Blockchain & Cryptocurrency: How Mining, Stablecoins, and Whales Shape the Market

When you hear Blockchain, a distributed digital ledger that records transactions across many computers so that any involved record cannot be altered retroactively. Also known as distributed ledger technology, it's the backbone of everything from Bitcoin to peer-to-peer energy sales. It’s not just about money—it’s about trust without middlemen. Whether you’re buying a meme coin or selling solar power from your roof, blockchain makes it happen automatically, securely, and transparently.

Behind every Bitcoin block is Bitcoin mining, the process where powerful computers solve complex math problems to verify transactions and add them to the blockchain, rewarded with new Bitcoin. In 2025, the U.S. controls nearly half the world’s mining power, thanks to cheap renewable energy. That’s a big shift from just five years ago, when China dominated. Mining isn’t just technical—it’s geographic, economic, and even environmental. And it’s not just Bitcoin. Coins like DOGPU are built for GPU miners, using real hardware and no premine, making them different from most meme coins that exist only on paper.

Then there’s stablecoin, a cryptocurrency designed to maintain a stable value by being pegged to a traditional asset like the U.S. dollar or Euro. mCEUR on the Celo blockchain lets people send Euro-backed money using just a phone number—no bank account needed. That’s huge for remittances and unbanked communities. But not all stablecoins are equal. Some are backed by real cash. Others? Not so much. And then there are coins like BCAT with no real supply but still trading—pure speculation.

Big players—called whales, individuals or entities holding large amounts of cryptocurrency whose trades can significantly affect market prices.—move markets without saying a word. A single wallet moving 500 Bitcoin can crash a price. Learning to spot real whale activity, not fake signals, gives you an edge. Tools exist to track these moves, and knowing when to follow—and when to ignore—is half the battle.

Some projects, like Caduceus CMP, promised big things with airdrops but never delivered. Others, like EXIR, are the only legal option for users under sanctions, even if they’re clunky. And blockchain energy trading? It’s real. Homeowners in Texas and California are already selling solar power directly to neighbors using smart contracts. No utility company. No delays. Just fair, automated deals.

This collection doesn’t sugarcoat anything. You’ll find the truth about meme coins with zero utility, the real story behind mining power shifts, and how stablecoins are changing finance for people without banks. Whether you’re new to crypto or you’ve been trading for years, what you’ll read here isn’t theory—it’s what’s actually happening right now, across North America and beyond.

SafeLaunch (SFEX) Token Airdrop: What We Know and Why You Should Be Careful

SafeLaunch (SFEX) token shows $0 price and zero trading volume in 2026. No legitimate airdrop exists - claims are likely scams. Learn why you should never interact with SFEX tokens and how to spot real crypto airdrops.

View More

What is Metaverser (MTVT) crypto coin?

Metaverser (MTVT) is a small, obscure ERC-20 token built for a metaverse platform with no public presence. Unlike MANA or SAND, it has no users, no working ecosystem, and minimal trading volume. Learn what it really is - and why it’s not worth investing in.

View More

Crypto Ban in Bangladesh: Legal Consequences for Bitcoin Trading

Bangladesh bans Bitcoin trading under money laundering laws, with prison time and frozen bank accounts as real risks. Despite 500K+ users trading underground, enforcement is strict, taxes are unregulated, and no legal path exists.

View More

METIS Airdrop: What You Need to Know About Me in Metis and How to Participate

Learn the truth about the 'Me in Metis' airdrop rumor and how to legitimately earn METIS tokens through staking, DACs, and ecosystem participation. No scams. No hype. Just facts.

View More

What is Curio Gas Token (CGT) Crypto Coin? A Real-World Look at Its Use, Price, and Risks

Curio Gas Token (CGT) is a niche crypto token built for real-world asset tokenization, but with near-zero adoption, collapsing prices, and almost no trading volume, it’s one of the riskiest assets in crypto today.

View More

Setting Up a Crypto Exchange Business in Malta Under MiCA Regulation

Learn how to set up a crypto exchange in Malta under MiCA regulation in 2026 - including licensing steps, costs, tax rules, and why major exchanges choose Malta for EU-wide access.

View More

Venus Crypto Exchange Review: DeFi Lending and Trading on Binance Smart Chain

Venus crypto exchange is a DeFi platform on Binance Smart Chain offering low-fee lending, borrowing, and trading. With no KYC, high APYs, and fast transactions, it's a top choice for crypto users tired of Ethereum's costs.

View More

DAO Hacks and Security: How Flash Loans, Voting Manipulation, and Weak Governance Are Stealing Millions

DAOs have lost over $300 million to hacks that exploit governance, not code. Learn how flash loans, off-chain manipulation, and weak voting systems are stealing funds - and what real security looks like.

View More

Velocimeter Crypto Exchange Review: A High-Risk Platform with Zero Trading Activity

Velocimeter crypto exchange has zero trading activity, a trust score of 0, and no transparency. Despite its DeFi claims, it's a high-risk platform with no users, no audits, and no future. Avoid it entirely.

View More

Horizon Dex Crypto Exchange Review: A High-Risk Platform with Minimal Traffic and No Regulation

Horizon Dex is an unregulated crypto exchange with negligible traffic, no user reviews, and no transparency. It shows all signs of being non-functional or a scam. Avoid it entirely.

View More

WifeDoge (WIFEDOGE) Airdrop: How to Get Free Tokens in 2026

WifeDoge (WIFEDOGE) has no official airdrop, but you can get free tokens through Bitget's Learn2Earn and referral programs. Learn how it works, where to trade it, and why it's still alive despite trading near $0.

View More

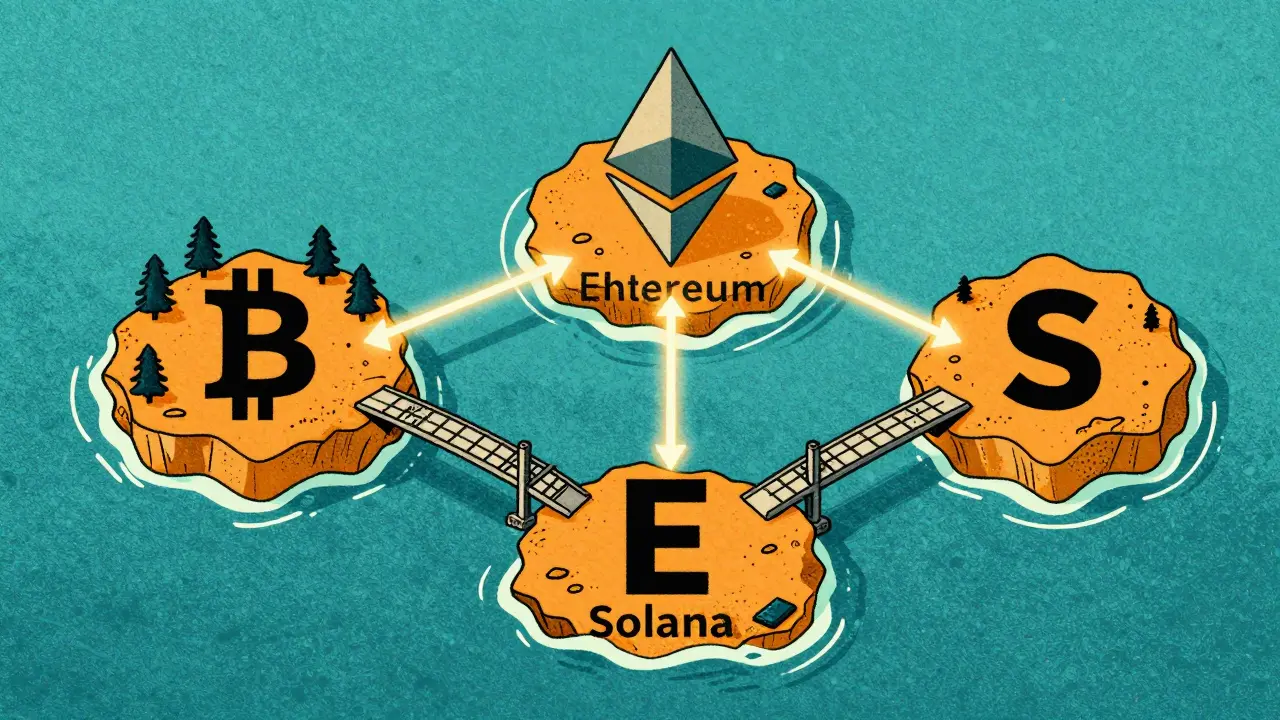

Real-World Cross-Chain Integration Examples for Blockchain Interoperability

Real-world examples of how cross-chain protocols like IBC, Chainlink CCIP, and LayerZero enable seamless asset transfers and smart contract communication between blockchains. Covers security, speed, costs, and use cases.

View More