosystems you believe in, you might win. The biggest airdrops in history didn’t go to the people who signed up last minute. They went to the people who used the product before it was popular. The early Uniswap traders. The OpenSea collectors. The Ethereum Name Service registrants. They didn’t hunt airdrops. They built something. If you want to qualify, do the same.Do I need to pay money to qualify for an airdrop?

No, legitimate airdrops never require you to pay to receive tokens. If a project asks you to send crypto, pay a fee, or buy a product to qualify, it’s a scam. Some airdrops reward you for spending gas fees on transactions (like swapping tokens), but you’re not paying to enter-you’re paying to participate in the ecosystem. That’s different.

Can I use the same wallet for multiple airdrops?

Yes, but it’s risky. Using your main wallet for every airdrop exposes your entire portfolio to potential scams. The safer approach is to use a dedicated wallet just for airdrops. Keep your main holdings in a separate, more secure wallet. That way, if you accidentally connect to a fake claim site, only your airdrop wallet is at risk.

What if I qualify but don’t claim the tokens?

If you don’t claim within the window, the tokens usually get redistributed to other eligible users or returned to the project’s treasury. You won’t get a second chance. Some projects send reminders, but many don’t. Treat the claim deadline like a bank transfer deadline-miss it, and you lose it.

Are airdrops taxable?

In the U.S., the IRS treats airdropped tokens as ordinary income based on their fair market value at the time you receive them. If you later sell those tokens for a profit, you owe capital gains tax. Keep records of the date you received the tokens and their value on that day. Many crypto tax tools like Koinly or CoinTracker can help track this automatically.

How do I know if an airdrop is real?

Check three things: First, the official website URL-make sure it’s not a fake domain like uniswap[.]io instead of uniswap[.]org. Second, verify the social media accounts-real projects have verified badges and consistent posting history. Third, look for transparency-do they list clear eligibility rules, team members, and code audits? If any of these are missing, walk away.

Chris Mitchell

December 9, 2025 AT 18:32Airdrops aren't free money-they're a loyalty program disguised as a gift. The real winners are the ones who treated the protocol like a tool, not a lottery ticket.

nicholas forbes

December 10, 2025 AT 13:32I tried three airdrops last year. Two were scams. One paid out $12. Gas fees alone cost me $87. Not worth it.

miriam gionfriddo

December 11, 2025 AT 20:11OH MY GOD YOU HAVE NO IDEA HOW MANY PEOPLE JUST CREATE 20 WALLETS AND FARM EVERYTHING-IT’S DISGUSTING. THEY’RE NOT USERS, THEY’RE BOTS WITH A SPREADSHEET. PROJECTS NEED TO CRUSH THIS. I’M SO ANGRY.

Brooke Schmalbach

December 12, 2025 AT 22:58Let’s be real-most airdrop hunters are degens who don’t understand blockchain at all. They think holding a token is investing. It’s not. It’s gambling with a side of FOMO. The projects that reward actual usage? Those are the only ones worth paying attention to. Everyone else is just noise.

And don’t get me started on the people who think signing up for a Discord is ‘engagement.’ That’s not participation. That’s window shopping.

The real strategy? Pick one ecosystem. Learn its governance. Vote even when you’re confused. Use the DEX. Stake. Lend. Be a user, not a speculator. That’s how you win.

Also, if you’re using Binance for airdrops, you’re already dead. Your tokens belong to the exchange. They’re not yours. Stop pretending.

And yes, gas fees add up. If you’re doing five transactions a week on Ethereum, you’re burning $100/month for a 0.1% chance at $50. That’s not a strategy. That’s financial self-harm.

Most people don’t realize the biggest cost isn’t money-it’s time. Three hours a week on Twitter threads and referral links? That’s a part-time job for a maybe payout. Prioritize your energy.

And if you think airdrops are ‘free’-you’re delusional. You’re paying with your attention, your data, your security, and your sanity. The only thing free is the illusion.

Build something. Don’t hunt it.

Shane Budge

December 13, 2025 AT 02:48Non-custodial wallet only. Always.

sonia sifflet

December 14, 2025 AT 08:52You think this is complicated? In India, we have people who don’t even know what a wallet is. Meanwhile, you’re debating which DEX to use for airdrops. The gap is hilarious. Also, why are you all so obsessed with free money? Just buy the token if you believe in it.

Chris Jenny

December 16, 2025 AT 03:10...you know the government is tracking these airdrops, right? They’re using them to build a blockchain surveillance database. Every transaction, every vote, every tweet-you’re giving them your digital fingerprint. And then they’ll tax you, freeze you, ban you. This isn’t freedom-it’s a trap. They want you to think you’re winning, but you’re just feeding the machine.

Also, MetaMask is owned by a CIA front company. I’ve seen the documents. Don’t connect your wallet. Use a paper wallet. Burn your internet.

Renelle Wilson

December 16, 2025 AT 09:35It’s important to recognize that the underlying philosophy of airdrops reflects a broader shift in how digital communities are cultivated. Rather than relying on traditional advertising or venture capital funding, projects are incentivizing genuine participation through token-based reciprocity. This model, while imperfect, fosters a sense of ownership and alignment between users and developers that was previously absent in centralized platforms. The individuals who succeed in this ecosystem are not those seeking the most immediate financial return, but those who approach it with curiosity, patience, and a commitment to understanding the technology beyond its price chart. In this light, the real reward isn’t the token-it’s the knowledge, the network, and the sense of being part of something evolving.

That said, the emotional toll of chasing these opportunities should not be underestimated. The anxiety of missing a snapshot, the frustration of unverified bounties, the exhaustion of navigating complex interfaces-it’s a mental burden that many overlook. For those who are time-constrained or financially vulnerable, the cost of participation may far outweigh the potential benefit. It’s worth asking: Is this the future we want? Or are we simply trading our attention for a digital lottery ticket?

Perhaps the most ethical approach is to engage only with projects that prioritize transparency, accessibility, and sustainability-not just token distribution. And always, always protect your private keys. Not because of scams, but because your autonomy is the only thing you truly own in this space.

Elizabeth Miranda

December 18, 2025 AT 09:26I’ve been using a dedicated MetaMask for airdrops since 2022. Never mixed it with my main wallet. Haven’t lost anything. Haven’t claimed everything either. But I’ve got a few hundred bucks in tokens I didn’t pay for. Worth it.

Also, I vote on every DAO proposal. Even the boring ones. I don’t understand half of them. But I show up. That’s what they want.

Chloe Hayslett

December 18, 2025 AT 21:38Wow. So you’re telling me the way to get rich is to become a crypto serf? Spend hours doing free labor for billionaires who’ll dump their tokens the second they launch? Thanks, I hate America.